Its been a good quarter for Value and Momentum factors. The year ahead will take us through two important election events. Equity markets in general do react to highly unexpected outcomes but adjust to them fairly quickly and move along with their long term trend. By the time we come out with our next edition of the Factor Investor Report, we would know the outcome of the Indian elections. The low levels of India Vix at this point in time reflect that the market is quite complacent or confident about the outcomes it has discounted. Let us hope it remains that way.

-Editor

1. Factor Performance Summary

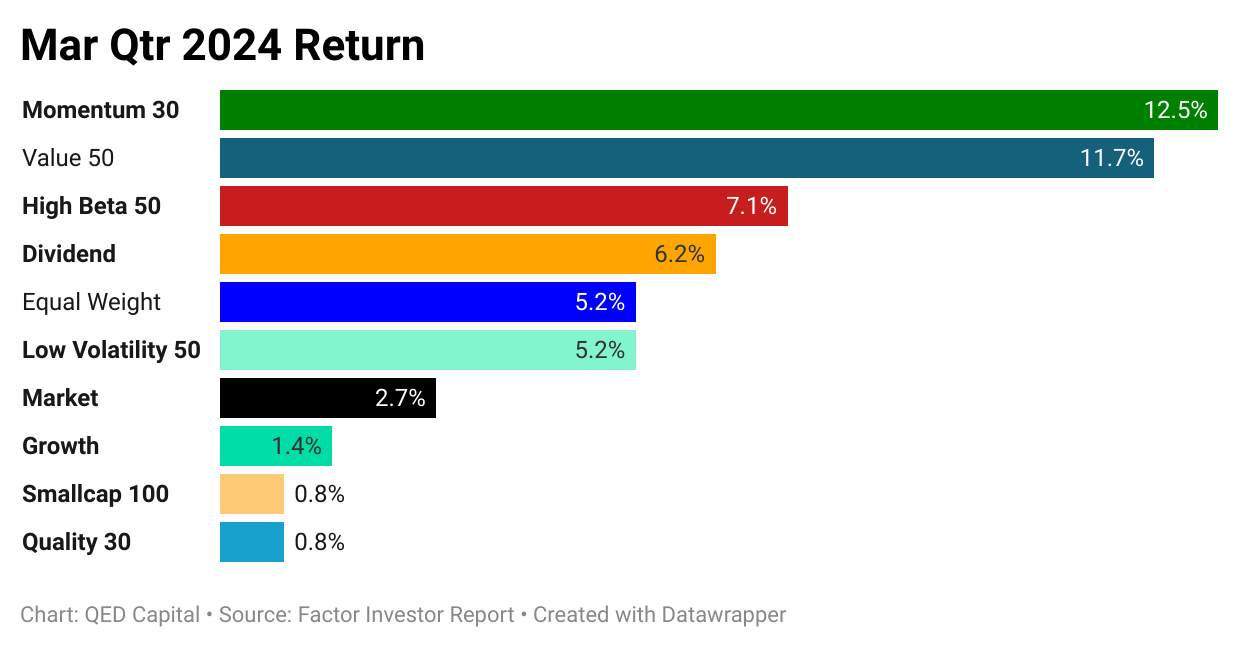

The March 24 quarter was a bit wobbly but up on a weekly and monthly basis. The quarter returns show a fairly good ride. Momentum overtook Value after a while on a quarterly return basis but over the longer term, Value still remains at the top. Small cap or Size has been replaced by Momentum as we will see below in the long term ranks.

2. Tactical Asset Allocation

3. Relative Returns and Risk and Returns- Annual

4. Factor Ranks

Value and Small Caps were winners in the second half of CY 2023 followed by Momentum. Value over took Small Caps in Jan to regain its number one position and momentum went from third to second place. Smallcaps have dropped to third place. Quality and Large Caps continue to be at the bottom of the table. Large Caps are showing signs of movement but the momentum in Small Caps is still quite strong.

5. Factor Excess Return Correlations

6. Sector Ranks

Realty remains robust. It jumped from the 7th spot to the 1st spot in Jun 23 and has remained there ever since. The fact that this has been a strong broad based sectoral move has been reflected in the stocks performance and those that show up in our momentum list. Energy and Infra have also been strong performers in the last six months along with autos.

7. Stock Ranks

An important component of our process is ranking stocks on Momentum and Low Volatility over a look back period of 6 months. In the table below we show the top ranked 20 stocks in our Mid and Small Cap universe. The rank is a combined score of Momentum and Low Volatility. It also shows the ranking of the stock one and three months ago.

8. Readings

When Ray Dalio, billionaire founder of Bridgewater Associates, the world's largest hedge fund, announced in October 2022 that he was stepping down from the company he founded forty-seven years ago, the news made headlines around the world. Dalio achieved worldwide fame thanks to a mystique of success cultivated in frequent media appearances, celebrity hobnobbing, and his bestselling book, Principles. In The Fund, Rob Copeland draws on hundreds of interviews with those inside and around the firm to reveal what really goes on with Dalio and his cohorts behind closed doors.

Tracing more than fifty years of Dalio's leadership, The Fund peels back the curtain to reveal a rarefied world of wealth and power, where former FBI director Jim Comey kisses Dalio's ring, recent Pennsylvania Senate candidate David McCormick sells out, and countless Bridgewater acolytes describe what it's like to work at this fascinating firm.

Dalio has stepped down from Bridgewater before; will the legacy of his Principles continue to chart the course of the firm? The Fund provides unique insight into the story of Dalio and Bridgewater, past, present and future.

Disclaimer: Nothing in this blog should be construed as investment advice. This is purely for educational purposes only. Please consult an investment advisor before investing.

Hi Team

Need to know, how did you calculate the factor ranks? Do you use any specific indices for same?