Editor’s note

Metals continue to strong and that shows in our sector ranking since Dec 2020. How long or strong this trend is and will last is the question on everyone’s mind. Stock ranks also show some interesting entries. We present an interesting take on investing and capital allocation.

We would like to hear from you about anything else you would like us to write about. This report will also be available at factorinvestor.substack.com and you can write to us at investor.relations@qedcap.com

20th May, 2021

1. Invest-O-Meter

2. Sector Ranks

3. Stock Ranks

4. Reading Corner

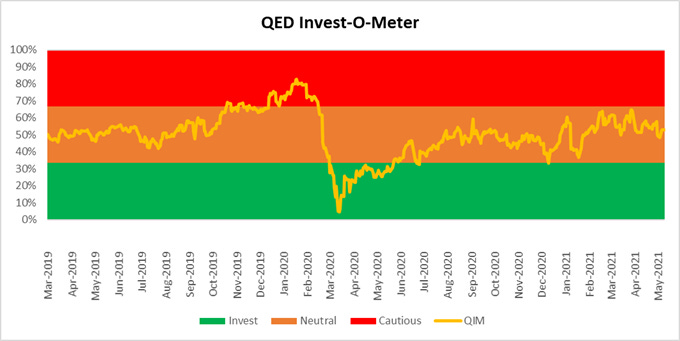

1. Invest-O-Meter

We are seeing sideways action in the markets now. Breadth indicators are still strong but overall market is in a range. Mid and Small Cap and stocks are on a tear lead by cyclicals, banks and finance.

2. Sector Ranks

We keep track of sector ranks as well to understand sector rotation. This sector ranking is done on a long term “relative momentum” basis of the respective sector indices. We also look at sector ranks on a medium term look back time frame.

Autos fall two ranks in the long term sector ranks, as sales fell in April 21. Banks climb a rank to 2 and finance climbs two ranks to 3. Metals continue to be at the top of the table. Pharma falls a rank and so does FMCG. So far the sectors which continue to be strong i.e. Metals, Banks, Finance and IT are non-consumer sectors with two of them being export oriented.

Metals stay at number one in the medium-term ranks. MSME concerns drive banking down from number 4 to 7. Pharma stays at 2. FMCG falls in line with fall in sales to 7.

3. Stock Ranks

An important component of our process is ranking stocks on Momentum and Low Volatility over a look back period of 6 months. In the table below we show the top ranked 20 stocks in our Mid and Small Cap universe. The rank is a combined score of Momentum and Low Volatility. It also shows the ranking of the stock one and three months ago.

Lots of action here. Astral Poly makes an entry at number One. Kajaria is still in the top 10. Chemical gets stronger – Galaxy and Aarti are represented here. UTI AMC and Ajanta make an entry this month.

4. Reading Corner

Play Your Own Game

Michael Jordan said he had to reconstruct his body when he went from basketball to baseball back to basketball. Baseball favored strong arms and chest; basketball required a leaner figure with a stronger core and legs. Part of the reason Jordan’s basketball return was rusty was because he was still lugging around his baseball arms. “Looking back, I didn’t have enough time to get back to a basketball body,” he said. Read on….

ITC has underperformed despite positive sentiment. Is the market right in punishing the stock?

Since 2014, the ITC stock has been a laggard and its RoE is falling. But things are changing post the company’s huge investment in non-tobacco category. There is a renewed investor interest claiming it to be a value buy. Then, why is the stock still underperforming the index? And, has the company got its capital allocation right? Read on here

Richer, Wiser, Happier: How the World’s Greatest Investors Win in Markets and Life by William Green

In Richer, Wiser, Happier, award-winning journalist William Green has spent nearly twenty-five years interviewing these investing wizards and discovered that their talents expand well beyond the financial realm and into practical philosophy. Green ushers us into the lives of more than forty of the world's super-investors, visiting them in their offices, vacation homes, and even their places of worship - all to share what they have to teach us. Green brings together the thinking of some of the best investors, from Warren Buffett to Howard Marks to John Templeton, and provides gems of insight that will enrich you not only financially but also professionally and personally. Read here