It is turning out to be quite a volatile and news heavy month. And two months into the year gives an indication that it is probably not going to be smooth sailing for the rest of the year too. But that is what markets are “no pain, no premium”. This is the time when the market tests participants whether they are in it for the long haul or they are just visiting tourists. Lots of changes in the stock ranks this month. We also look at the breadth of the market and there are some concerning data points there. We are working on some new tools for asset and risk allocation. More on those later. Stay safe.

Do write to us at investor.relations@qedcap.com with your feedback, suggestions and queries.

-Editor

1. Factor Ranks

Size (Smallcap) drops a rank and so does value. Number one place is now occupied by Momentum. Low Volatility and Quality bring up the rear. An important point to note here is that these are relative rankings based on returns.

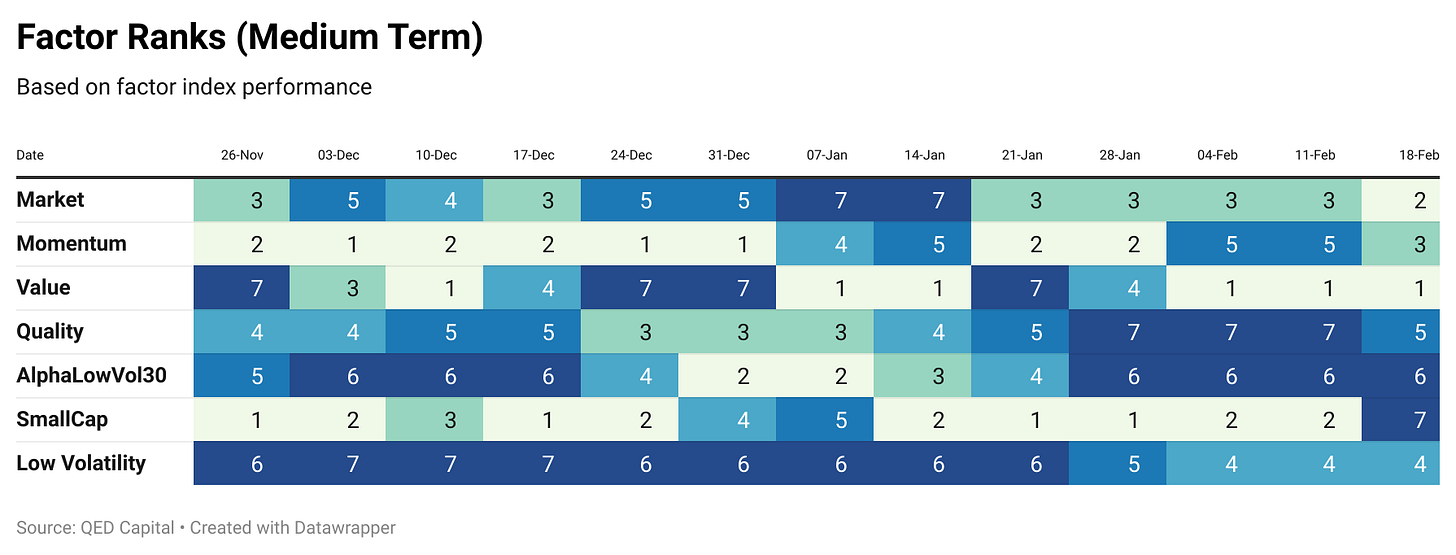

In the medium term ranks, value leads marking a sharp reversal from the bottom on Jan 21st. The rapidly changing ranks suggest there is some kind of rotation going on in the factors.

In terms of trend most of these long only factor tilt indexes are trading below their 200 and 100 dma. Next week we will know if they give a monthly close below the 200 dma or 10 Month ma.

2. Sector Ranks

IT has been in top 4 through the year and continues its stellar run. FMCG and Pharma continue to languish at the bottom. Realty ranks are volatile but it is showing relative strength among sectors.

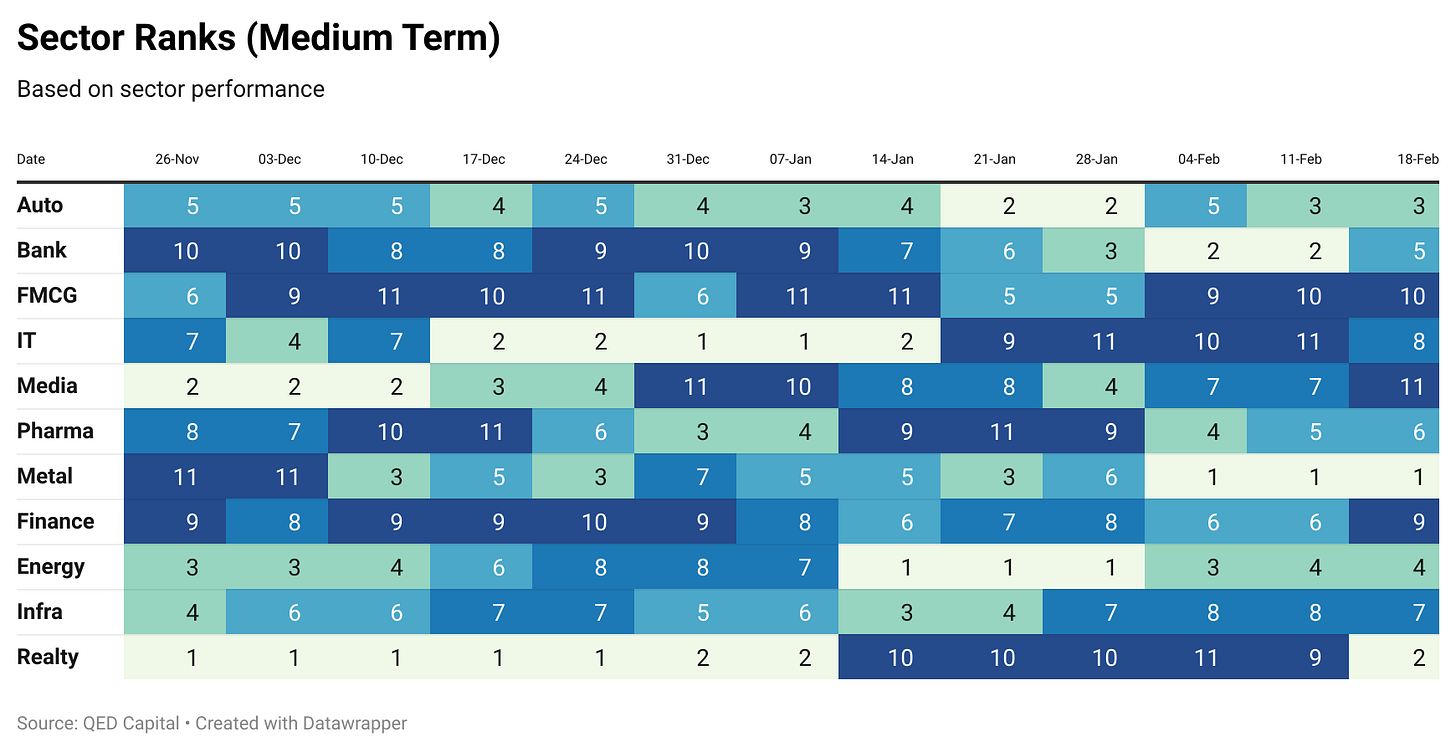

The medium term ranks tell us a different story. The medium and long term ranks are not aligned which again tells us there is rotation going on. Media and Realty again flatter to deceive.

Pharma and FMCG indexes are already below longer term moving averages. So the trend there seems to be down. Others like Metal and Finance are close to their 10 Month MAs. Auto, Energy and Telecom are showing strength.

3. Stock Ranks

An important component of our process is ranking stocks on Momentum and Low Volatility over a look back period of 6 months. In the table below we show the top ranked 20 stocks in our Mid and Small Cap universe. The rank is a combined score of Momentum and Low Volatility. It also shows the ranking of the stock one and three months ago.

A number of stocks have jumped up from the bottom 3 months ago to the top 20 now. Elgi, Network 18, TV18, Ingersoll-Rand and Thermax to name a few. Again the trend is not too comforting. If stocks climb ranks steadily it is better than climbing in a volatile fashion.

Another point of worry is that the breadth of the market is showing weakness. At the end of Sep 21, 80% of stocks in the Nifty 500 were trading above their 200 DMA. This fell to 50% in Dec 21. And as of 22nd Feb of the current year, this number has further fallen to 30%. And while the Nifty 500 is 10% off its highs, more than 450 stocks are off by 10% from their 52 week high. But this is not unexpected after two years of stellar returns. So hang in there if this is your first experience of stealth bear market.

4. Reading/Listening Corner Corner

Excess Returns Podcast - Systematic Macro Investing with 42 Macro Founder Darius Dale

Many investors see macro forecasting as a process about making bold binary predictions about the future of the economy and the market. Those predictions can gets lots of press when they are right, but the reality is that risk management and probabilities are much more important to a macro process than big, bold calls. In this episode the hosts talk to Darius Dale of 42 Macro, who has developed a systematic process to address these issues. They talk about the process of identifying the market regime using quantitative methods and how to use that information to build portfolios and manage risk. They also ask for his outlook on all the major asset classes based on his systematic framework. Listen to it here.

The Power Law - Venture Capital and the Art of Disruption

Innovations rarely come from "experts." Jeff Bezos was not a bookseller; Elon Musk was not in the auto industry. When it comes to innovation, a legendary venture capitalist told Sebastian Mallaby, the future cannot be predicted, it can only be discovered. Most attempts at discovery fail, but a few succeed at such a scale that they more than make up for everything else. That extreme ratio of success and failure is the power law that drives venture capital, Silicon Valley, the tech sector, and, by extension, the world. With a riveting blend of storytelling and analysis, The Power Law makes sense of the seeming randomness of success in venture capital, an industry that relies, for good and ill, on gut instinct and personality rather than spreadsheets and data. We learn the unvarnished truth about some of the most iconic triumphs and infamous disasters in the history of tech, from the comedy of errors that was the birth of Apple to the venture funding that fostered hubris at WeWork and Uber. By taking us so deeply into the VCs' game, The Power Law helps us think about our own future through their eyes.

Disclaimer: Nothing in this blog should be construed as investment advice. This is purely for educational purposes only. Please consult an investment advisor before investing