”FIIs continue to sell, DIIs continue to buy.

Inflation continues to be high. Fed continues to hike but is a bit shy.”

June has not been unlike May 22. However, the last week or so we have seen some respite. We held our first LinkedIn live event with the topic - Factor Performance across Macroeconomic cycles. The link of the recording is there in section 4. We will put it up on our YouTube channel also. Do send us your feedback and questions. We would love to hear more from you.

-Editor

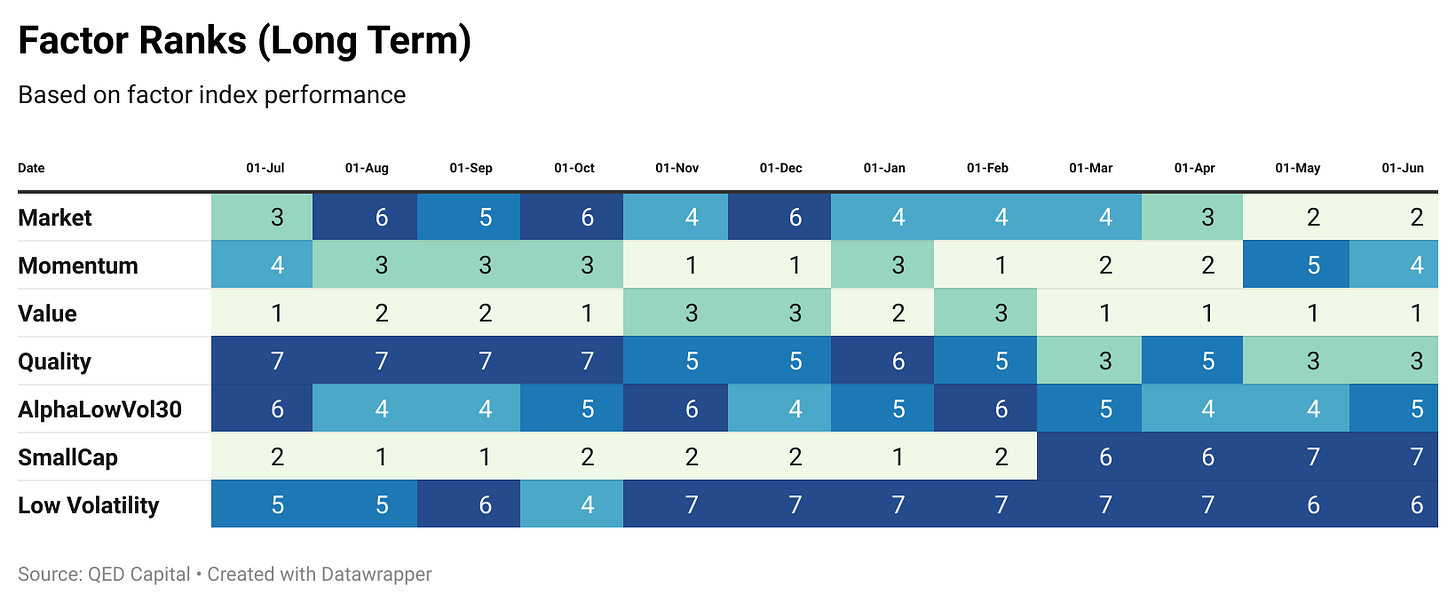

1. Factor Ranks

Value remains at the top spot, followed by Market Factor and Quality. Small Cap and Low Volatility bring up the rear. Although our sense is by the time this contraction period is done with, we may see Low Volatility move up the ranks.

The last statement made above is visible clearly in the medium term tanks, Low Volatility is number one, making a smart jump from number 7 rank in May. It is followed by Market and Quality.

Last month the only factor in an uptrend has now joined the rest of the pack. All factor are now in a downtrend.

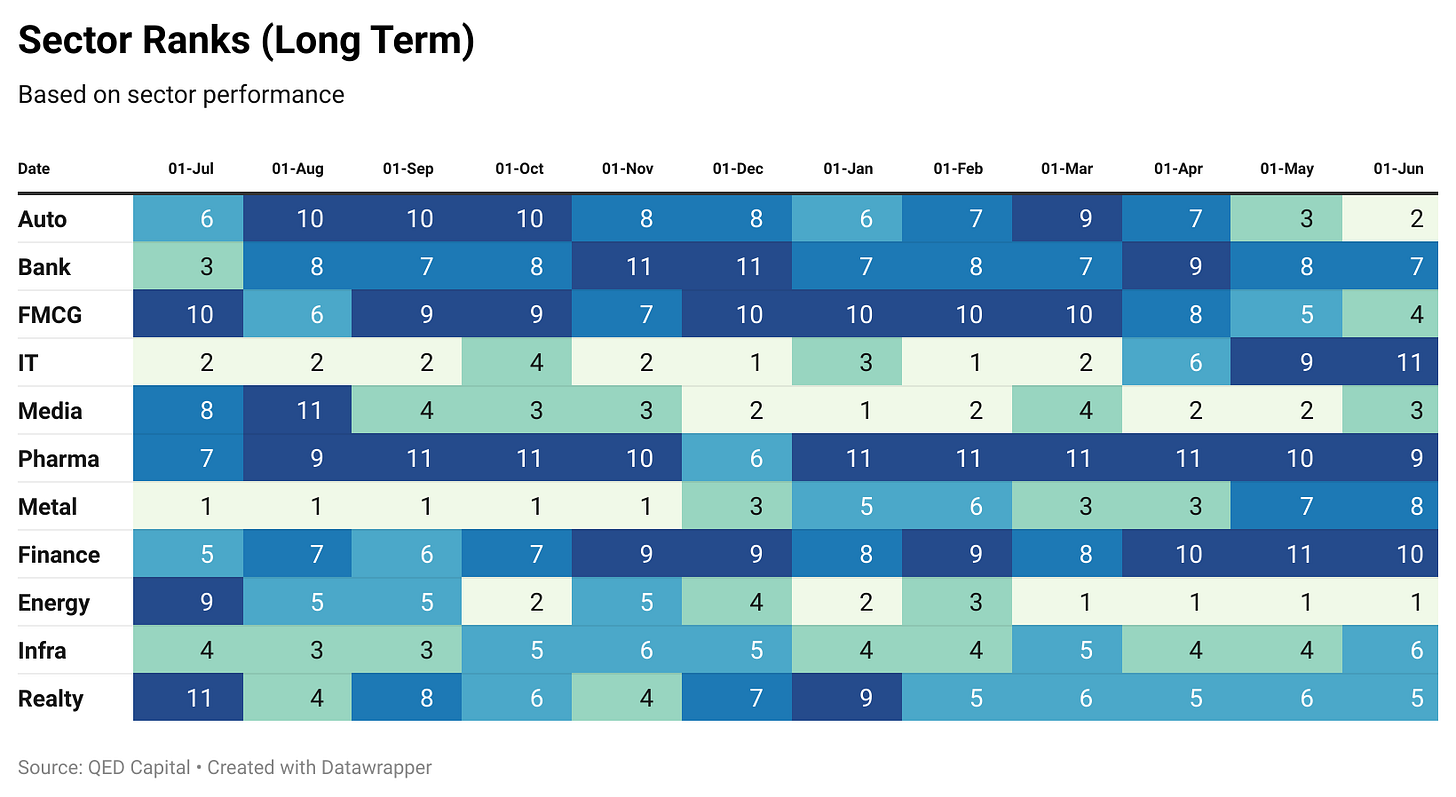

2. Sector Ranks

Energy continues to be at number. But an interesting one at 2 and 4 - Auto and FMCG respectively. FMCG ties in well with the rise of the Low Volatility sector. IT continues to bring up the rear.

In fact the medium term FMCG trend mirrors the medium term trend of Low Volatility factor.

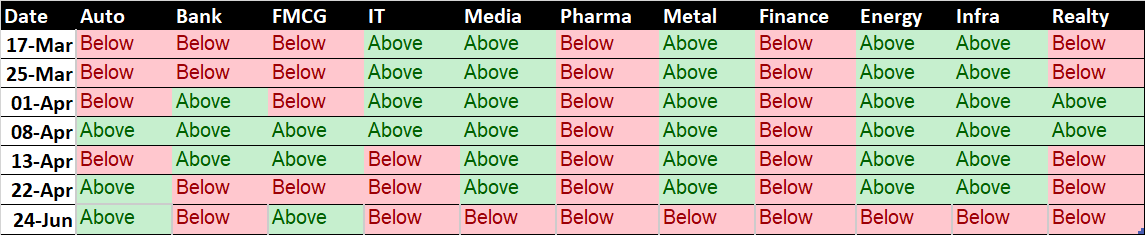

Auto and and FMCG are bucking the trend and are bobbing near the trend boundary. However, the rest of the sectors are all in a down trend.

3. Stock Ranks

An important component of our process is ranking stocks on Momentum and Low Volatility over a look back period of 6 months. In the table below we show the top ranked 20 stocks in our Mid and Small Cap universe. The rank is a combined score of Momentum and Low Volatility. It also shows the ranking of the stock one and three months ago.

Most stocks are in a downtrend. But on a relative basis some stocks will continue to do relatively “less worse” than others. An interesting entrant is Crisil this month.

4. Reading/Listening Corner

On 24th June 2022, we conducted our first LinkedIn Live event on “Factor Investing across Macro Economic Regimes” where Anish Teli (Partner-QED Capital) and Rajan Raju (Director-Invespar) discussed the performance of academic full factors and long only factor portfolios across macroeconomic regimes. The link to the recording of the event is available below.

Link to the discussion: “Factor Investing across Macro Economic Regimes”

Disclaimer: Nothing in this blog should be construed as investment advice. This is purely for educational purposes only. Please consult an investment advisor before investing.