1. Factor Ranks

2. Invest-O-Meter

3. Sector Ranks

4. Stock Ranks

5. Reading Corner

Editor’s note

We would like to hear from you about anything else you would like us to write about. You can write to us at investor.relations@qedcap.com

20th July, 2021

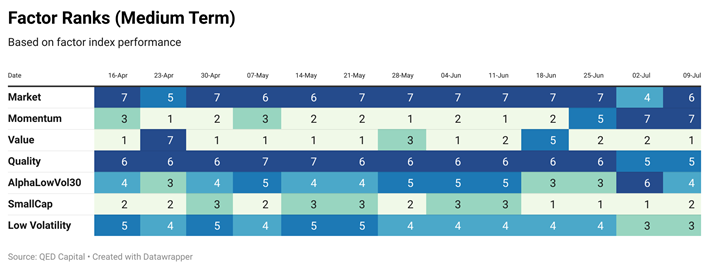

1. Factor Ranks

We rank the following factors based on long term (40 week) price performance. And on medium term (12+4 weeks) price performance. Value and Small Cap remain at the top in both long term and medium term ranks.

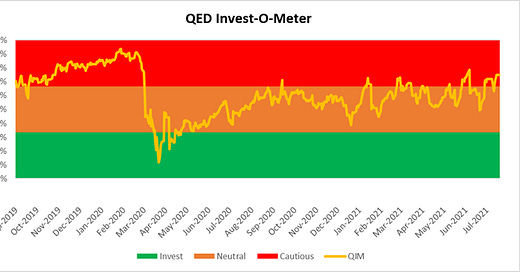

2. Invest-O-Meter

Markets broke out briefly and are back in earlier range. Invest-o-meter flashes cautious. Mid and small caps have run up smartly and caught up with large caps. The third quarter of the CY is usually volatile and choppy.

3. Sector Ranks

We keep track of sector ranks as well to understand sector rotation. This sector ranking is done on a long term “relative momentum” basis of the respective sector indices. We also look at sector ranks on a medium term look back time frame.

No change in long term sector ranks. Metals, Banks and Financials continue to be at the top of the ranks.

In the medium term ranks, Infra falls and climbs back to number 5. Metals remain at number 1. IT climbs from 5 to 3. Banks also climb. Auto, Energy and FMCG bring up the rear.

4. Stock Ranks

An important component of our process is ranking stocks on Momentum and Low Volatility over a look back period of 6 months. In the table below we show the top ranked 20 stocks in our Mid and Small Cap universe. The rank is a combined score of Momentum and Low Volatility. It also shows the ranking of the stock one and three months ago.

Lots of action here. Polycab remains at the top spot. Laurus and ICICI Securities make an entry. As do Aavas Financiers and Mphasis.

5. Reading/Listening Corner Corner

Denise Shull — Making Intuition Work For You

In this episode of Infinite Loops Jim speaks with Denise Shull, a Performance and Strategy advisor and Founder at The Rethink Group. We talk about: Role of emotions in trading and investing Could Daniel Kahneman be wrong? Listen On…

Not all Index Funds are created Equal

In 2005 Nobel Laureate, the late Paul Samuelson said, “ The creation of the first index fund by John Bogle was the equivalent of the invention of the wheel, the alphabet, wine and cheese”. The index fund he was referring to was the index fund which is weighted by the market capitalization of the companies in the index. Then some smart person decided why not give equal weightage to all stocks in the index and call it - An Equal Weighted Index and dub thee Smart Beta. Read on here

Key Man: How the Global Elite Was Duped by a Capitalist Fairy Tale

Arif Naqvi was charismatic, inspiring and self-made. The founder of the Dubai-based private-equity firm Abraaj, he was the Key Man to the global elite searching for impact investments to make money and do good. He persuaded politicians he could help stabilize the Middle East after 9/11 by providing jobs and guided executives to opportunities in cities they struggled to find on the map. Bill Gates helped him start a billion-dollar fund to improve health care in poor countries, and the UN and Interpol appointed him to boards. Naqvi also won the support of President Obama's administration and the chief of a British government fund compared him to Tom Cruise in Mission: Impossible.The only problem? In 2019 Arif Naqvi was arrested on charges of fraud and racketeering at Heathrow airport. A British judge has approved his extradition to the US and he faces up to 291 years in jail if found guilty.

Disclaimer: Nothing in this blog should be construed as investment advice. This is purely for educational purposes only. Please consult an investment advisor before investing.