Sometimes years happen in months and months happen in years. This month felt like that. Markets were spooked by the Adani-Hindenburg episode and even the Budget and Fed Meeting did not manage to divert the attention of domestic investors from the Adani saga. Energy indices took a hit. But with time, if this is an over reaction by the market participants, prices will mean revert, else they will not. This churning is what leads to survival of the fittest and strongest. Ultimately in the long run, markets care about earnings. And human emotions of fear and greed will continue to drive the churn, which may look irrational when viewed with a shorter time frame, but start making sense as the time frame increases. Value seems to have gained “momentum” and quality seems to be losing steam. That is another churn happening under the surface. Expensive growth stocks have taken a hit. You can read more about that in our Dec 2022 Investor Update here. Here’s to a profitable 2023.

We also have a book releasing soon - Mind Money Matters. You can read more about it here and sign up to get an alert when it is released or open for pre-order.

-Editor

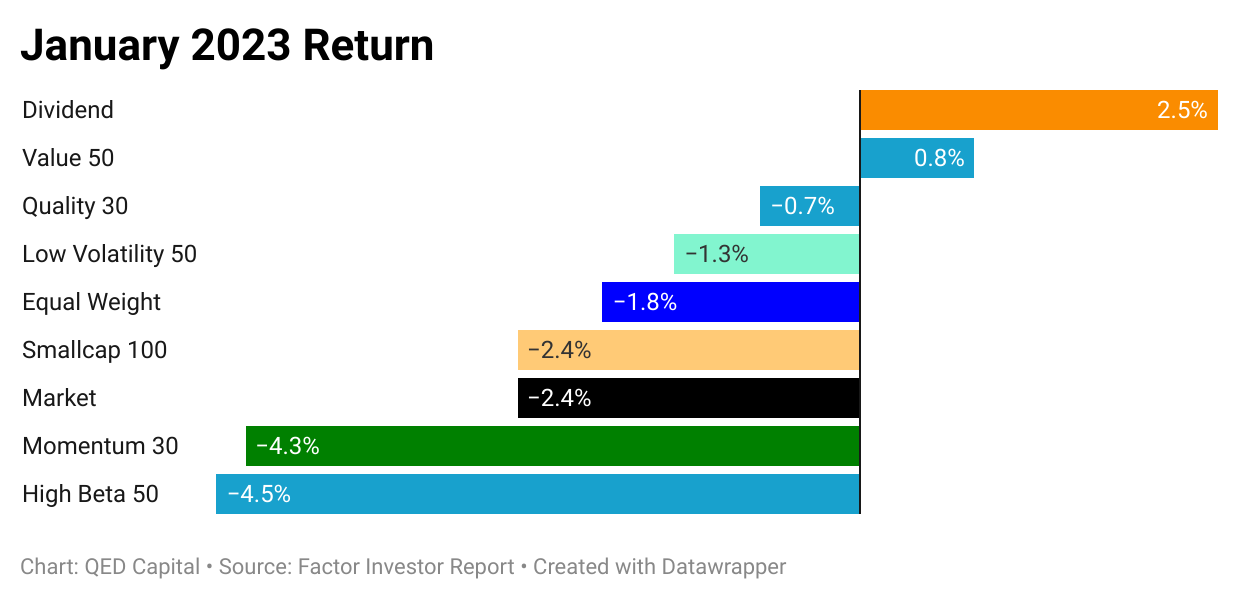

1. Factor Performance Summary

Value up even in a down month even though Dividend was the best performer. ITC has a 10% weight in Dividend, and that could explain its out performance.

We wrote about Value vs Quality’s performance over the last 14 years in our quarterly update. Renowned investor Daniel Loeb of Three Point Capital is calling it “Revenge of the Value Nerds”. This is what he has to say on the subject. “I tend to be more of a bottom up analyst but 2023 should prove to be a year of a battle of two narratives. Rates and inflation on one hand versus GDP growth, margins and ultimately earnings on the other. Markets will be further determined by participant’s outlook from current company performance versus ’24 and beyond. I don’t think camping out in the last decade’s darlings, with rosaries in hand, hoping for a comeback, will be the winning strategy. We have already seen the revenge of the value nerds. I think more to come. This was a framework to think about the market and economy not a prediction. That’s up to you.” You can read the entire letter here.

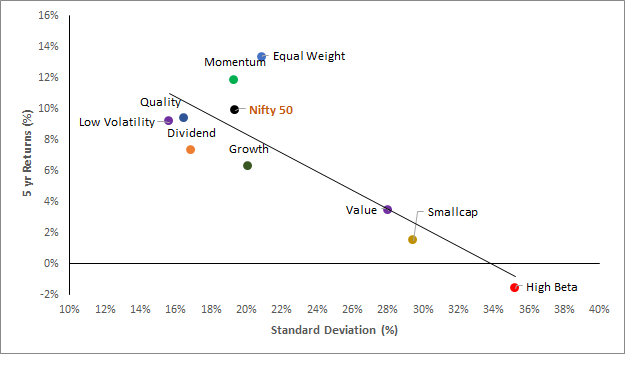

2. Five Year Risk & Return - Absolute

A small but important change from last time. Value factor has moved up to the risk/reward trendline. Until last month it was below it. Value’s performance in the last 2 years has taken its 5 year annual price return to ~4% up from 2% until few month ago. Still way below the broad market index return of 10%. But the trend is encouraging and if value continues in this direction, it could end up being the trade of the decade.

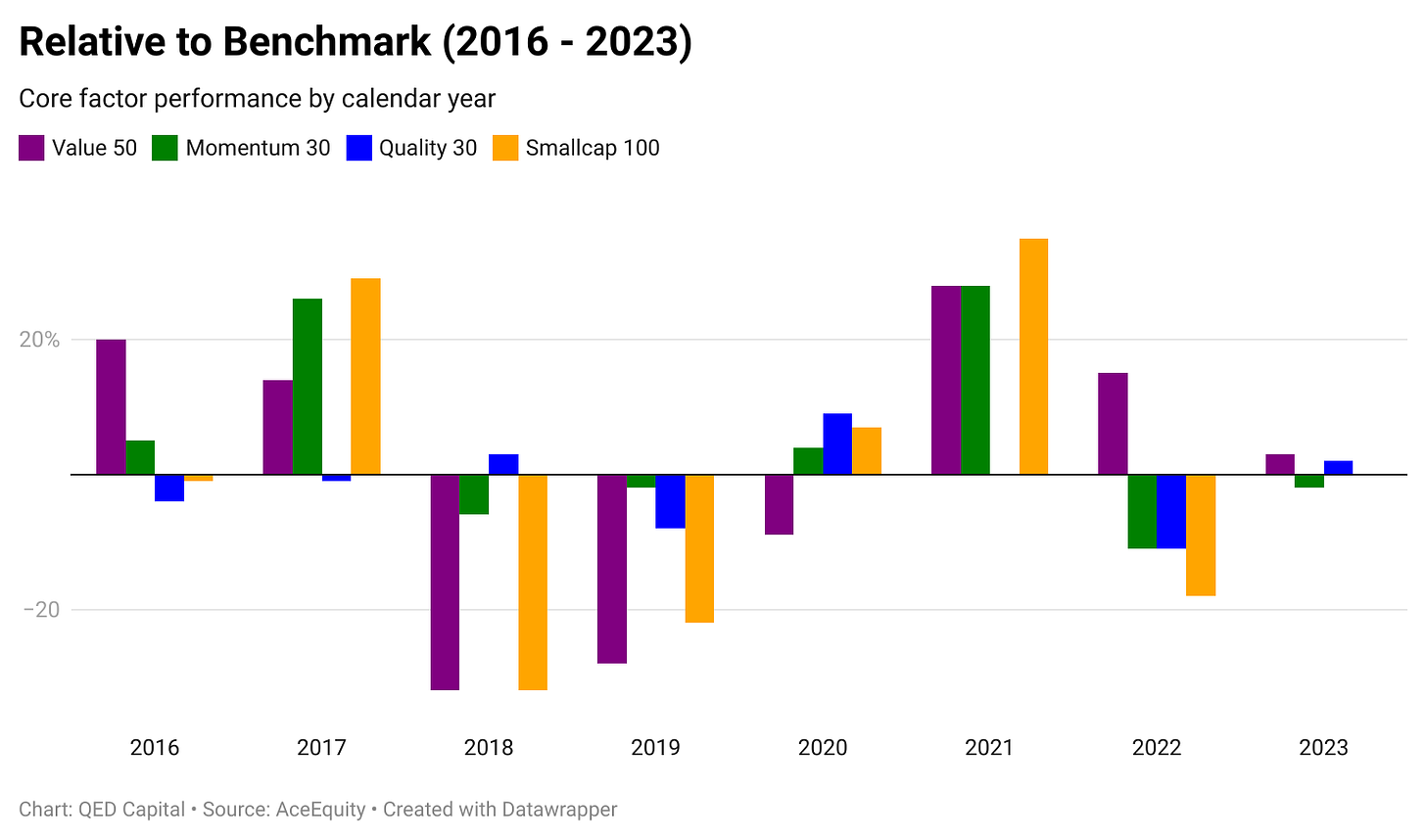

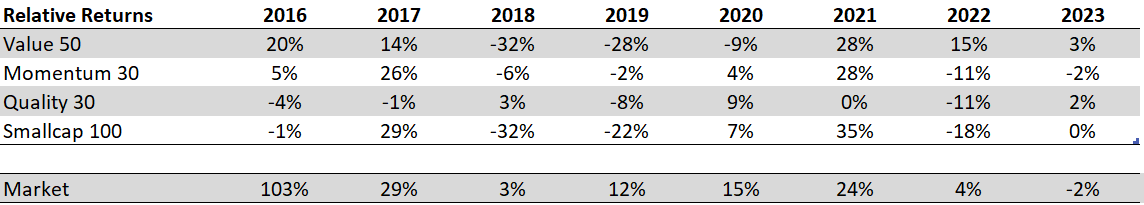

3. Relative Returns - Annual

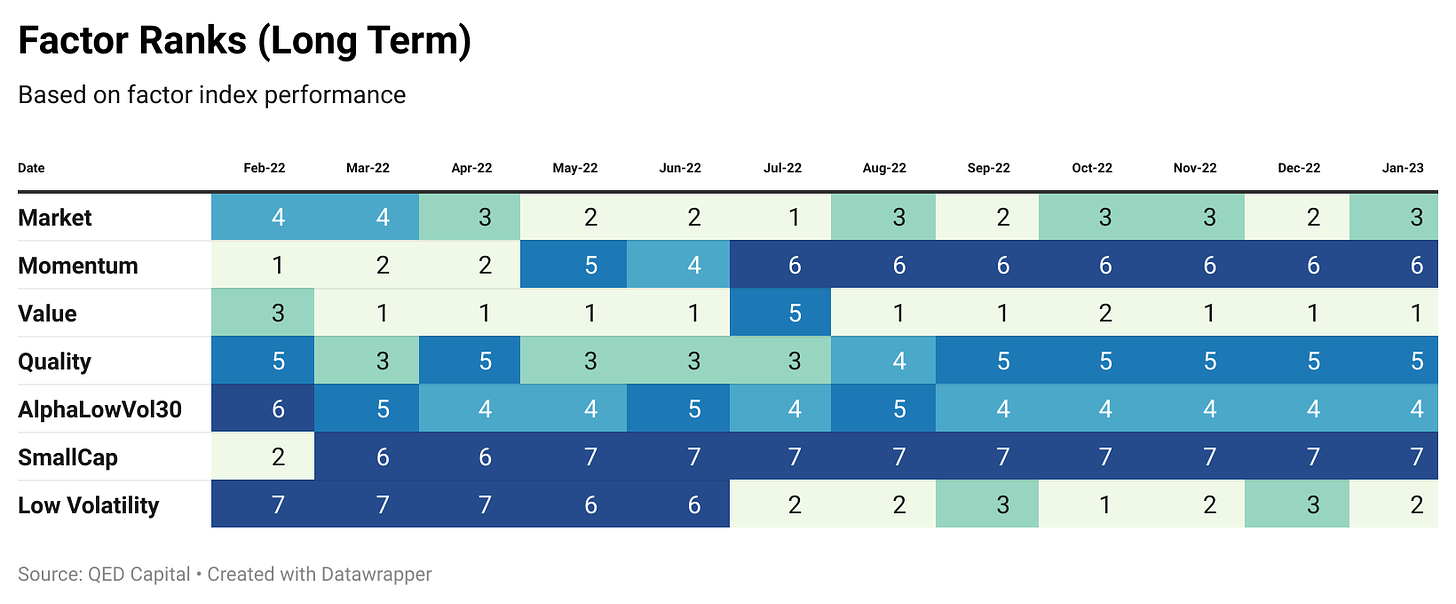

4. Factor Ranks

Low Volatility is getting rewarded in a very volatile market environment and takes second spot from Market. Value maintains its top rank.

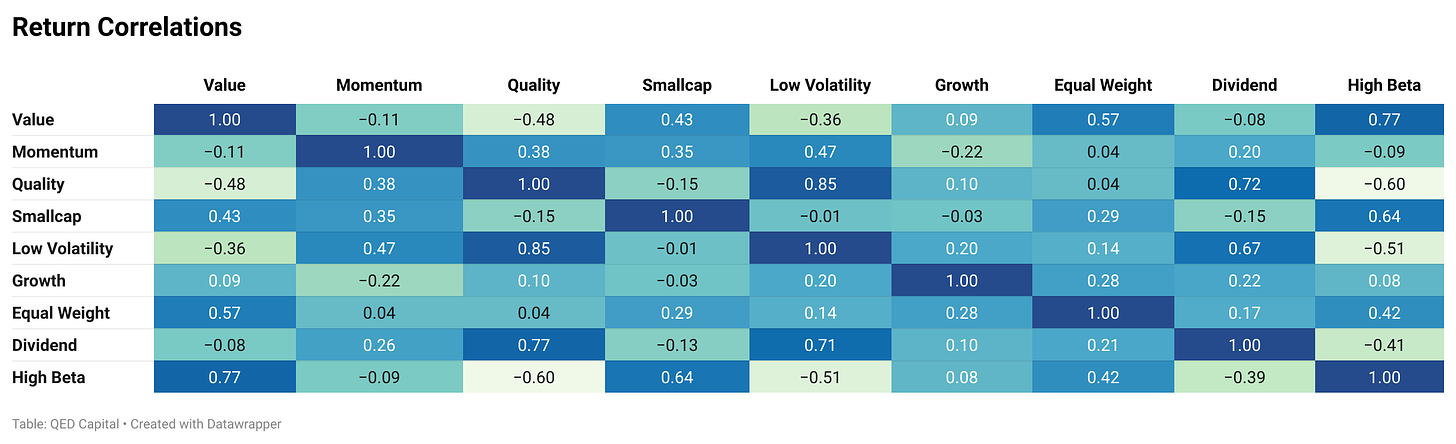

5. Factor Excess Return Correlations

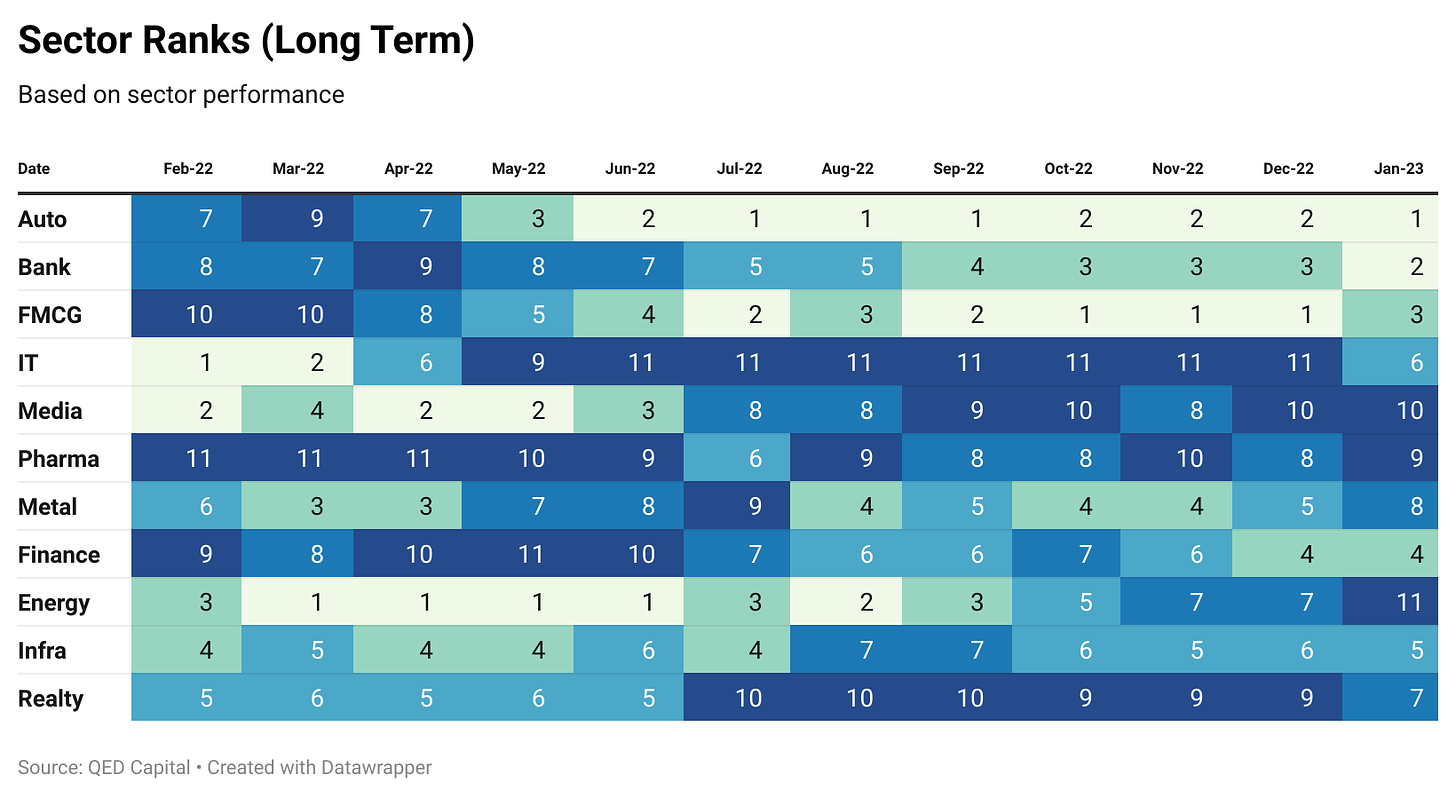

6. Sector Ranks

Energy sees a big fall from 7th to 11th rank. This may be primarily driven by the ~14% weightage to Adani Transmission and Adani Green. IT makes a big jump from 11th to 6th spot. Autos and Banks jump a spot each while FMCG loses its top spot and falls to number 3.

7. Stock Ranks

8. Readings

International Diversification in Equity Portfolios: An Indian Perspective by Rajan Raju

This paper examines the evidence of the benefits of international diversification in the Indian context. Using a time series of returns over almost three decades, we examine alternative measures of codependence for the Indian equity market and a sample of global equity markets, gold and INR-USD. We also look at evidence of risk-adjusted returns and worst-case returns for simulated portfolios of India only and portfolios with exposure to international markets/assets and show the benefits of international diversification for an Indian investor. Indian markets tend to crash together with international markets over short horizons. However, internationally diversified portfolios are more resilient over longer holding periods than purely domestic portfolios. Our results offer one possible solution to build more robust long-term portfolios in India: reduce home bias.

Disclaimer: Nothing in this blog should be construed as investment advice. This is purely for educational purposes only. Please consult an investment advisor before investing.