Editor’s note

This month we look at the myths surrounding momentum investing from the paper “Facts, Fiction and Momentum Investing”. We also take a quick look at the Momentum factor in India as the first Momentum Index Fund is launched this month. Lots of moves in Sector and Stock Ranks. And interesting content in the reading and listening corner.

We would like to hear from you about anything else you would like us to write about. This report will also be available at factorinvestor.substack.com and you can write to us at investor.relations@qedcap.com

17th February, 2021

Contents

1. Fact, Fiction and Momentum Investing

2. Nifty200-Momentum30 Index Fund

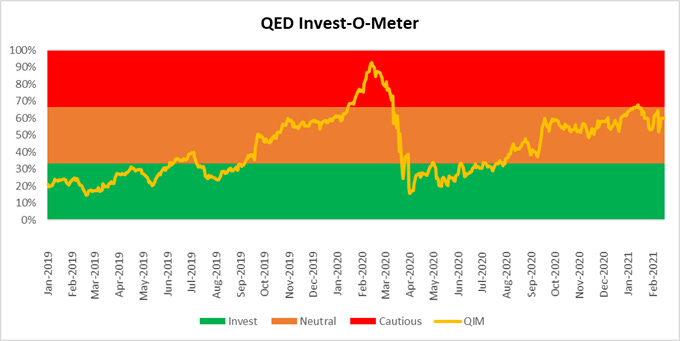

3. Invest-O-Meter

4. Sector Ranks

5. Stock Ranks

6. Reading/Listening Corner

Fact, Fiction and Momentum Investing

Momentum - tendency for stocks with a positive trend to continue to do well, and those that are falling continue to slide.

We discovered the world was not flat before we understood and agreed why.

Cliff Asness

Momentum works (Even in Japan and on Fama’s EMH Planet). We just cannot agree on why.

In 2013, twenty years post the academic discovery of momentum investing (Jegadeesh and Titman (1993), Asness (1994)), the smart folks at AQR decided to take on the Momentum nay sayers and wrote a paper titled “Fact, Fiction and Momentum Investing”. They addressed ten myths about momentum factor along with data and rationale from “widely circulated academic papers and analysis from the simplest and best publicly available data.” We give you a quick summary of one that rankles the most.

Myth #1: There is no theory behind momentum.

Momentum works (Even in Japan and on Fama’s EMH Planet), we just cannot agree on why. There isn’t a unified theory or a catchy story on why it works. It has worked for over 200 years, though it was academically discovered only about twenty-eight years ago. Even Fama and French use momentum as a “screener” to buy and sell their value stocks. This has been publicly stated by Ken French and by DFA (where Fama is one of the co-founders). Momentum, however, is the one factor that does not fit into the mental model of Efficient Market Hypothesis as it would lead to the conclusion that prices have information that can be exploited or in other words there is mispricing of securities. However, even Jim Simons makes the point that empirical data backed by robust out of sample testing (and what can be better than his 40% post fees CAGR returns) outranks an elegant theory however logical it may sound if it doesn’t work in the real world and data does not support it. We all know the EMH is flawed as it assumes rationality and fair pricing at all times but there in is a conundrum in that itself. The Grossman-Stiglitz paradox[1]. Anyways I digress.

There are two broad reasons why factors work: Risk premium and Behavioral mispricing. Let us look at these two in more detail in the context of momentum.

Behavioral – The most accepted behavioral theory for momentum factor is that investors have time frames from a day to decades and they take their time in expressing their view on new information that comes in i.e. there is underreaction at first and then gradually the information gets factored in. The other reasons could be that investors are conservative, are facing liquidity issues or are simply displaying the disposition effect.

Risk – The risk-based model put forth states that “high-momentum stocks face greater cash flow risk because of their growth prospects or face greater discount rate risk because of their investment opportunities, causing them to face a higher cost of capital.”

Some believe that a risk-based rationale makes a factor more robust as human behavior is susceptible to change and the phenomenon may be short lived. However, in the case of momentum “evidence from over 200 years of data, in dozens of financial markets, and in many different asset classes suggests” that this is not the case here. And when all else fails, they nay-sayers fall back on the EMH hypothesis and state that momentum cannot be explained in an efficient market scenario. And that would have been true had markets been “perfectly efficient”. But as the Grossman-Stiglitz paradox above tells us, that the participants keeping the market efficient have to be incentivized enough and for that some inefficiency needs to exist for them to exploit. Don’t get me wrong, markets are very tough to beat. Ask the entire mutual fund industry where over 80% of funds fail to beat the market but doesn’t mean that some investors may not be able to beat the market. We just do not know ex-ante who those might be.

Some of the other myths that are quite well addressed in the paper are:

Myth #2: Momentum cannot be captured by long-only investors as “momentum can only be exploited on the short side”.

Myth #3: Momentum does not work for a taxable investor.

Myth #4: Momentum is best used with screens rather than as a direct factor.

But you are going to have to read the paper for that.

Nifty200-Momentum30 Index Fund

The first pure Momentum Factor Index fund is being launched by UTI AMC and deserves a under the hood look. We have the ICICI Alpha Low Volatility ETF but that is a two-factor index. This one is pure momentum which is one of the most robust factors out there. There are some comprehensive reviews written about the fund. There are some comprehensive reviews written about the fund. You can read the one by Ravi Saraogi here and by Prashanth Krish here. We will do a detailed review on the live performance of the fund maybe 3-6 months down the line.

A couple of common issues that investors have expressed is that they do not know how it will work out because momentum is a relatively high churn strategy compared to value and there is little live data for this index. The Alpha 50 index has been around for a while. Let me address both issues here.

The question one needs to ask is – Does Momentum work in India?

Professors Agarwalla, Jacob and Varma in their paper – “Size, Value and Momentum in Indian Equities” have stated what makes factor investing risky is that all factors experience large drawdowns and do not work all the time. The Momentum factor in India as per their analysis has the largest premium among all factors. This is also in line with data globally. So, there is no reason that a well-constructed momentum factor strategy should not work in India. In fact, on the long-only side they find that momentum portfolio dominates all other factor portfolios.

The graphs from their site shows that momentum does work over time but also has large drawdowns. The Value Factor has had larger drawdowns than Momentum. However, on a risk adjusted basis it more than delivers. So, it does deserve a place in your portfolio and the allocation depends on your risk appetite and tolerance.

Invest-O-Meter

QIM is pushing the lower boundary of the “Cautious” zone and is sort of bumping around there. We are not in the red zone yet but still at the periphery. A quick correction and recovery phase around the budget and we are back to making new all-time highs. If you are a trader follow your plan and if you are an investor, even then follow your plan. If you do not have a plan, you are roadkill. Just ask the Game Stock shareholders who were left holding the bag thinking it will go to $1000.

Sector Ranks

We keep track of sector ranks as well to understand sector rotation. This sector ranking is done on a long term “relative momentum” basis of the respective sector indices. We also look at sector ranks on a medium term look back time frame.

Banks continue to progress in the long term sector ranks, led by a roaring and strong bank nifty. A strong move from number 5 to 3. IT exchanges places with Metals at number 1 and 2.

Metals however falls two places to number 4 in the medium-term ranks. Banking is the number one spot here followed by Financial Services at number 2.

Stock Ranks

An important component of our process is ranking stocks on Momentum and Low Volatility over a look back period of 12 months. In the table below we show the top ranked 20 stocks in our Mid and Small Cap universe. The rank is a combined score of Momentum and Low Volatility. It also shows the ranking of the stock one and three months ago.

Lots of action here. Cera moves to number 4 from 45 three months ago and even Kajaria enters at number 7. Also, two tyre stocks, MRF and Ceat enter the top 20. Lakshmi Machine Works continues to make good progress as it moves from number 14 last month to 5 this month.

Reading/Listening Corner

Excess Returns The Elusive Definition of Risk (Ep. 71)

Risk is one of the most difficult concepts in investing to define. Part of that is because we face many risks as investors that come from many different directions. But another part of it is that risk is ultimately different for every investor, which makes a universal definition impossible to find. In this episode, listen to some of the most important risks we face as investors, and why they are impossible to disentangle from our own behavior. Also look at some practical ways used to measure risk to help optimize results for factor-based strategies. Listen on….

Quality portfolio with long-term returns: How a low-cost Coffee Can helps investors

The CCP is a portfolio of high-quality stocks with high RoE and strong fundamentals. But many a times, it comes with a huge cost that eats into the returns. Index funds and factor funds could be the low-cost alternatives to high-cost CCPs. Creating winning portfolios is a science and an art. Investors, both professionals and DIY (do it yourself), know that there are no perfect solutions. This is true for momentum as well as value investors. The problem gets tougher when the stock market is coming out of the Covid-19 crisis and returns are almost 100% up from its March 2020 lows. So, how will you build a portfolio, especially when you are a DIY investor? Read on to find out how.

Against the Gods: The Remarkable Story of by Peter Bernstein

People in all walks of life--poker players, politicians, scientists, and investors--constantly make choices and take risks. The modern world would fail to exist without the tools we routinely apply to evaluate and control those risks we take. The great success story begins a thousand years ago with a group of bold thinkers who embarked on a remarkable adventure of intellectual discovery, transforming superstition into the powerful tools of risk control that we use today. These scientific and mathematical pioneers discovered new uses for numbers, determining the extent to which the past can affect the future.

[1] The Grossman-Stiglitz paradox says that if asset prices perfectly reflected all information, then there would be no reason for anyone to collect information and trade assets, so asset prices couldn't perfectly reflect all information.