This quarter the smooth trend in value, that was in place over the last many quarters showed signs to stalling and perhaps even reversing. The market is trying to make up its mind about the next direction it wants to take. And until then things will be volatile. Trends are visible only in hindsight. We can only respond to these changes with a predefined robust process. At no point in time is there easy money to be made in markets. This also is visible to market commentators in hindsight. Our aim is to manage risk and run our process over the long run.

-Editor

1. Factor Performance Summary

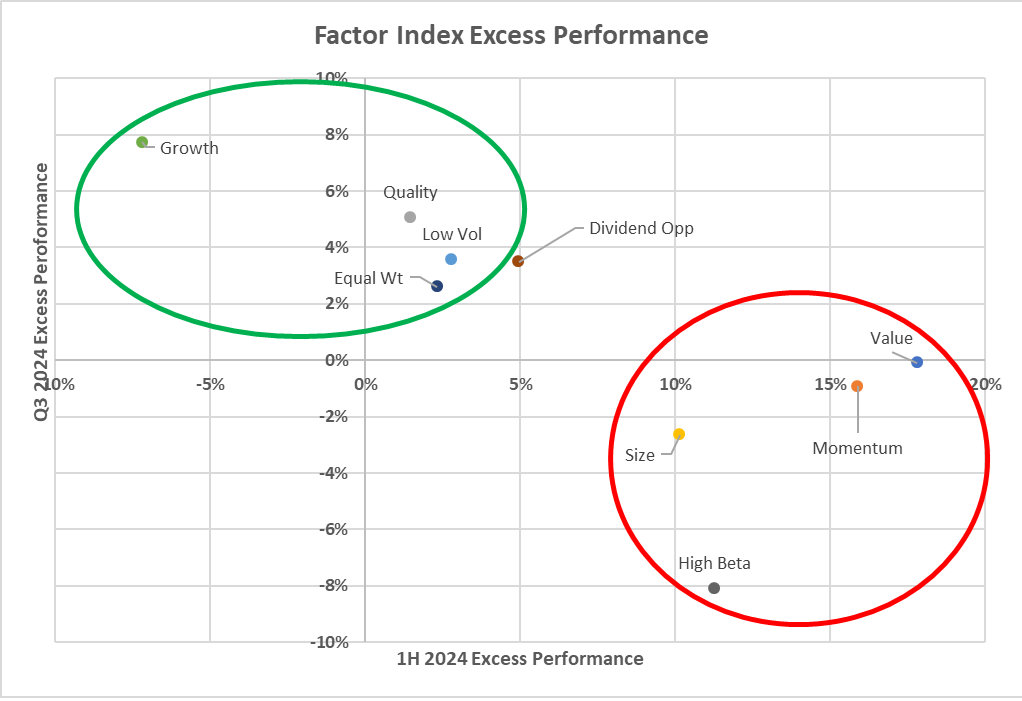

Quality, Low Volatility and Growth made a come back this quarter. A reversal in what has done well in the last 2-3 yrs i.e. Value and High Beta underperformed the market. As did Momentum.

On a YTD basis Value and Momentum are still leading the reversal in the last three months not withstanding.

This chart below explains the reversal of fortunes. Factors that performed well in the first half of the year, either did not beat the market and underperformed the market in the Sep 24 quarter. High Beta was the worst performer and Growth was the best performer. Low Vol, Quality and Growth had a good quarter after a not great CY2024 H1.

Whether this is a long, mid or short term reversal is something that time will only tell.

2. Tactical Asset Allocation

3. Relative Returns and Risk and Returns- Annual

4. Factor Ranks

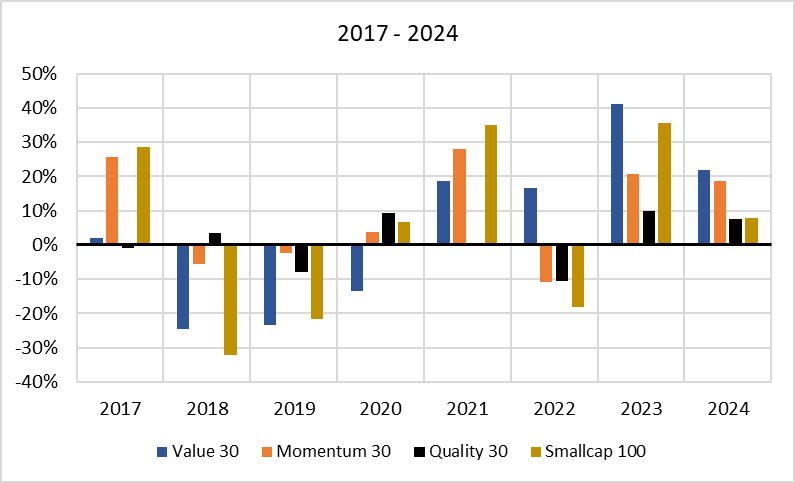

Value dropped to rank 2 for the first time this year and Momentum moved to number 1. Quality has moved a rank up from 6 to 5. Also Low Volatility moved a rank up from 5 to 4. Smallcap or Size fell the most this quarter from rank 3 to 6.

5. Factor Excess Return Correlations

6. Sector Ranks

7. Stock Ranks

An important component of our process is ranking stocks on Risk Adjusted Momentum over a look back period of 6 months. In the table below we show the top ranked 20 stocks in our Mid and Small Cap universe. The rank is based on Risk Adjusted Momentum score. It also shows the ranking of the stock one and three months ago.

8. Readings

The Less-Efficient Market Hypothesis by Clifford S. Asness

Market efficiency is a central issue in asset pricing and investment management, but while the level of efficiency is often debated, changes in that level are relatively absent from the discussion. I argue that over the past 30+ years markets have become less informationally efficient in the relative pricing of common stocks, particularly over medium horizons. I offer three hypotheses for why this has occurred, arguing that technologies such as social media are likely the biggest culprit. Looking ahead, investors willing to take the other side of these inefficiencies should rationally be rewarded with higher expected returns, but also greater risks. I conclude with some ideas to make rational, diversifying strategies easier to stick with amid a less-efficient market.

Disclaimer: Nothing in this blog should be construed as investment advice. This is purely for educational purposes only. Please consult an investment advisor before investing.