Dec 24 was perhaps one of the most volatile and brutal quarters since March 2020. It has been five years since. While we have had a few corrections and volatility along the way, they have been short lived and shallow. This time seems to be something which may be longer and deeper in duration and depth. Time will tell. The numbers do indicate that. However, in markets, human behavior prevails in the short run and that is the most unpredictable factor. Remember, while it may be painful, like a gall bladder stone - this too shall pass.

Here is wishing all readers a very happy, safe and hopefully profitable 2025.

-Editor

1. Factor Performance Summary

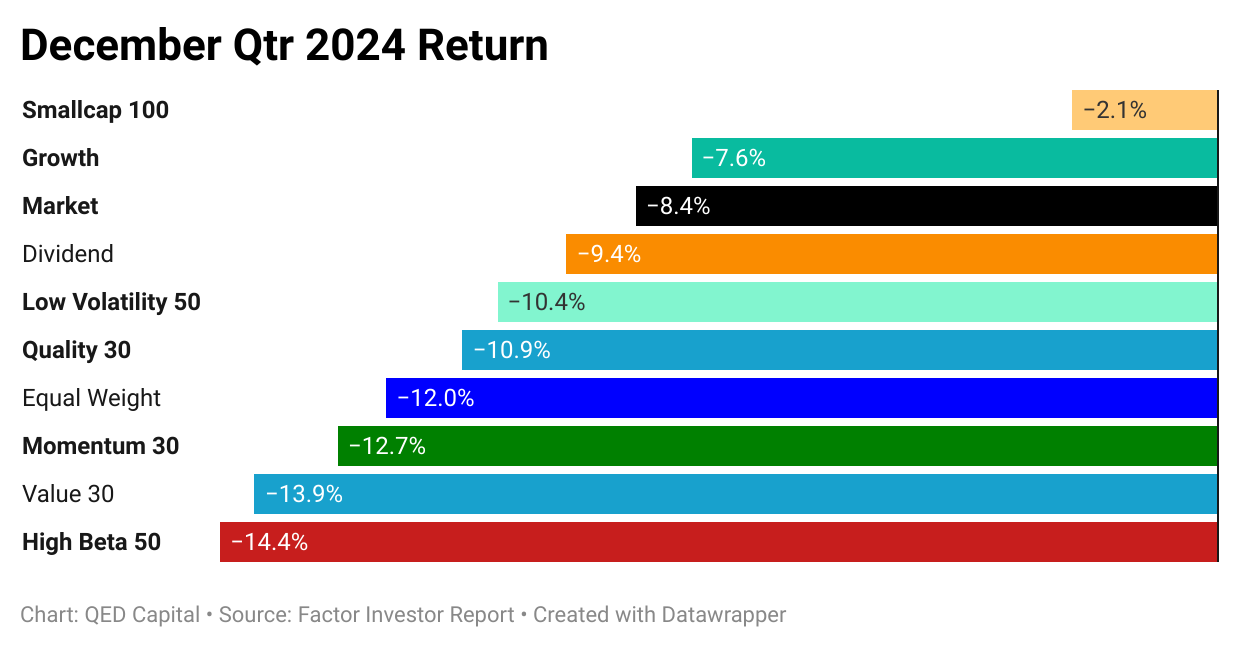

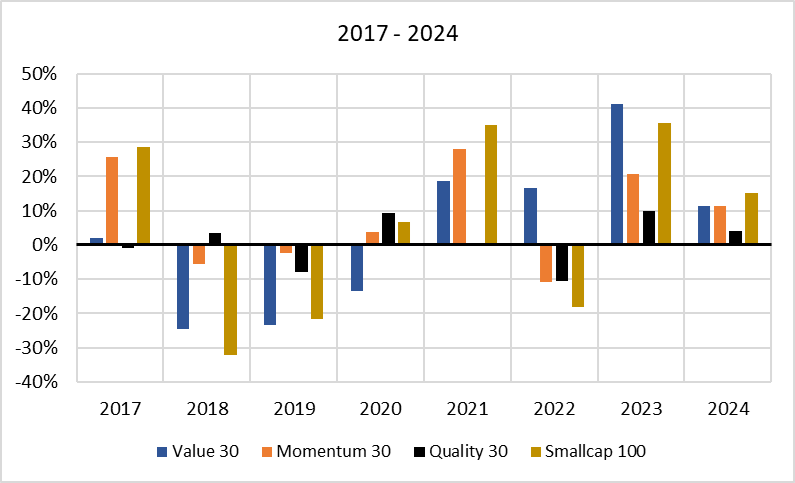

What a difference a quarter can make. Along with the Indian Cricket Team, markets also suffered a fall from all time highs and in very specific pockets. Large Caps were hit the most at the index level and at the factor level. Value which has been a top 2 performer this year, lost the most among factors. Low Volatility which did not live up to its name, also took a hit larger than the market. Momentum and Quality were also not spared. Size (small caps) on the other hand had the least fall. Various theories doing the round that FII selling hit large caps more and steady SIP flows supported the small and micro cap end of the market. How long this will continue is anyone’s guess but the gap is widening. Size factor (long-short) reached 97th percentile during the year and since then has reverted to 70th percentile but the gap is still quite wide on a cumulative basis.

2nd year in a row, small cap and value finish in the top two with the positions inverted. Value, Momentum and Quality gave back a significant portion of their returns in Dec 24 but if anyone had offered these returns at the beginning of the year, most investors would have taken it in a heartbeat.

The year ahead is going to be challenging. If one wants to stay in the market in this volatile phase then be ready to play a lot of block or tackle. Or as Old Patridge may have said retreat to the hills or go fishing.

2. Tactical Asset Allocation

In Nov 24 the model moved to about 70% risk off and now to 100% risk off. This compared to 100% risk on in the last quarter.

3. Relative Returns and Risk and Returns- Annual

The 5 year CML (capital markets line) is still sloping up.

This compared to just a year and half ago when it was sloping down as it should in the long run. A lot has changed in a year and half. So to get back to an downward sloping line what needs to happen is that higher beta factors like Size, Value, High Beta need to correct even more from here. Or Quality, Low Volatility and Dividend Yield need to do extremely well from here. Both can happen in a relative sense too. The future will be very interesting. But this see-saw will soon tilt over to the other side.

4. Factor Ranks

Smallcaps have been solid through the year with a dip in couple of months. Value was going strong right upto Sep 24 after which it started dropping. Momentum is doing what momentum does. Stay in a range at the top end. Quality is making a comeback as economic headwinds loom large on the horizon. Low Volatility has been the biggest disappointment this quarter in terms of fall. The ranks done reflect that.

5. Factor Excess Return Correlations

6. Sector Ranks

Energy has had the biggest fall this year going from 2nd rank to the last rank on the table. Recession anyone. Pharma and IT are the top of the table. Realty which started at number one, finishes the year at a decent 3rd rank. Banks have done well to climb from the bottom to the 5th spot. Autos have had a see-saw year and end the year weak at the 6th rank.

7. Stock Ranks

An important component of our process is ranking stocks on Risk Adjusted Momentum over a look back period of 6 months. In the table below we show the top ranked 20 stocks in our Mid and Small Cap universe. The rank is based on Risk Adjusted Momentum score. It also shows the ranking of the stock one and three months ago

8. Readings

The Money Trap is Sama’s thrilling, stranger-than-fiction personal odyssey detailing his experiences alongside SoftBank’s iconic founder Masayoshi Son – a visionary maverick who wants to be remembered as ‘the crazy guy who bet on the future’ and whose mission is ‘happiness for everyone’. Sama takes the reader on a wild ride as he consorts with billionaire CEOs and heads of state, negotiates mega-deals across the world and contends with a mysterious dark-arts smear campaign that takes a toll on his private life.

This fascinating and humorous saga provides a unique insider perspective on an industry that is disrupting our daily lives. Written with self-deprecating wit, unflinching honesty and searing introspection, The Money Trap is ultimately a morality tale: in life, as in technology investing, more money isn’t always the answer.

Disclaimer: Nothing in this blog should be construed as investment advice. This is purely for educational purposes only. Please consult an investment advisor before investing.