This month we are revising a blog written few years ago but very relevant in light of the volatility in mid and small caps that we have seen in the last couple of weeks. Nothing out of the ordinary, but still can shake a few investors who joined the party late. For system and rules based investors, it tests their conviction and belief in their systems. Fair amount of action in the factor and sector ranks.

1. Mid and small caps get volatile

This is an excerpt from a blog I wrote a couple of years ago. Thought of getting it out given the volatility is up and some shakeouts are visible. These are the times when one’s faith and conviction in factor and systems investing is tested.

Its simple but not easy

Odysseus was the ultimate systems investor. He was warned by Circe that on the way back to Ithaca, he would encounter the sirens. They were known to lure sailors with their melodious singing and cause ships to crash on the rocks close to the shore.

Now Odysseus wanted to hear the sirens, but he didn’t want to get lured by them and cause his ship to crash. So devised a plan. He told his crew, to tie him to a post and ordered them to close their ears with beeswax. And he said under no condition were they to untie him, however much he begged and pleaded. This is beautifully captured in the painting above by John William Waterhouse.

A few days ago, Cliff Asness said in an interview “A huge part of our job is building a great investment process that will make money over the long term, but a fair amount of our job is sticking to it like grim death during the tougher times.”

So what does Odysseus have in common with Cliff Asness. They both know that they have to tie themselves to the post (in case of Asness it is his rules based investment process). As seductive as the siren’s singing may sound and however tempted Asness may be to over ride his investment process, because of the current narrative in the market and media, he knows that in order to survive and get through the journey, he will have to not untie him self from the proverbial post. Asness knows a bit or two about that.

2. Factor Ranks

Smallcaps fall a rank to 2. While value climbs to numero uno position. Momentum factor stays steady at 3. There is more action in the medium term ranks

The large cap and small cap divergence is seen in the medium term factor ranks. Market Factor (Large caps) has climbed to 2 while smallcaps has fallen to 4 after a rough last week. This small reversal was not totally unexpected given the way smallcaps were moving up. Value factor remains at number 1 while momentum factor is close at number 3.

3. Sector Ranks

We keep track of sector ranks as well to understand sector rotation. This sector ranking is done on a long term “relative momentum” basis of the respective sector indices. We also look at sector ranks on a medium term look back time frame.

Banks seem to have a made a comeback but not enough to make a dent on the longer term ranks. Over the last 40 week Metal index has climbed 76% while Banks are up 26%. So still quite a way to catch up here for banks. IT is slipping though. And led by strong crude prices, energy has climbed up.

IT has slipped to the near bottom of the table here followed only by Pharma. Energy is number 1. Banks have climbed to number 6. Energy is strong at number 1 while realty and auto climb to 3 and 4 respectively.

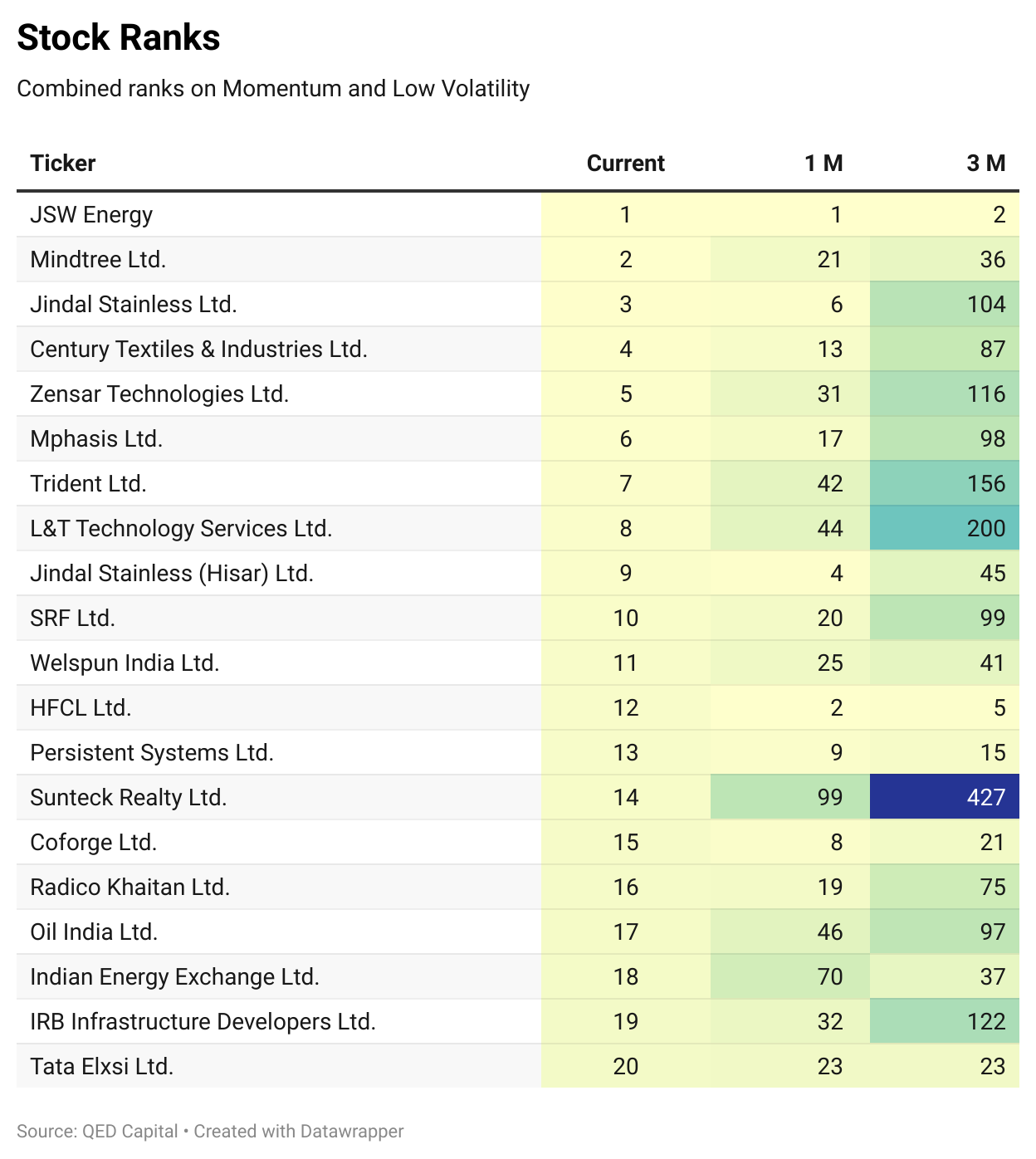

4. Stock Ranks

An important component of our process is ranking stocks on Momentum and Low Volatility over a look back period of 6 months. In the table below we show the top ranked 20 stocks in our Mid and Small Cap universe. The rank is a combined score of Momentum and Low Volatility. It also shows the ranking of the stock one and three months ago.

JSW Energy remains at the top followed by Mindtree which has had a strong run. New entrants in the top 20 are Zensar, Trident, LTTS, Sunteck Realty and IEX to name a few.

Disclaimer: Nothing in this blog should be construed as investment advice. This is purely for educational purposes only. Please consult an investment advisor before investing.