The entire report is available at this link - Factor Year Report

1. Factor Year Report-2025

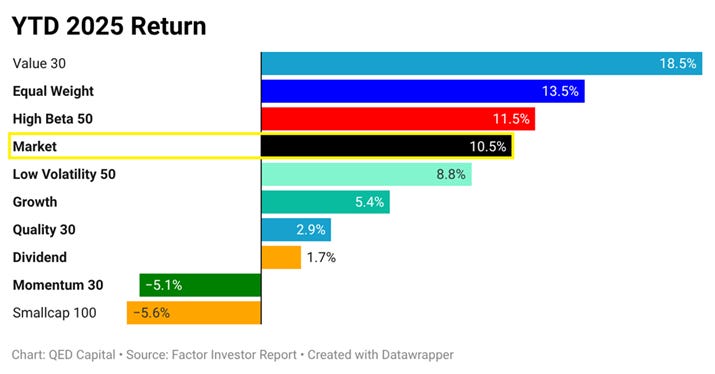

•Market: In 2025 leadership proved fragile, trends reversed quickly, and crowded exposures were tested as markets shifted from momentum-driven optimism to valuation and discipline.

•Value: Value benefited from cyclical recovery, sector rotation, and valuation normalization, emerging as the outperformer.

•Momentum: Momentum had a tough 2025. It struggled amid no clear trend emerging, frequent rotations, with sharp drawdowns. It did catch up a bit towards the end of the year.

•Quality & Low Volatility: Protection over participation. Defensive factors did what they were meant to do—limit damage during drawdowns but lagged during rebounds.

•Factor Investing: Factors reflect underlying fundamentals of the market. It is a disciplined and systematic way to apply time-tested investment principles.

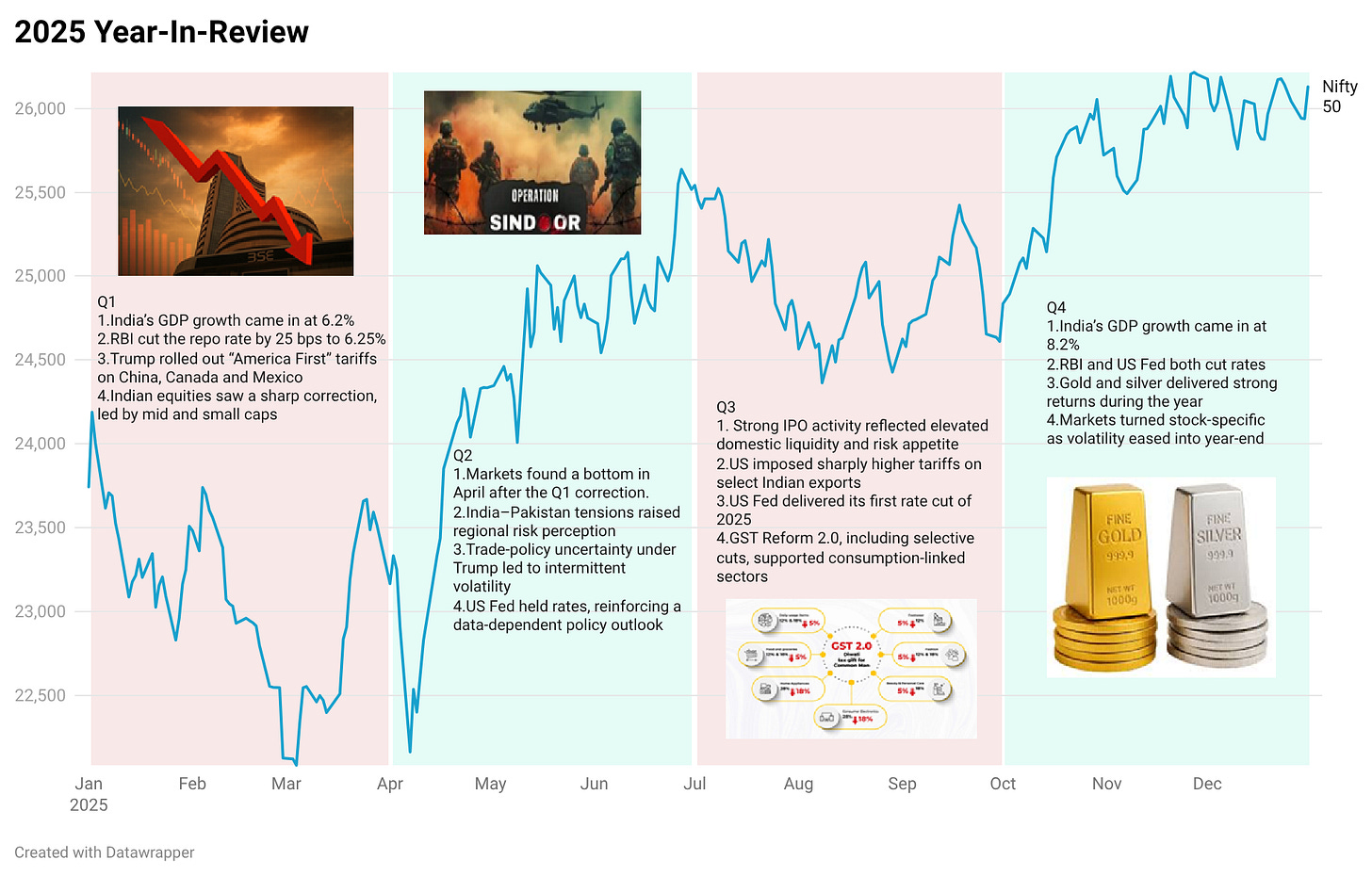

2. CY 2025 Year in Review

3. CY 2025 Factor Performance

•Value-Led Leadership – Factor performance in 2025 was dominated by Value, which delivered the strongest returns and materially outperformed the Market.

•Cyclical Risk Rewarded – Equal Weight and High Beta finished ahead of the benchmark, reflecting periods of risk-on conditions.

•Defensive Stability – Low Volatility lagged the Market but provided steadier participation during phases of elevated uncertainty.

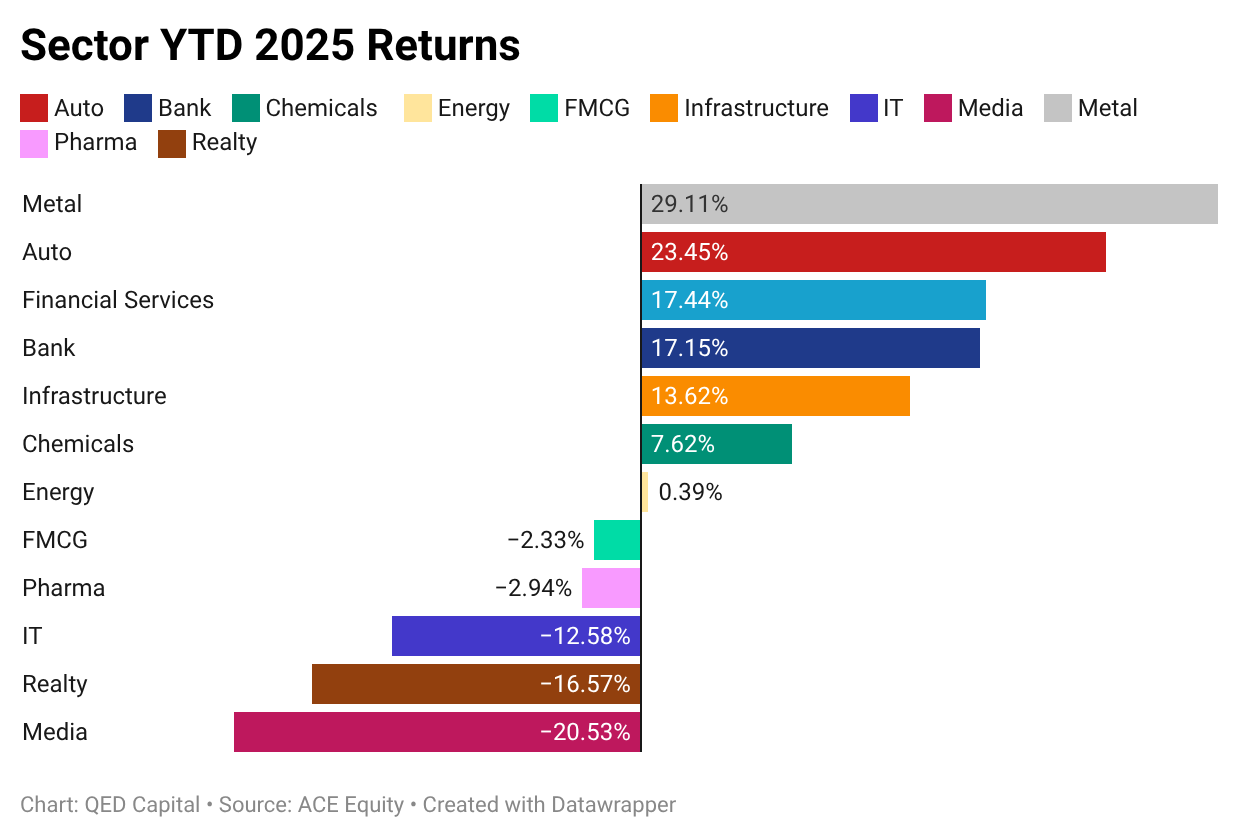

4. CY 2025 Sector Performance

Uneven Market Leadership – Sector performance in 2025 showed clear dispersion, with outcomes varying sharply across sectors rather than reflecting broad-based strength.

Cyclical Strength – Metals and Auto, finished the year at the top of the performance rankings. Metals carry forward that strength into CY 2026.

Financial Stability – Financials and Banks delivered steady returns, supporting overall market breadth.

Moderate Mid-Tier Performance – Infrastructure and Chemicals delivered modest gains, placing them in the middle of the sector performance spectrum..

The entire report is available at this link - Factor Year Report

Disclaimer: Nothing in this blog should be construed as investment advice. This is purely for educational purposes only. Please consult an investment advisor before investing.

Learn more about our investment offerings and philosophy - Our Website

Connect with us on whatsapp - Our whatsapp connect

Find us on X - Our X Account

Find us on LinkedIn - Our LinkedIn Page

Solid breakdown of how 2025 rewarded valuation discipline over momentum chasing. The sharp dispersion in sector performance mirrors what I saw play out in realtime, especially metals crushing it while defensive plays just treaded water. Value's comeback feels overdue given how badly it lagged the previous few years, tho cyclical reversals always make people nervous about sustainability.