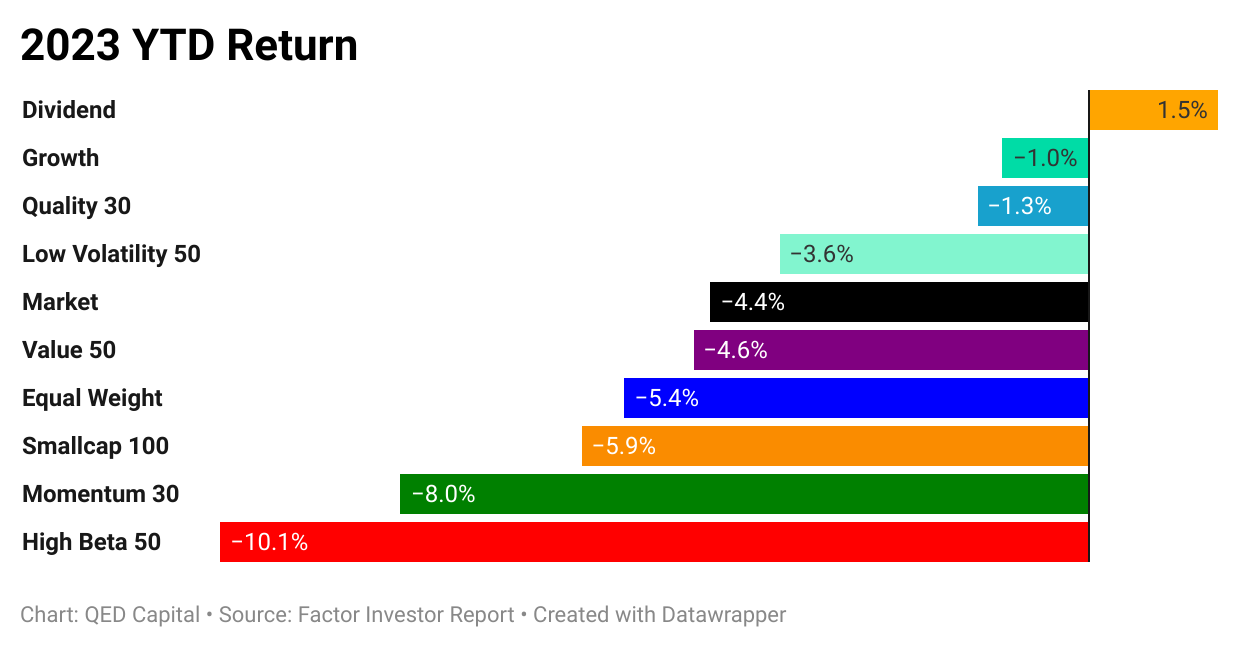

Value also falls this month and the only one that rises YTD is Dividend Yield. Some interesting moves in sectors. Defensives seem to be gaining strength.

We are happy to announce that the book, “Mind, Money, Matters” co-authored by Anish is finally out. It is available on Amazon and Flipkart.

On Thursday, 9th March, we are doing a Factor Master Class, with Rajan Raju and Anish Teli where we cover findings of the paper by AQR, called Fact, Fiction and Factor Investing and present them in the Indian Context. Here is the LinkindIn Live link.

-Editor

1. Factor Performance Summary

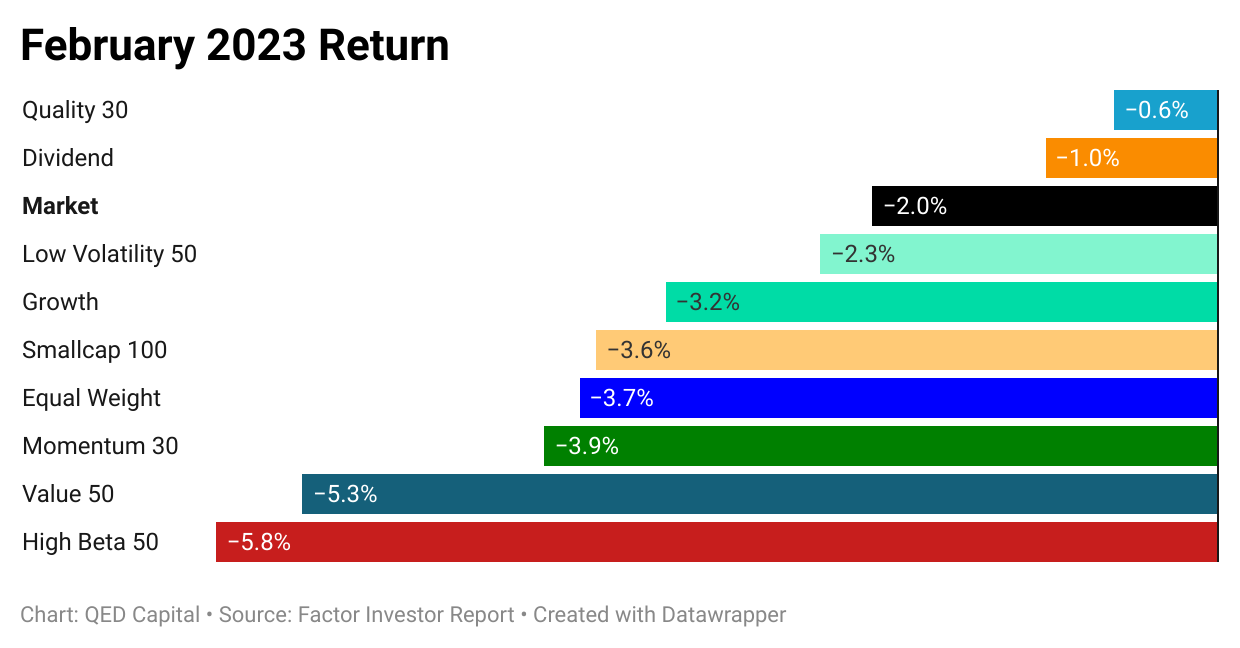

It has not been a great month all around for long-only portfolios. Given the Fed’s increased hawkishness, the short term volatility may continue. Defensive factor styles like Dividend and Quality suffered the least, while Value and Momentum had falls greater than the market.

2. Five Year Risk & Return - Absolute

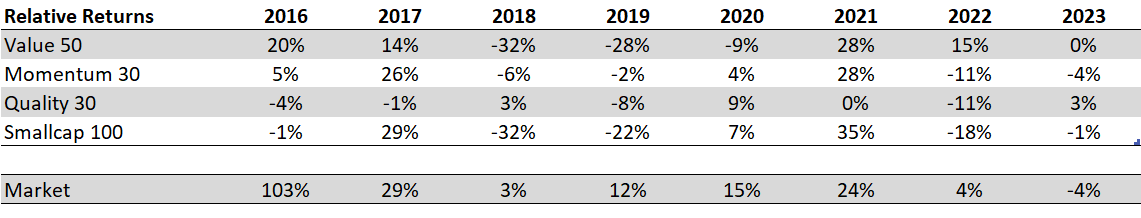

3. Relative Returns - Annual

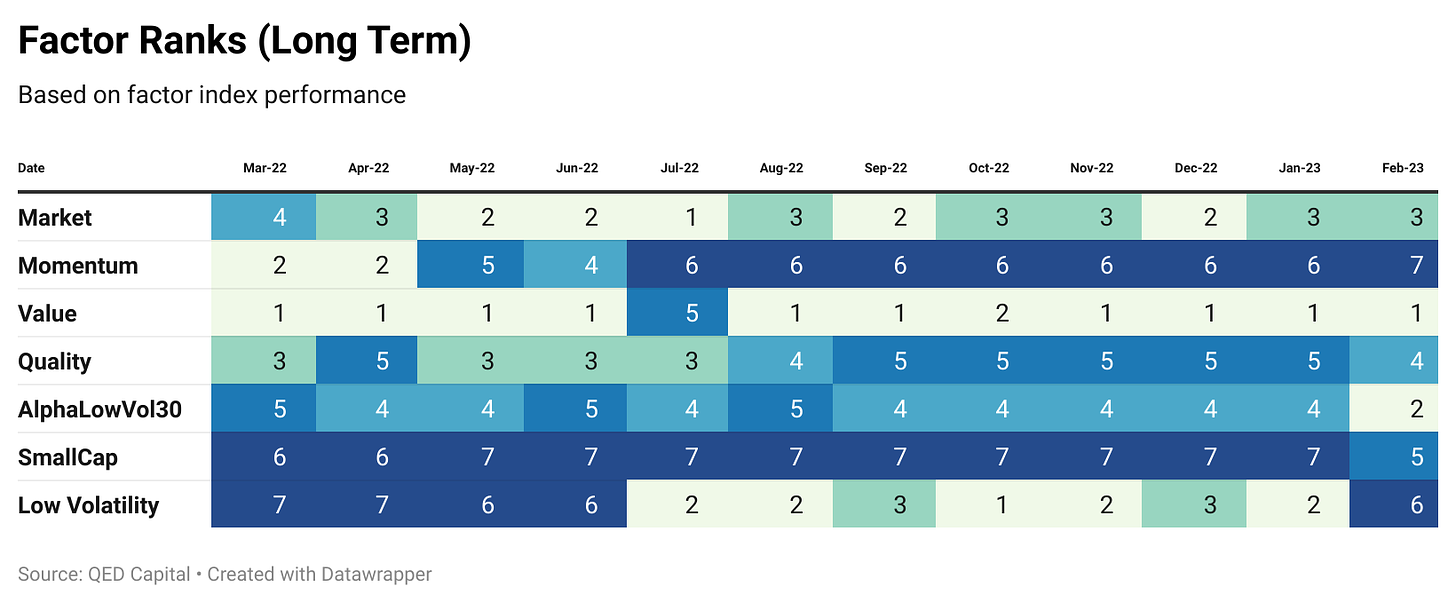

4. Factor Ranks

Not much changes here. Smallcaps recover a bit at the expense of Momentum and Low Volatility. Quality also climbs a rank.

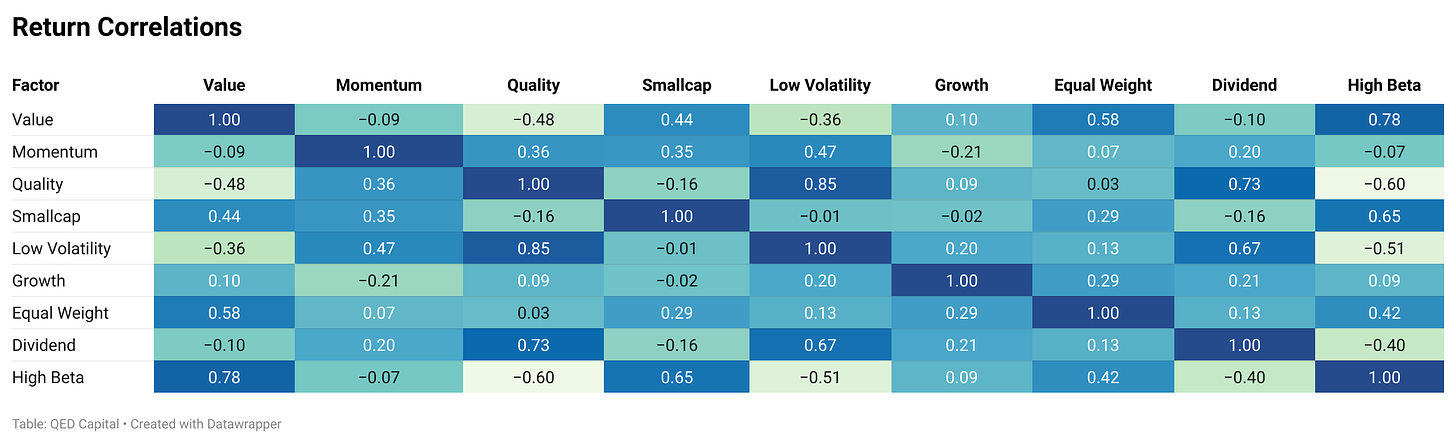

5. Factor Excess Return Correlations

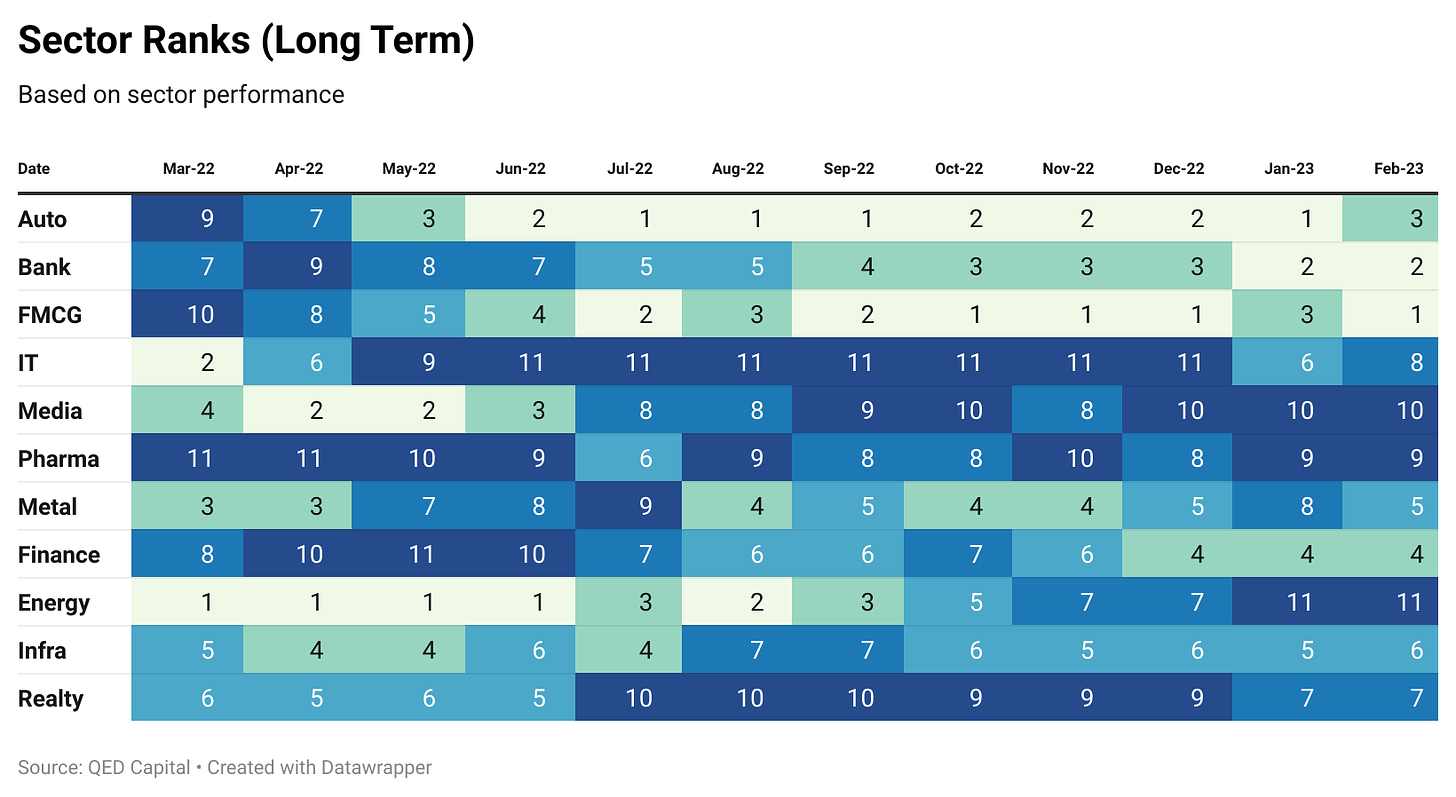

6. Sector Ranks

In keeping with the factor styles, FMCG climbed back to the top followed by Banks and Auto. Anecdotal evidence tells us that there is a long waiting for popular car models and Auto sales continue to be strong. IT continues its up/down movement. Energy brings up the rear.

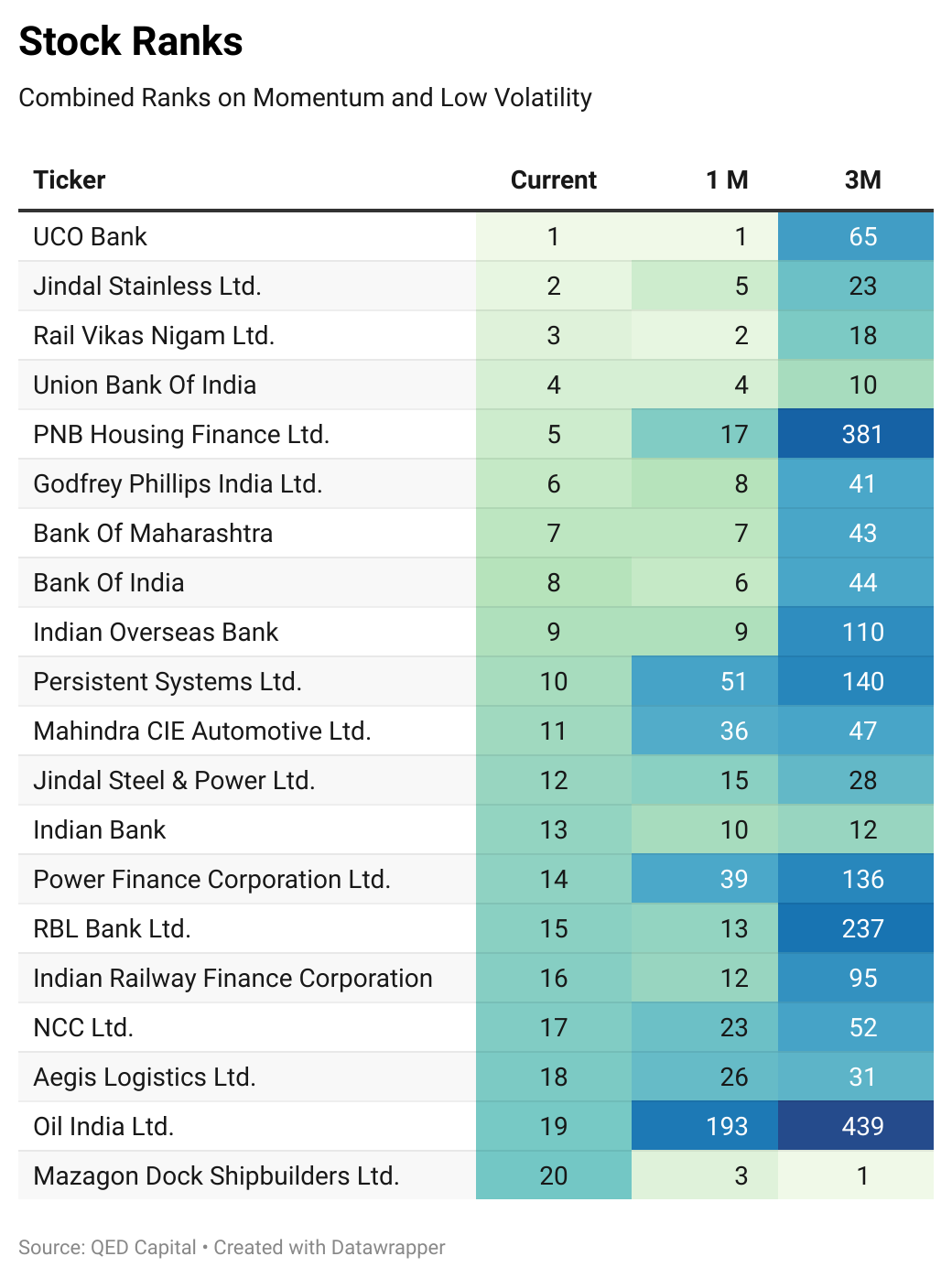

7. Stock Ranks

Stocks from the banking and finance space dominate the list.

8. Readings

Learn what role your Mind plays in your investing behaviour and how to build a goal-based portfolio using simple building blocks or want to know what the relevant questions to ask your advisor, then this book is for you.

Investing is more about the "Mind" and how investors behave when it comes to money and investing decisions.

This book will help you to identify your behavioral biases and how to manage those biases. It will also give you a framework to prioritize your financial goals in order to create wealth over the long term.

You can order it on Amazon here and it is available in both the paperback and kindle unlimited version.

Disclaimer: Nothing in this blog should be construed as investment advice. This is purely for educational purposes only. Please consult an investment advisor before investing.