We have been speaking and writing about Low Volatility factor this month. And the latest video release yesterday talks about the multi-factor portfolio that we have built based on the paper, “The Conservative Formula: Evidence from India by Rajan Raju and Anish Teli (2022)” In October we will cover the other two factors - Momentum and Value/Quality that are part of the multifactor strategy. You can watch the videos on our channel here . If you have specific topics or questions that you want us to cover please send them to us in the comments section or email us at investor.relations@qedcap.com. Until next month. Stay safe in the markets.

- Editor

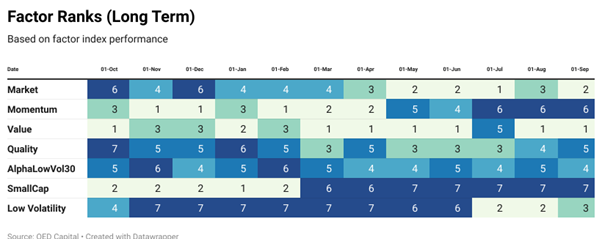

1. Factor Ranks

Value factor has outperformed the rest of the other factors still leads the long term rankings. Market factor has consistently improved throughout the 12 months, even in a volatile month, and managed to jump to 2nd rank. On the contrary, Momentum and Smallcap (or Size) are under pressure and are placed at 6th and 7th rank respectively. Quality and AlphaLowVol30 exchanged ranks this month and are placed at 5th and 4th rank respectively. Low volatility on the other hand has slipped to 3rd rank but has managed to stay in the top three for the third month in a row.

Momentum is at top spot here and value and quality bring up the rear end. So medium term and long term performance is in divergence. Which tells us some activity in terms of factor rotation is happening here.

Size Factor (Smallcaps) are in a downtrend and now quality has also joined Size. Rest all other factors remain in an uptrend for now.

2. Sector Ranks

Auto remains the best performing sector followed by FMCG. Energy has kept it space in the top 3. IT however languishes at the bottom.

Bounce in metals and strength in Banks is medium reading. Auto is a bit weak here. IT however is still at the bottom here.

IT, Media and Pharma remain in a funk. Realty moves into a downtrend.

3. Stock Ranks

A lot of changes in the stock ranks over the 3 Month period. The momentum has switched quite a bit as one can see many stocks in the 200-400 region now in the top 20.

4. Reading/Listening Corner

The Conservative Formula: Evidence from India by Rajan Raju and Anish Teli (2022)

We implement the Conservative Formula outlined by Van Vliet and Blitz (2018) on data from Indian stock markets. It selects 100 liquid stocks based on three criteria: low realised volatility, high net payout yield and strong price momentum. We demonstrate that this simple yet robust formula exposes investors to key factors like low volatility, quality (through operating profitability and investment factors) and momentum in India. The quarterly rebalanced portfolio of 100 stocks significantly outperforms the S&P BSE 100 in absolute returns (by 12.6% pa compound) and risk-adjusted returns. We show the Conservative portfolio’s performance outperforms the S&P BSE 100 and the Speculative portfolio over different business cycles. The formula has been shown to work over long periods: in US markets since 1929 and in other markets like Europe, Japan and Emerging Markets. Our paper extends this evidence to India. The conservative formula uses three simple criteria that do not require accounting data and, therefore, should appeal to a broad base of asset owners and managers in India. Link

Influence Empire: The Story of Tencent and China's Tech Ambition

In 2017, a company known as Tencent overtook Facebook to become the world's fifth largest company. It was a watershed moment, a wake-up call for those in the West accustomed to regarding the global tech industry through the prism of Silicon Valley: Facebook, Google, Apple and Microsoft.

Yet to many of the two billion-plus people who live just across the Pacific Ocean, it came as no surprise at all.

Founded by the enigmatic billionaire Pony Ma, the firm that began life as a simple text-message operator invested in and created some of China's most iconic games en route to dreaming up WeChat - the Swiss Army knife super-app that combines messaging, shopping and entertainment. Through billions of dollars of global investments in marquee names from Fortnite to Tesla and a horde of start-ups, Ma's company went on to build a near-unparalleled empire of influence.

In this fascinating narrative - crammed with insider interviews and exclusive details - Lulu Chen tells the story of how Tencent created the golden era of Chinese technology, and delves into key battles involving Didi, Meituan and Alibaba. It's a chronicle of critical junctures and asks just what it takes to be a successful entrepreneur in China.

Disclaimer: Nothing in this blog should be construed as investment advice. This is purely for educational purposes only. Please consult an investment advisor before investing.

![Influence Empire: The Story of Tecent and China's Tech Ambition: Shortlisted for the FT Business Book of 2022 by [Lulu Chen] Influence Empire: The Story of Tecent and China's Tech Ambition: Shortlisted for the FT Business Book of 2022 by [Lulu Chen]](https://substackcdn.com/image/fetch/$s_!BhFQ!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2Fbede9aa7-0121-4bc3-8274-bf775106d726_325x500.jpeg)

i appreciate the blog posts . thank you