Editor’s note

This month there is a lot of activity in the stock and sector rankings. Cyclicals are entering the list and most deep value stocks are entering the momentum screen. An article on Smart Beta and some interesting recommendations for reading.

We would like to hear from you about anything else you would like us to write about. This report will also be available at factorinvestor.substack.com and you can write to us at investor.relations@qedcap.com

17th March, 2021

1. Is my beta smarter than yours?

2. Invest-O-Meter

3. Sector Ranks

4. Stock Ranks

5. Reading Corner

1. Is my beta smarter than yours?

“Smart Beta makes me sick”

William Sharpe, Nobel laureate

The origins of the term “Smart Beta” are not very clear. Value and small-cap investing styles have been used by active managers for long now. In the last couple of decades, after Fama and French’s seminal 1992 paper, “The Cross-Section of Expected Stock Returns”, index providers realized that these styles could be delivered to investors in transparent rules-based indexes.

Are other betas really “smart”er than market beta?

Smart Beta in my view is merely a marketing term to distinguish other factors/beta from “Market Beta” which has been around the longest and is the underpinning of Passive Index Investing.

Smart Beta is a term used for other factors like size, quality, momentum, etc. or if the portfolio of stocks in say a Market Beta fund is constructed with different weights. It’s like saying if we played with a heavier bat like Sachin Tendulkar, we would have more power in our shots, or if we changed the weight of our bats depending on where we are in the stage of the game like Dhoni does, then we will have an edge over the bowler.

Ultimately all bats will make runs if the cricketer stays at the crease and connects. Some bats are heavier and some are lighter. Sachin’s bats are not “smarter” than Dhoni’s. Smart is not an attribute we can apply to betas too. They all have different sources, but ultimately they are there to deliver returns to you.

Now the most popular and simple form of getting exposure to market beta is buying a fund replicating a market cap-weighted index. However, some believe that an equal cap-weighted index is better. And it is sold as a “smart market beta” index fund. You can read the whole article in the pdf file here or on Indexheads where it was first published in Dec 2019.

2. Invest-O-Meter

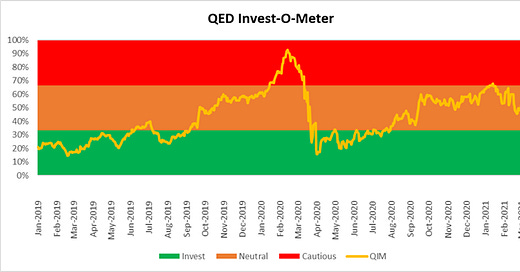

QIM is pushing the lower boundary of the “Cautious” zone and is still sort of bumping around there. We had a small correction in late Feb and now again things are choppy to say the least. Stay safe and look out for your hedges.

3. Sector Ranks

We keep track of sector ranks as well to understand sector rotation. This sector ranking is done on a long term “relative momentum” basis of the respective sector indices. We also look at sector ranks on a medium term look back time frame.

Banks continue to progress in the long term sector ranks, led by a roaring and strong bank nifty. They continue to remain at 3 and finance at 4. The activity is more in the PSU banking space though. IT keeps its place at number 2.

Metals are back to the top from number 4 in the medium-term ranks. Banking is has fallen from number 1 spot to number 4. FMCG and Pharma remain at 9 and 10. Showing that it is still a “risk on” environment.

4. Stock Ranks

An important component of our process is ranking stocks on Momentum and Low Volatility over a look back period of 12 months. In the table below we show the top ranked 20 stocks in our Mid and Small Cap universe. The rank is a combined score of Momentum and Low Volatility. It also shows the ranking of the stock one and three months ago.

Lots of action here. Tata Chemicals entered the top 20 table in end Feb. A number of industrials and capital goods companies in the mix here. Linde is here because of corporate events. Syngene is falling and fast.

5. Reading Corner

Value Stocks a Week Away From ‘Holy Grail’ Momentum Boost

Value stocks are morphing into their once-feared momentum rivals, a shift that could accelerate in coming weeks and give their rally a fresh boost. May 6 would be the six-month anniversary of the relative low for value stocks against their growth and momentum peers . “There is a significant overlap emerging between deep value stocks and momentum stocks -- there are a number of autos, banks, materials, and energy stocks which are screening as both value and momentum,” wrote Bernstein strategist Sarah McCarthy in a note Wednesday. Read on….

Hanlon’s Razor: Relax, Not Everything is Out to Get You

Hanlon’s Razor teaches us not to assume the worst intention in the actions of others. Understanding Hanlon’s Razor helps us see the world in a more positive light, stop negative assumptions, and improve relationships. Hanlon’s Razor is a useful mental model which can be best summarized as: ‘Never attribute to malice that which can be adequately explained by neglect.’ Like Occam’s razor, this heuristic is a useful tool for rapid decision-making and intelligent cognition. Read on to find out how.

Book: Blood and Oil: Mohammed bin Salman's Ruthless Quest for Global Power

Blood and Oil is the explosive untold story of how Mohammed bin Salman and his entourage grabbed power in the Middle East and acquired a network of Western allies - including well-known US bankers, Hollywood figures, and politicians - all eager to help the charming and crafty crown prince. Through astonishing interviews with powerful insiders, Blood and Oil tells how MBS's cabal played the Saudi economy and capitalised on the omnipotence of feudal power while effectively stamping out dissent, before allegations of his extreme brutality and excess began to slip out. A story of breathtaking dealings that range from Riyadh to London, Paris to America, this is a thrilling and brutal investigation into extreme wealth, one of the world's most decisive and dangerous new leaders, and the bid for Saudi transformation that is reverberating around the world.