In line with our goal to be a quantitative research driven fund house and put more implementable research out there, we have published our second paper this year. The Conservative Formula: Evidence from India takes the Conservative Formula outlined by Blitz and Van Vliet and applies it to Indian data. An extract of the paper is given below. In other events, it looks like the Fed’s actions are having some effect but with an inverted 2-10 yield, it is tough to say how far the Fed will go. There has been a sharp bounce back this month and only time will tell whether the bottom is in place and we are out in the clear or this was a classic bear market rally and we go back down again. We hope you enjoy reading the month’s report.

Do write to us at investor.relations@qedcap.com with your feedback, suggestions and queries.

-Editor

1. The Conservative Formula: Evidence from India

by Rajan Raju and Anish Teli

Abstract

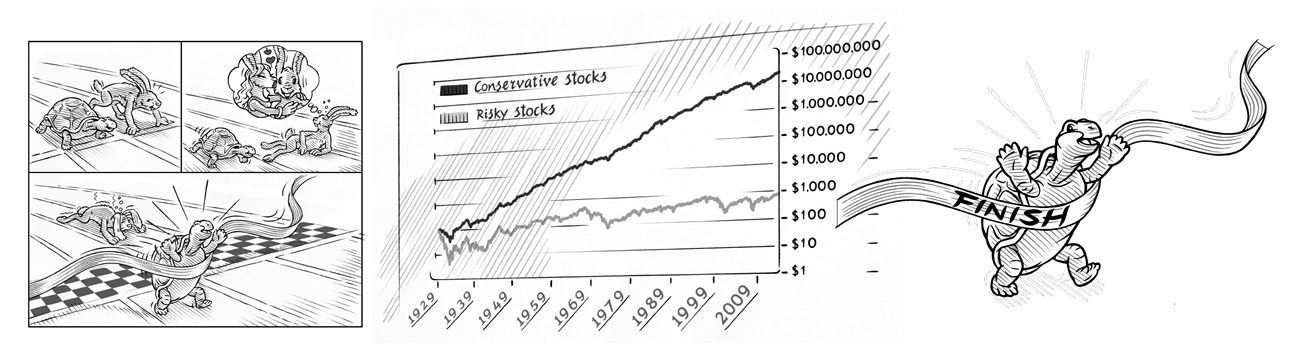

We implement the Conservative Formula outlined by Van Vliet and Blitz (2018) on data from Indian stock markets. It selects 100 liquid stocks based on three criteria: low realised volatility, high net payout yield and strong price momentum. We demonstrate that this simple yet robust formula exposes investors to key factors like low volatility, quality (through operating profitability and investment factors) and momentum in India. The quarterly rebalanced portfolio of 100 stocks significantly outperforms the S&P BSE 100 in absolute returns (by 12.6% pa compound) and risk-adjusted returns. We show the Conservative portfolio’s performance outperforms the S&P BSE 100 and the Speculative portfolio over different business cycles. The formula has been shown to work over long periods: in US markets since 1929 and in other markets like Europe, Japan and Emerging Markets. Our paper extends this evidence to India. The conservative formula uses three simple criteria that do not require accounting data and, therefore, should appeal to a broad base of asset owners and managers in India.

You can download and read the complete paper here

2. Factor Ranks

Markets have made a good recovery in July. Now whether its a classic bear market rally or the beginning of the next bull run is something that time will only tell. All the factor indexes still remain below their long term trend averages except for Low Volatility. But quality is coming close.

Low volatility remains the top performing factor in the medium term ranks. Quality follows and then the broader market index. This is in line with our analysis of factor performance in macro economic cycles that we carried out earlier. You can watch the discussion here. Factor Performance across Macroeconomic Cycles

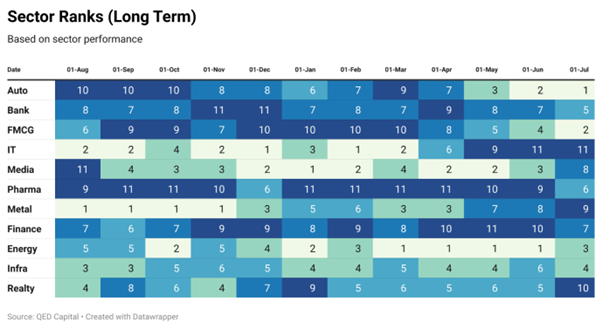

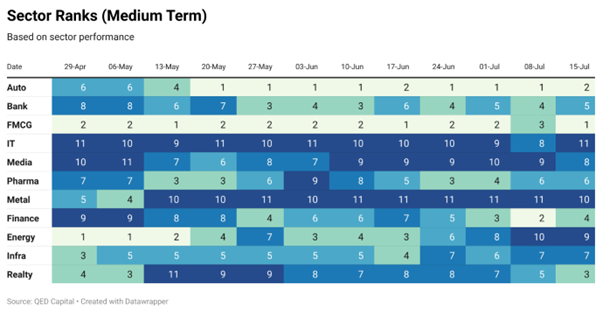

3. Sector Ranks

Auto has steadily climbed up the ranks to number one. Followed by FMCG and Energy. While the performance of the latter two sectors is not a surprise, Auto’s performance indeed is. It is a cyclical sector which is usually a leading indicator of an uptrend. Bring up the rear is IT and Realty.

Just like long term, auto has shown one of the best performances in medium term as well, it had jumped from 6th rank to 1st and now rests at 2nd spot behind FMCG which is at the top of the table. Even though USDINR is close to Rs. 80, IT has still failed to gain momentum and sits at the bottom of the table. Pharma and infra have remained flat for the past two weeks. Pharma was seen jumping ranks whereas infra is losing momentum has been falling consistently. Media, metal, energy bring up the rear at 8th, 10th ,9th respectively. Even though energy has performed decently well in long term but in medium term it has seen the worst fall.

4. Stock Ranks

An important component of our process is ranking stocks on Momentum and Low Volatility over a look back period of 6 months. In the table below we show the top ranked 20 stocks in our Mid and Small Cap universe. The rank is a combined score of Momentum and Low Volatility. It also shows the ranking of the stock one and three months ago.

With Auto being a strong performer, it is represented here by TVS Motor. Few other names that deserve a mention are Nocil, Blue Dart, AIA and M&M Financials. If markets continue with the uptrend, this is just the beginning. Let us see how the rest of the year pans out.

Disclaimer: Nothing in this blog should be construed as investment advice. This is purely for educational purposes only. Please consult an investment advisor before investing.