This month we have two new additions. The Factor Returns over a month and the last 12 months. And we are also putting in the trend table. Which tells us which factors and sectors are in a uptrend and which are in a downtrend. We hope you enjoy reading this edition. And we will be back next month with some more additions.

Do write to us at investor.relations@qedcap.com with your feedback, suggestions and queries.

-Editor

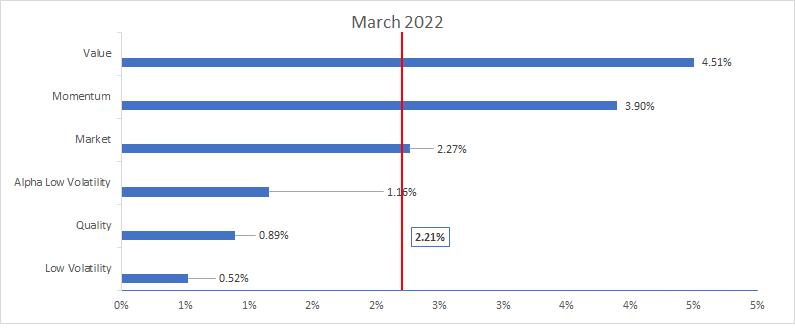

1. Factor Returns

We are adding a new section on factor returns for the month and past 12 months. This month, value and momentum performed better than the average of the factors at 2.2%.

Over the last 12 months, value and momentum have done equally well. Quality, Market and Low Volatility underperformed the average.

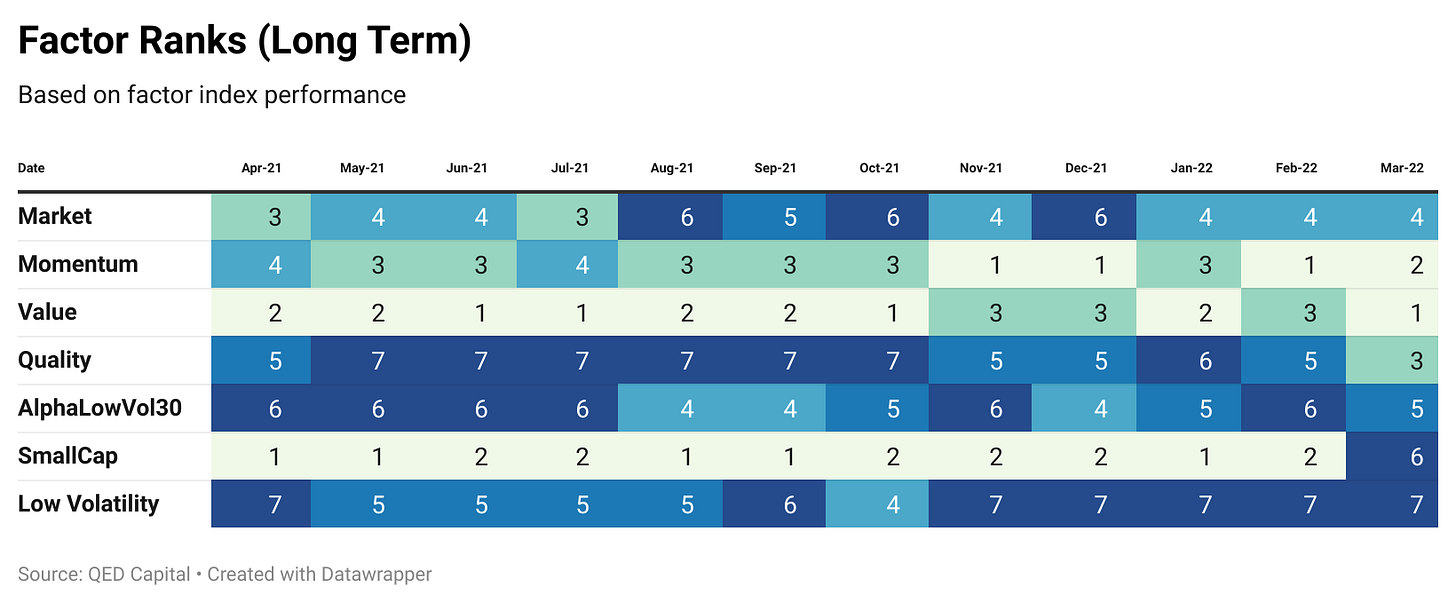

2. Factor Ranks

Value moves to the top followed by Momentum. Quality moves to 3rd place. Small Caps lose steam and fall from 2 to 6. Market and Low Volatility retain their ranks.

Quality and Momentum gain strength in the medium term ranks. Size (Small-caps) and Market factor lose steam. This is visible in the long term ranks too. Which tells us that broad based market strength is weakening while certain styles are still doing well.

And we are also adding a trend overlay as the above horse race is relative ranking. But we also need to know what is doing how on a trend basis. Market, Momentum and Value are still holding on an uptrend after going down in Feb and Mid March 22. Rest are all in a downtrend. Interesting to note that smallcaps which have performed quite well are in a downtrend while large caps are up. So thats being driven by energy and metals largecaps. And may also be a trend for year. LargeCaps over Mid and SmallCaps.

3. Sector Ranks

Energy, IT, Metals and Media are driving the market. Autos, Pharma and FMCG remain in a funk.

Pretty much the same story here, except IT taking some short term beating. But rest of the medium term ranks are in line with long term ranks.

IT, Metals, Energy, Infra and Media in an uptrend and keep the markets going. Banks, Pharma and FMCG continue to be a drag.

4. Stock Ranks

An important component of our process is ranking stocks on Momentum and Low Volatility over a look back period of 6 months. In the table below we show the top ranked 20 stocks in our Mid and Small Cap universe. The rank is a combined score of Momentum and Low Volatility. It also shows the ranking of the stock one and three months ago.

Trident finally gives way to KPIT at the numero uno position. Narayana Hrudalaya makes to the top 20, along with Balrampur Chini, GNFC and BDL among others.

Disclaimer: Nothing in this blog should be construed as investment advice. This is purely for educational purposes only. Please consult an investment advisor before investing