Editors Note

We are working on a rotation model which will use the factor and sector ranks which we provide in the monthly reports. We should have it out in the Jan 2022 report. Other than that, small amount of volatility causes a fair amount of noise in markets. The market gods are just making things interesting else markets were just one way so far. This month we have the factor ranks, sector ranks and stock ranks. Along with an unmissable podcast with the god father of momentum investing - Sheridan Titman, An interesting academic read on factor investing right from the 19th Century (1866-1926) and a book recommendation - spoiler alert - its on Warren Buffett but actually its more about having a capital allocation or “money mind” by an author who has not disappointed us in the past - Robert Hagstrom.

- Editor

1. Factor Ranks

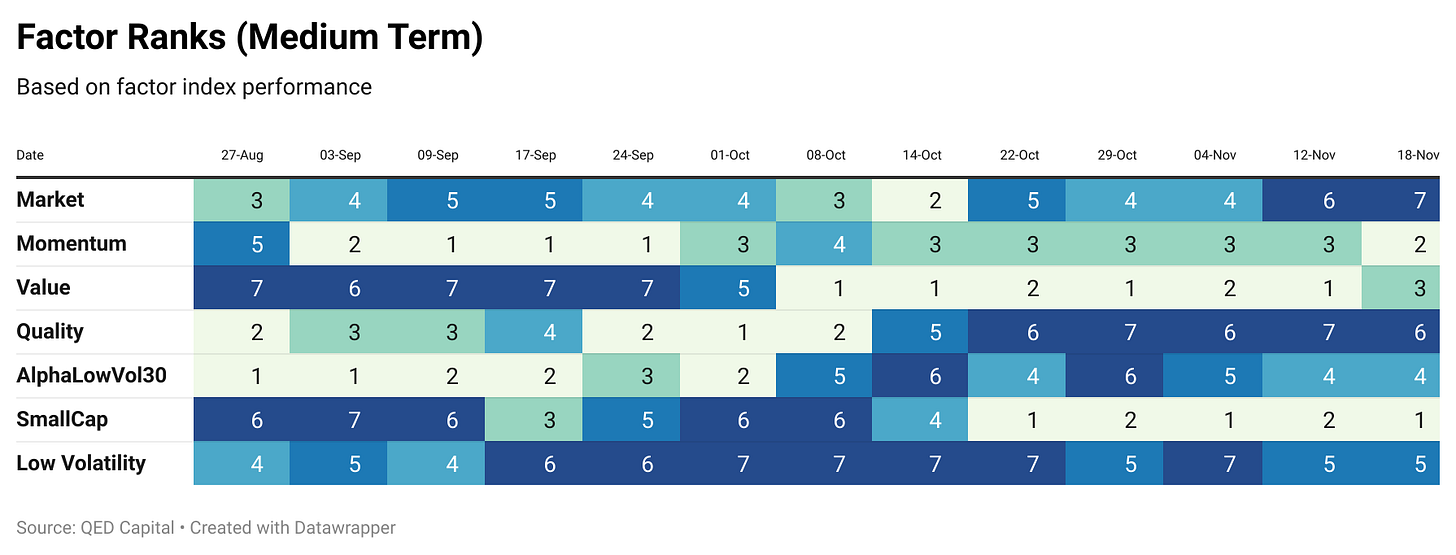

In the long term ranks, Momentum climbs two spots and replaces value. Value drops two places to 3. Large caps also climb couple of spots. Surprisingly low volatility drops 3 spots but it climbs two spots in the medium ranks.

The combination of momentum and low volatility captured by the AlphaLowVol index climbs two spots. Momentum also gains while Value falls.

2. Sector Ranks

We keep track of sector ranks as well to understand sector rotation. This sector ranking is done on a long term “relative momentum” basis of the respective sector indices. We also look at sector ranks on a medium term look back time frame.

Banks and Financials continue to underperform and fall couple of ranks and bring up the reat. Metals and IT continue to be at the top. FMCG climbs a couple of ranks along with Auto.

More action in the medium term ranks. Banks and Pharma continue their downward trajectory. Metals is at divergence from the longer term ranks. So it should not be long before we start seeing Metals move in the longer term ranks too. Energy, Auto and Realty continue to perform well.

3. Stock Ranks

An important component of our process is ranking stocks on Momentum and Low Volatility over a look back period of 6 months. In the table below we show the top ranked 20 stocks in our Mid and Small Cap universe. The rank is a combined score of Momentum and Low Volatility. It also shows the ranking of the stock one and three months ago.

Gujarat Fluro makes a big leap in the ranks. But this seems to be driven by the fact that it hasn’t corrected much in the last few months along with market. Other stocks that enter the ranks are Tata Power and three other realty names.

4. Reading/Listening Corner Corner

Sheridan Titman On His Seminal Paper on Momentum Investing and What He Has Learned Since

Momentum was a factor that many academics were very reluctant to embrace. Our guest this week, Sheridan Titman, helped to change that with his 1993 paper "Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency" that he co-wrote with Narasimhan Jegadeesh. In this interview, we discuss both his original work on momentum and what he has learned since. We also cover his research on combining value and momentum and the relationship between location and firm value, and what he thinks practitioners get wrong about academic research.

We hope you enjoy the discussion.

The Cross-Section of Stock Returns before 1926 (And Beyond)

by Guido Baltussen, Bart van Vliet & Pim van Vliet (Robeco Quantitative Investments)

Authors study the cross-section of stock returns using a novel constructed database of U.S. stocks covering 61 years of additional and independent data. Their database contains data on stock prices, dividends and hand-collected market capitalizations for 1,488 major stocks between 1866-1926. Results over this ‘pre-CRSP’ era reveal a flat relation between market beta and returns, an insignificant size premium, and significant momentum, value and low-risk premiums that are of similar size as over the post-1926 period. Overall, stock characteristics can explain over 25% of variation in stock returns. Further, recent machine learning methods are successful in predicting cross-sectional returns out-of-sample. These results show strong out-of-sample robustness of traditional factor models and novel machine learning methods.

Warren Buffett: Inside the Ultimate Money Mind by Robert G. Hagstrom

In Warren Buffett: Inside the Ultimate Money Mind, Hagstrom breaks new ground with a deep analysis of Buffett’s essential wisdom, an intricate mosaic of wide-ranging ideas and insights that Buffett calls a Money Mind. What exactly is a Money Mind? At one level, it’s a way of thinking about major financial issues such as capital allocation. At another level, it summarizes an overall mindset for successfully investing in today’s fast-paced stock market, a mindset that depends on a commitment to learning, adapting, and facing down irrelevant noise. This is not a method book. It is a thinking book.

Disclaimer: Nothing in this blog should be construed as investment advice. This is purely for educational purposes only. Please consult an investment advisor before investing.

![Warren Buffett: Inside the Ultimate Money Mind by [Robert G. Hagstrom] Warren Buffett: Inside the Ultimate Money Mind by [Robert G. Hagstrom]](https://substackcdn.com/image/fetch/$s_!fdvE!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2Fae8b525b-0144-4c23-8b52-3840246f93a0_338x500.jpeg)