It been a brutal sell off in the markets so far with last week’s pullback giving some respite. We remain data driven and will go where the data tell us to go. We have started our YouTube channel where we give you the factor performance for the week, month and year to date. We also take up a topic to discuss and give you the update on our Risk On/Risk Off model which will also be on our website soon. So do go and check it out here, subscribe and comment there. We would love to hear more from you.

-Editor

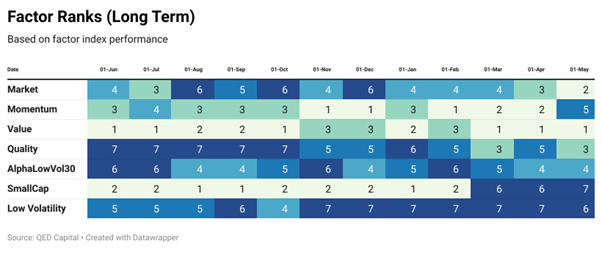

1. Factor Ranks

Value remains at the top spot with Market moving up to the second spot. Quality and Low Volatility move up a spot each.

In the medium term ranks, Low Volatility has moved up from the bottom to the top. This is not surprising given the volatility in markets last week. Momentum and Value have fallen the most. Quality climbs two spots.

The trend is now down across the board. Value which was the only one which was holding fort is also now in a downtrend. This is contributed by Metals and Energy.

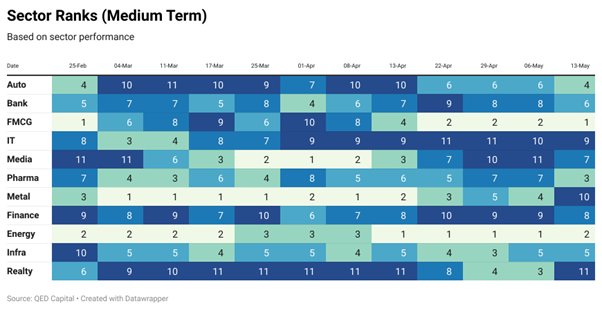

2. Sector Ranks

Energy, Media and Auto occupy the top three spots. Metals have fallen to number 7. IT has fallen another 3 ranks to number 9 now.

The medium term ranks were already showing weakness in IT sector since March 22. Metals have taken slid down from 3rd to the 10th rank. FMCG and Pharma (the relatively low volatility defensive sectors) have moved up in the top 3 ranks with Energy keeping them company.

Auto, FMCG, Metals and Infra were up last month but have given way and moved into a downtrend. Except for Energy, all other sectors are in a downtrend.

3. Stock Ranks

An important component of our process is ranking stocks on Momentum and Low Volatility over a look back period of 6 months. In the table below we show the top ranked 20 stocks in our Mid and Small Cap universe. The rank is a combined score of Momentum and Low Volatility. It also shows the ranking of the stock one and three months ago.

Stocks like HAL, PVR, and Indian Hotels have entered the top 20 among a few others. It is important to remember that these are relative return rankings. So the stocks in the list are relatively stronger than others in the market. It however doesn’t mean that they cannot fall if the market continues it down trend.

4. Reading/Listening Corner Corner

Podcast:

RWH005: MEET THE MASTER W/ ASWATH DAMODARAN

William Green sits down with valuation guru, Aswath Damodaran. Here, Aswath shares insights on how to value stocks, find the right investment strategy for you, and build a joyful life.

Books

The Bogle Effect: How John Bogle and Vanguard Turned Wall Street Inside Out and Saved Investors Trillions

The index fund wouldn’t be jack without Jack. It was just one innovation fueled by The Vanguard Group founder Jack Bogle’s radical idea in 1975 to make investors the actual owners of his new fund company. While the move was as much to save his job as it was to save investors, the end result was powerful: a fund company for the people and by the people. Bogle began a 50-year process of lowering costs inch by inch, which ultimately unleashed a populist revolt that has saved average investors trillions of dollars while reforming and right-sizing much of the entire financial industry.

Disclaimer: Nothing in this blog should be construed as investment advice. This is purely for educational purposes only. Please consult an investment advisor before investing.