In the previous edition, I had mentioned of an exciting research project we were working on. The project was a report on long only factor investing in India. This can be read on SSRN at 'Long' Factors, not 'Short' Change : Long Only Factor Portfolios in India. This is perhaps one of the most exhaustive research papers on Factor Investing in India. An extract of the paper is given below. In other events, it looks like the Fed has finally decided to act before the market wrests control back. This will create some short term pain and opportunities. Value seems to be making a come back but it is too early to tell. We hope you enjoy reading the months report.

Do write to us at investor.relations@qedcap.com with your feedback, suggestions and queries.

-Editor

1. Research Paper

'Long' Factors, not 'Short' Change : Long Only Factor Portfolios in India

by Rajan Raju and Anish Teli

Abstract

We show that monthly rebalanced, equal-weighted, long-only winner portfolios, drawn from the top 200 stocks in India, built using systematic rules that underpin popular factors of momentum, low volatility and quality deliver alpha for the period under study. The market exposure is significant across all the style strategies we looked at. Therefore, correlations between the strategies are significantly higher than those observed for academic factor returns. We include alternate calculation methodologies for some factors and find that not all implementations of factor strategies are the same. Not all strategies have high turnover. Indeed, strategies like low volatility and quality show fairly low turnover. Factor exposure persistence over time varies across strategies and persistence should be considered when implementing factor-style strategies. We also find that size and sectoral preferences of factors are dynamic and could reduce perceived diversification benefits. Finally, we show that alpha for momentum, low volatility and quality strategies survives real-world implementation costs. While winner portfolios using momentum, low volatility, and quality rank higher than the broad S&P 200 Index over the period under study, there is not one factor-style that is a consistent winner.

You can download and read the complete paper here.

2. Factor Ranks

There some divergences and some similarities in the long term and medium term ranks. Smallcap and Momentum rank high in both long term and medium term lookbacks. Value however is up in the long term ranks but low in the medium term ranks. Quality is underperformed in both long and medium term look backs.

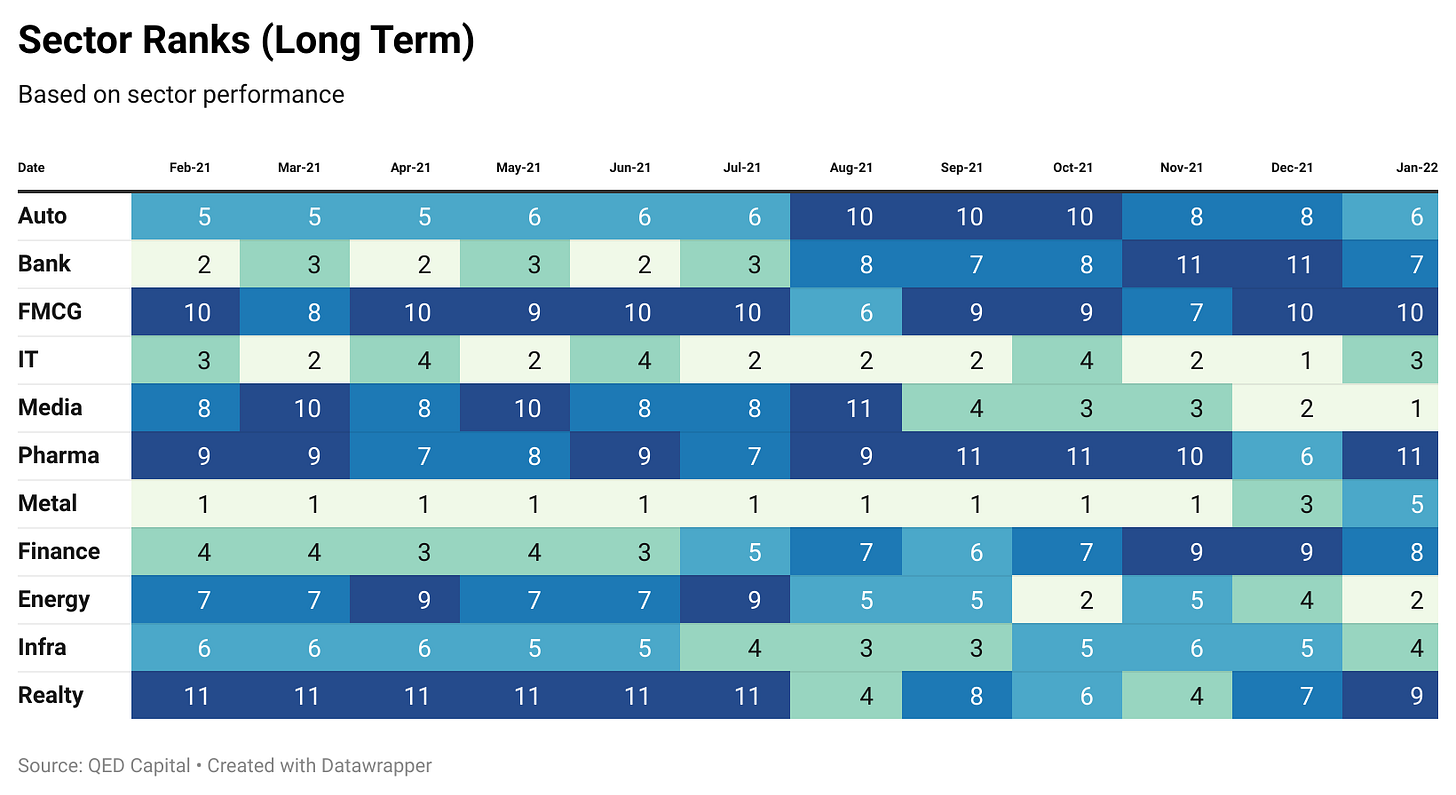

3. Sector Ranks

Similar story in the long and medium term ranks. IT is doing well in the longer term ranks but is down below in the medium ranks. Energy (thanks to high crude) is high in both time frames. BFSI are at the lower end. But their performance seems to be picking up. Defensives like Pharma and FMCG are at the bottom in longer term lookbacks but FCMG has made progress in the medium term ranks.

4. Stock Ranks

An important component of our process is ranking stocks on Momentum and Low Volatility over a look back period of 6 months. In the table below we show the top ranked 20 stocks in our Mid and Small Cap universe. The rank is a combined score of Momentum and Low Volatility. It also shows the ranking of the stock one and three months ago.

Some names like Tanla, Gujarat Fluorochem, Zee, Tube Investments and Vodafone Idea have seen a big jump in ranks from where they were 3 months ago. In the last couple of weeks, IT names have taken it on the chin, but compared to their performance over the last year, it is par for the course.

5. Reading/Listening Corner Corner

An interesting Clubhouse session with the William Green Author of "Richer, Wiser, Happier" You can listen to it here

The book is also our book recommendation for the month.

In Richer, Wiser, Happier, award-winning journalist William Green has spent nearly twenty-five years interviewing these investing wizards and discovered that their talents expand well beyond the financial realm and into practical philosophy. Green ushers us into the lives of more than forty of the world's super-investors, visiting them in their offices, vacation homes, and even their places of worship - all to share what they have to teach us. Green brings together the thinking of some of the best investors, from Warren Buffett to Howard Marks to John Templeton, and provides gems of insight that will enrich you not only financially but also professionally and personally.

Disclaimer: Nothing in this blog should be construed as investment advice. This is purely for educational purposes only. Please consult an investment advisor before investing.