Its Value all the way in November. And it seems like it will have the last word. True to nature, Momentum lags when Value does well, and that seems to be happening. Momentum is lagging along with Quality. Two interesting papers to read this month in the reading section. One is an updated paper on Nominal and Real Returns in India and the other is on the Quality Factor in India.

-Editor

1. Factor Performance Summary

In keeping with global trends, Value factor was the best performer in November, followed by High Beta. The broader Market factor finished up a pretty good 4% up. Not a great month for Quality and Momentum factor which underperformed the market.

Value continues to lead the YTD numbers (leaving aside Growth for a bit as it is a very concentrated index). The broader market is up 8% while Low Vol and Dividend are positive. Quality and Momentum are still negative on a YTD basis and have Dec to just get over the finish line and close in positive territory. Smallcaps have recovered quite a bit from their lowest point during the year but are still quite deep in negative.

2. Five Year Risk & Return - Absolute

Not much changes on a 5 year basis. But this year belongs to Value and High Beta.

3. Relative Returns - Annual

The picture and the table below says it all. Value north. Momentum south.

4. Factor Ranks

Value takes over the numero uno spot again from Low Volatility. Momentum and Small caps lag with Quality for company. Performance of Low Volatility is consistent with the FMCG sector performance.

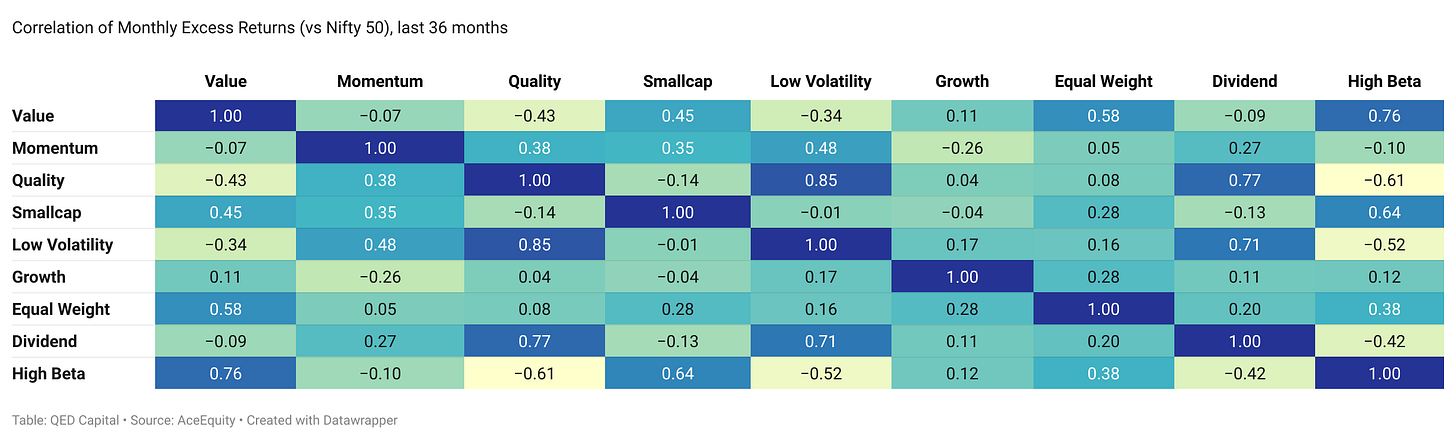

5. Factor Excess Return Correlations

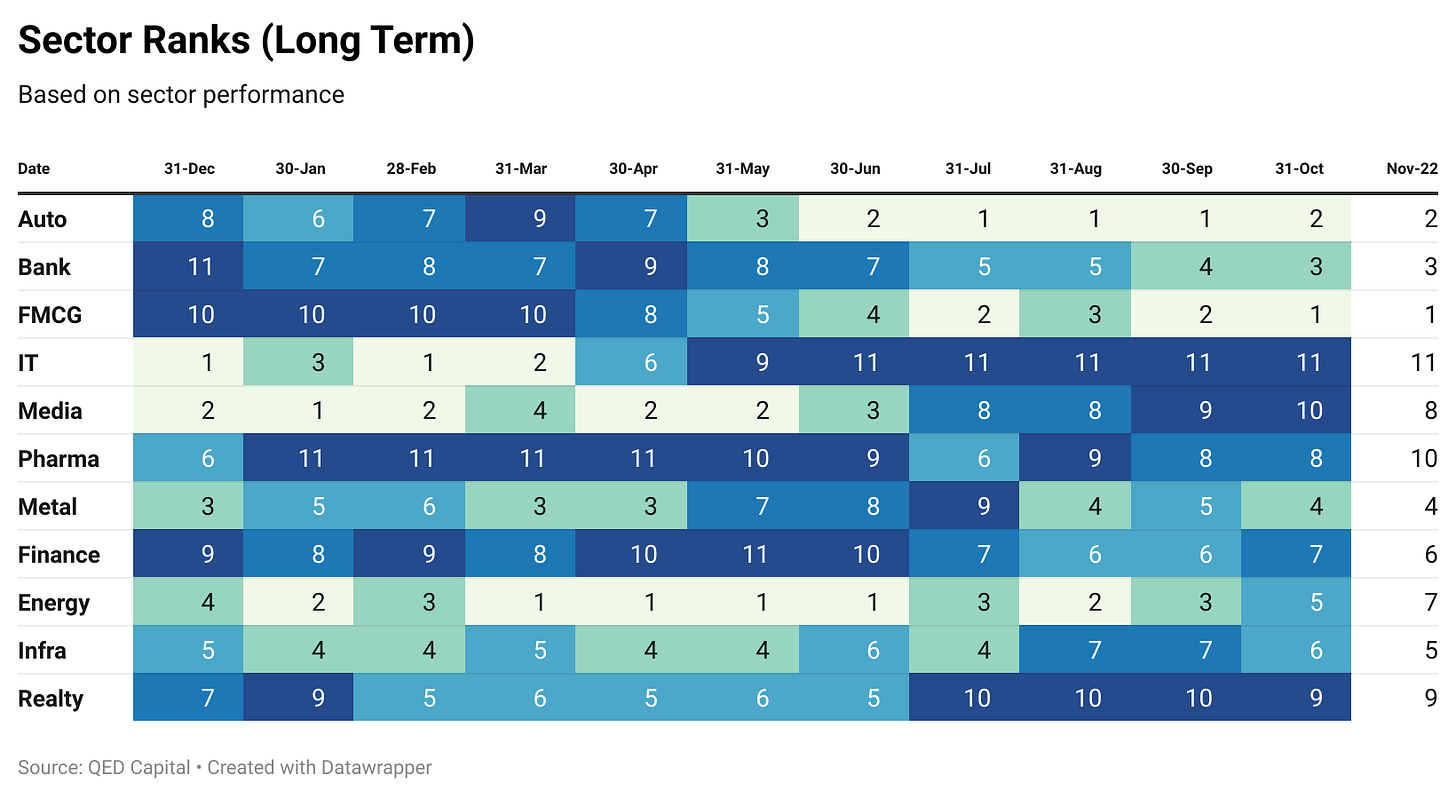

6. Sector Ranks

In utter contradiction with the Value factor performance, but in line with the Low Volatility factor performance, FMCG leads the long term sector ranks. Banks, Auto and Metals follow. PSU banks and PSU companies in general are having a great run, and that is perhaps masked by the sector ranks. IT has had a good bounce, but in relative terms it still lags and is at the rear.

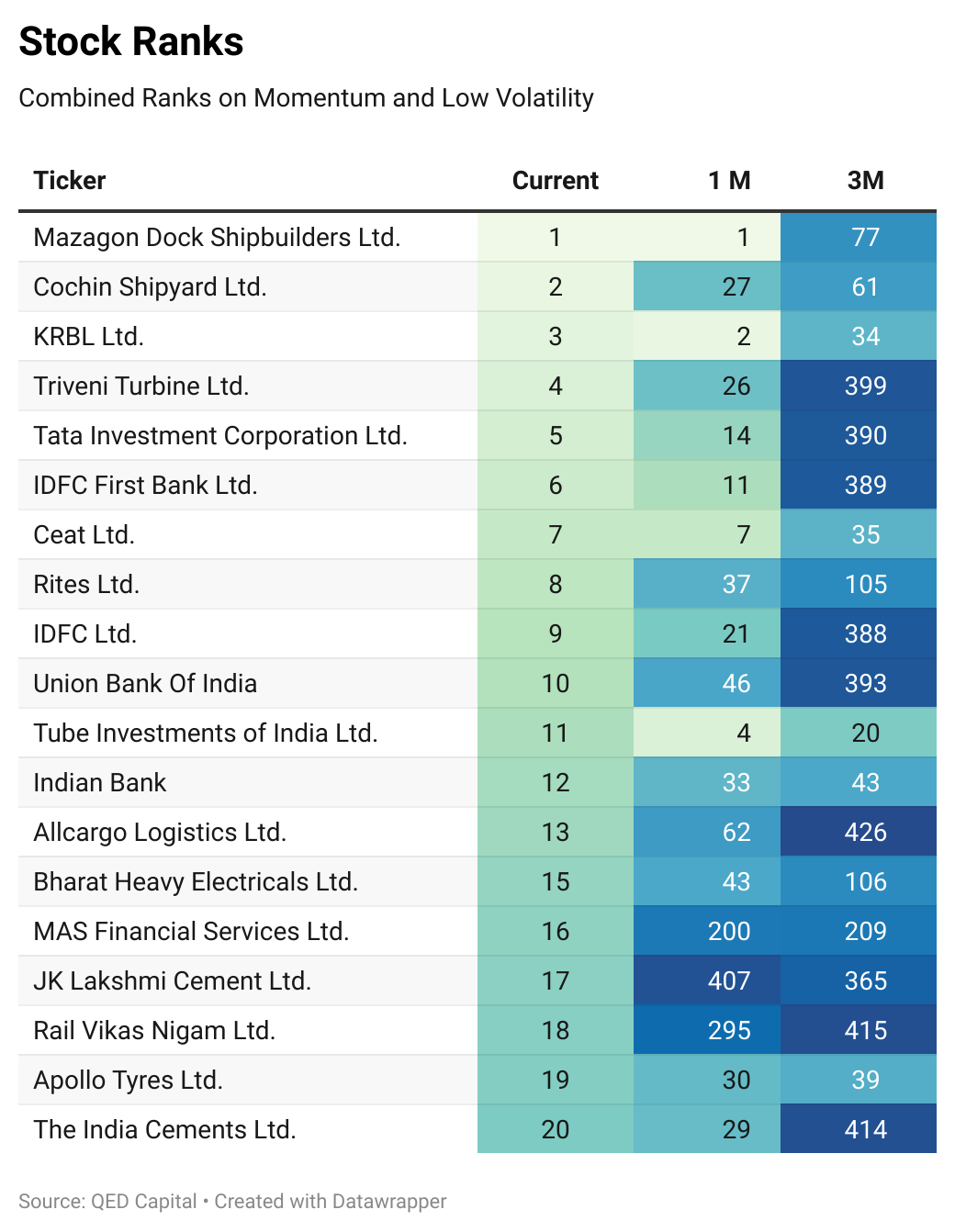

7. Stock Ranks

An important component of our process is ranking stocks on Momentum and Low Volatility over a look back period of 6 months. In the table below we show the top ranked 20 stocks in our Mid and Small Cap universe. The rank is a combined score of Momentum and Low Volatility. It also shows the ranking of the stock one and three months ago.

8. Readings

Abstract: We study the characteristics of Quality factor (QMJ) in India, which is the second largest emerging market. The QMJ factor earns a four factor alpha of 0.92% per month, significantly outperforming the other widely employed factors, market, size, value and momentum factors. A long-only Quality factor earns an alpha of 0.69% per month. The alpha of quality factors is highly significant, judged by the thresholds recommended by Harvey, Liu, and Zhu (2016). The key drivers of the alpha are profitability and payout, which are both consistent with the tunnelling hypothesis. Besides the alpha, the low portfolio churn, lower risk, shorter drawdowns, and viability of long-only strategies restricted to large capitalization stocks suggest that portfolios tilted towards high-quality stocks are highly attractive to institutional and retail investors.

Link: https://web.iima.ac.in/assets/snippets/workingpaperpdf/6392838778-2022-11-01.pdf

Nominal and Inflation-Adjusted Asset Returns in India: A Historical Survey, 2022 by Rajan Raju

Date Written: November 7, 2022

Abstract: In India, households are increasingly investing in financial assets, making the need for long-term data sets increasingly critical. Historical average long-term real returns range from 1.0% pa (range: 0.6 - 1.2%) for Fixed Deposits to 6.0% pa (range: 5.6 - 6.4%) for Equity. We show that all assets show significant risks (volatility, sequence risk, drawdowns) that pose unique challenges in constructing appropriate portfolios to deliver positive inflation adjusted returns to meet investor objectives.

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4270204

Disclaimer: Nothing in this blog should be construed as investment advice. This is purely for educational purposes only. Please consult an investment advisor before investing.