Contents

1. Factor Ranks

2. Invest-O-Meter

3. Sector Ranks

4. Stock Ranks

5. Reading Corner

Editor’s note

We introduce factor rankings this month. Stocks in our ranking list are included in the NSE strategy indices. And some interesting sector moves.

We would like to hear from you about anything else you would like us to write about. This report will also be available at factorinvestor.substack.com and you can write to us at investor.relations@qedcap.com

19th June, 2021

1. Factor Ranks

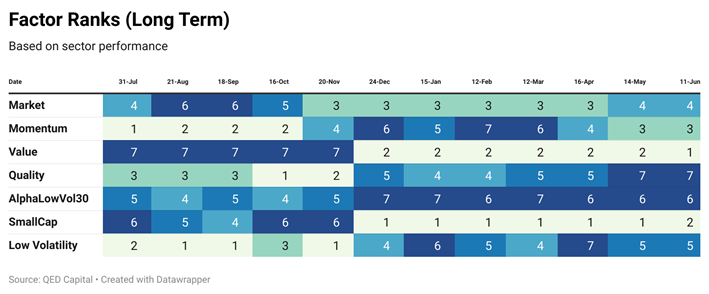

This month we are introducing factor rankings. We will be ranking the following factors based on long term (40 week) price performance. And on medium term (12+4 weeks) price performance. The factors we are ranking and the benchmark we are using for them are given below.

Its not surprise that Value is the top ranking factor and quality is right at the bottom. The interesting part is how Momentum which was languishing at the bottom in January and February of this year has rebalanced its way back to number 3. It uses price which is the purest form of signal and price adapts to all themes that are performing in the market.

Its no surprise that Value is the top-ranking factor and quality is right at the bottom. The interesting part is how Momentum which was languishing at the bottom in January and February of this year has rebalanced its way back to number 3. It uses price which is the purest form of signal and price adapts to all themes that are performing in the market.

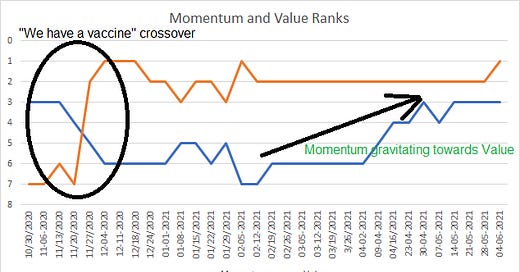

It is for this reason that some call Momentum the “Chameleon Factor”. When we had a vaccine in November 20, there was a massive rotation out of WFH stocks and into Economy Reopening stocks. These were also beaten down old economy value stocks. Correlate these with the Sector ranks and you will see at the same the Metals sector started its ascent and defensives like Pharma and FMCG started underperforming.

Momentum strategies with a weekly and monthly rebalancing frequency moved quickly out of pharma and FMCG and into metals. Those with a longer rebalance frequency like quarterly or six monthly were late to the party. However, that will matter only in the short run. There are a couple of links to read about rebalance frequency and the chameleon factor in the Read/Listen Page.

Value, Momentum and Small cap are the factors working in the medium term ranks too. There are various studies which show that Value and Momentum work better in small caps over large caps. You can read more on that here.

2. Invest-O-Meter

And the range bound volatile market continues. There are trends in the sectors and stocks which continue. But the broad-based Index continues to try and break out. Invest-O-Meter remains in Neutral leaning towards Cautious zone.

3. Sector Ranks

We keep track of sector ranks as well to understand sector rotation. This sector ranking is done on a long term “relative momentum” basis of the respective sector indices. We also look at sector ranks on a medium term look back time frame.

No change in long term sector ranks. Metals, Banks and Financials continue to be at the top of the ranks.

In the medium term ranks, Infra climbs to number 6 from 10. Metal is at number one. But given the action this week this may change. Energy keeping steady at 4 with oil prices on an upswing. FMCG continues to bring up the rear.

4. Stock Ranks

An important component of our process is ranking stocks on Momentum and Low Volatility over a look back period of 6 months. In the table below we show the top ranked 20 stocks in our Mid and Small Cap universe. The rank is a combined score of Momentum and Low Volatility. It also shows the ranking of the stock one and three months ago.

Lots of action here. Astral Poly made an entry last month at number one. And is now at three. It is also being included in the Nifty Alpha 50 w.e.f. 30th June 2021 along with Dalmia Bharat, Kajaria Ceramics. Mindtree is being included in the Alpha Low 30 Index.

5. Reading Corner

The problem with momentum ETFs

Offering something of a fix, Athanasios Psarofagis, ETF analyst at Bloomberg Intelligence, said European momentum ETFs should look to products such as the Vanguard US Momentum Factor ETF (VFMO), which has discretion over the timings of rebalances. “One thing it can do is do it in sleeves, meaning it breaks the ETF into 12 sub portfolios,” Psarofagis said. “It does not rebalance the whole thing in one shot but rebalances 1/12 monthly.” Read on….

Momentum on a Value Hunt

As a result of changes in relative factor performance over the past six months, securities with higher value exposure started to exhibit higher momentum characteristics, as can be seen in the increase in value-momentum correlation in the exhibit below. Simultaneously, poor performance in growth, low-volatility and quality stocks decreased their momentum characteristics. Read on here

Bitcoin Billionaires: A True Story of Genius, Betrayal & Redemption by Ben Mezrich

Bitcoin Billionaires is the story of the brothers' redemption and revenge in the wake of their epic legal battle with Facebook - and the first great book from the world of bitcoin. Planning to start careers as venture capitalists, the brothers quickly discover that no one will take their money for fear of alienating Zuckerberg. While nursing their wounds in Ibiza, they accidentally run into a shady character who tells them about a brand new idea: cryptocurrency. Immersing themselves in what is then an obscure and sometimes sinister world, they begin to realize "crypto" is, in their own words, "either the next big thing or total bulls--t." There's nothing left to do but make a bet. From the Silk Road to the halls of the Securities and Exchange Commission to the Facebook boardroom, Bitcoin Billionaires will take us on a wild and surprising ride while illuminating a tantalizing economic future.