June was a good month for markets as has been July till date. Most factors managed to beat the market. We are planning to to make the factor investor a quarterly report. So perhaps the next report that we will do will be at the end of Sep. Until then enjoy the trend.

- Editor

1. Factor Performance Summary

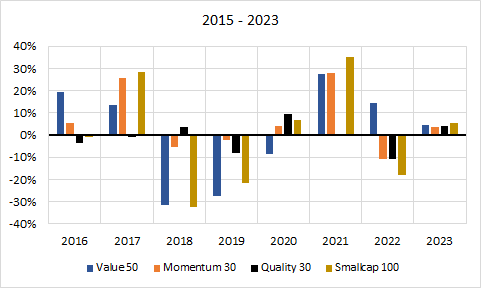

Smallcaps have come to the party and in a big way. It has led folks who pay too much attention to markets on a daily basis to conclude that we are already in a bubble. High Beta also had a great month followed by value and low volatility.

On a YTD basis Dividend still is the top performer followed by Size (smallcaps) and Growth. All factors are comfortably beating the market on a YTD basis.

2. Tactical Asset Allocation

3. Relative Returns and Risk and Returns- Annual

4. Factor Ranks

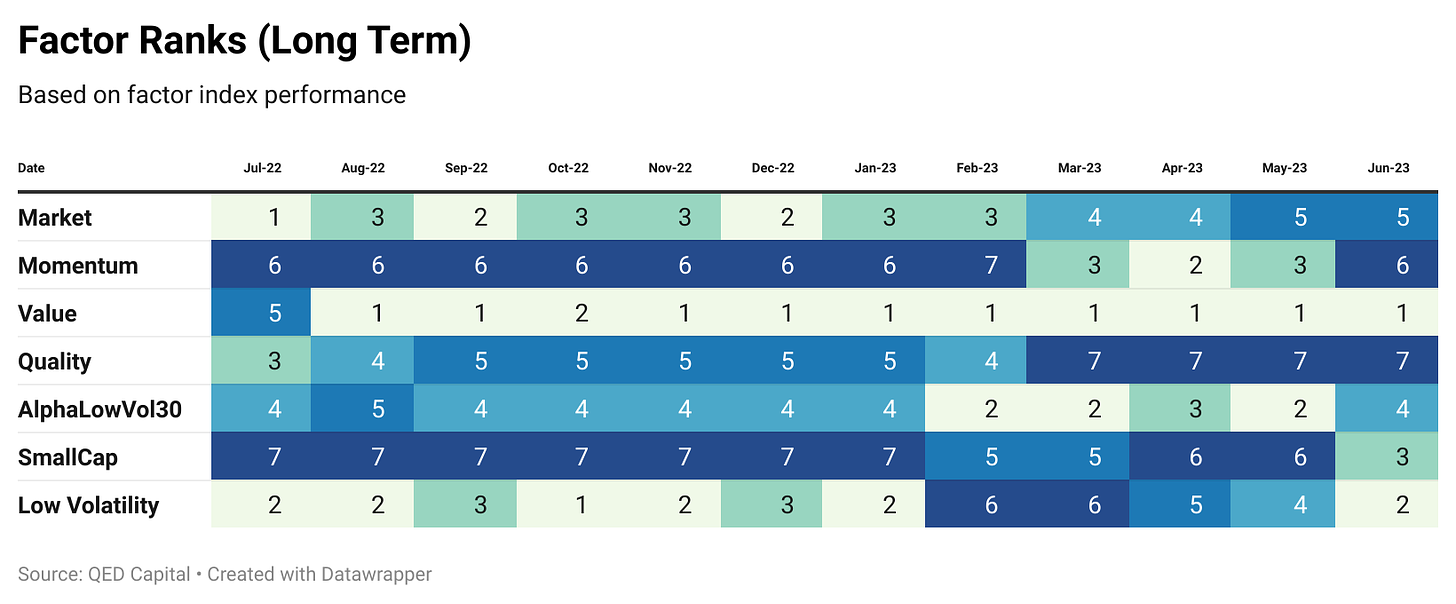

In keeping with the performance Size makes the biggest move from 6 to 3. Low Volatility also climbs from 4 to 2.

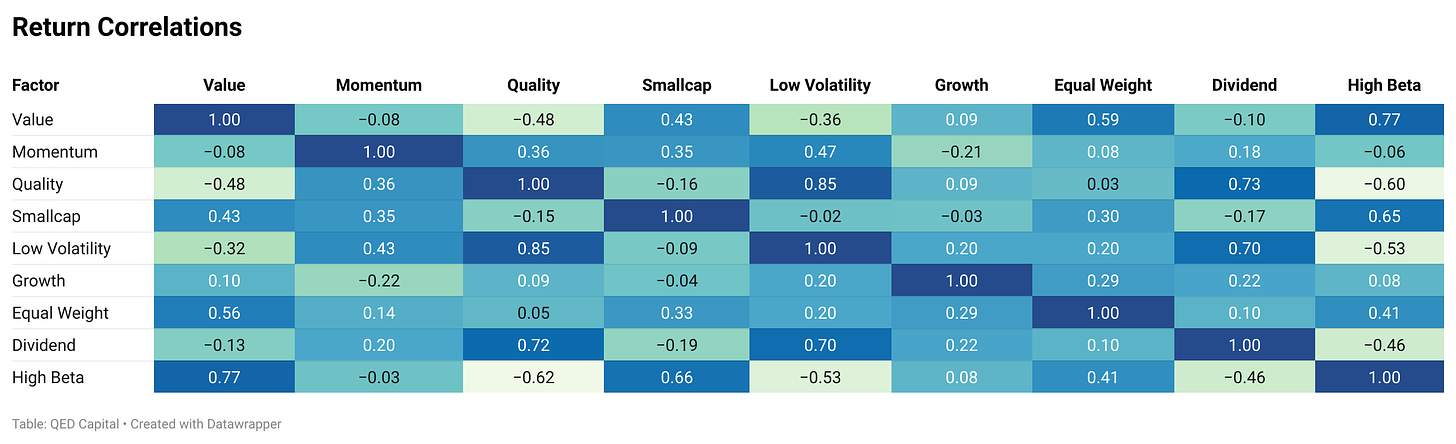

5. Factor Excess Return Correlations

6. Sector Ranks

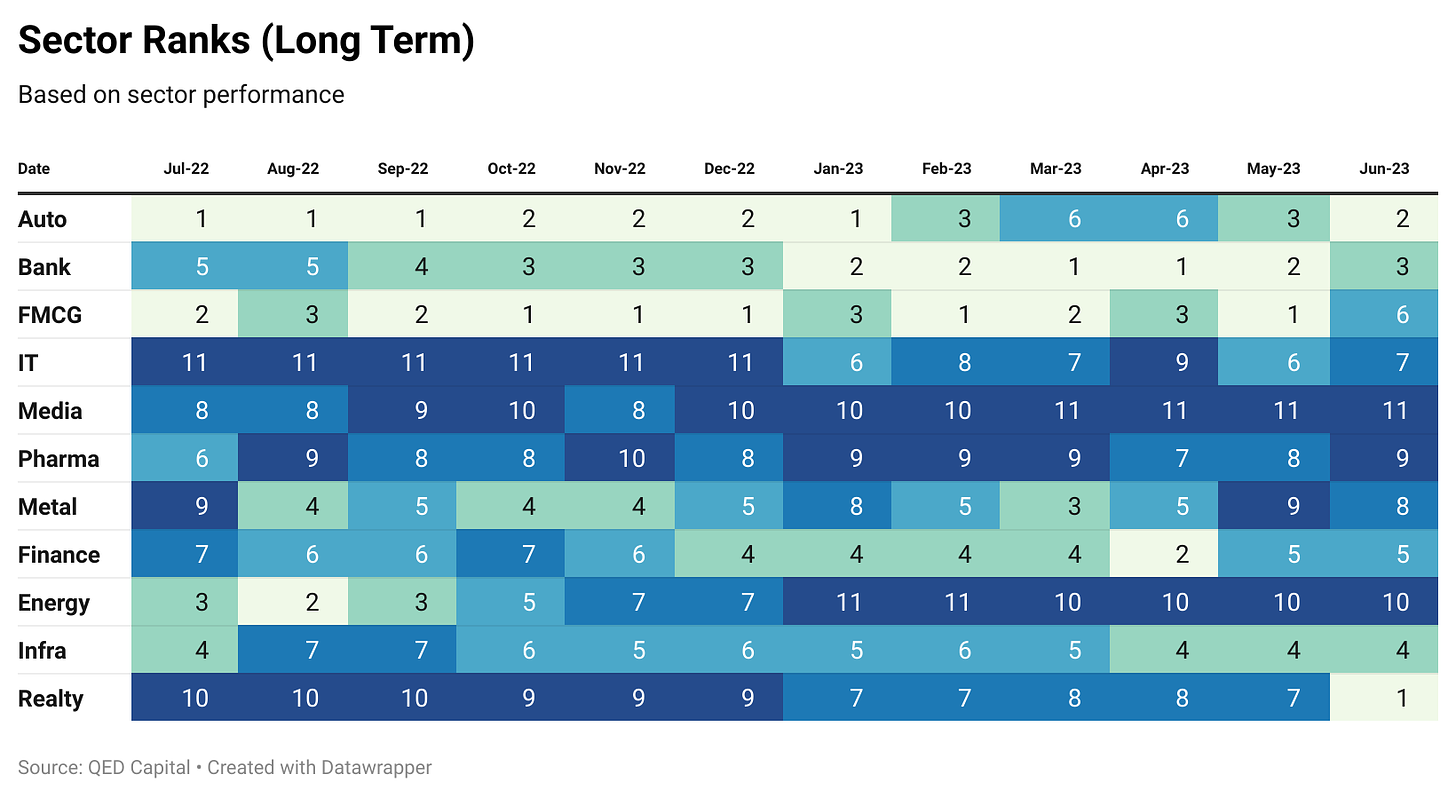

Realty makes the biggest jump from 7 to 1, while FMCG drops from 1 to 6. This indicates “risk on” sentiment in the markets.

7. Stock Ranks

An important component of our process is ranking stocks on Momentum and Low Volatility over a look back period of 6 months. In the table below we show the top ranked 20 stocks in our Mid and Small Cap universe. The rank is a combined score of Momentum and Low Volatility. It also shows the ranking of the stock one and three months ago.

Disclaimer: Nothing in this blog should be construed as investment advice. This is purely for educational purposes only. Please consult an investment advisor before investing.