If the Sep 23 Qtr was good, the Dec 23 Qtr was a monster on with markets giving as much returns in a quarter as much as have been their annual returns in the past. Smaller the market cap and more volatile the stock, the higher the returns. Strong flows from domestic investors and robust SIP flows have been growing month on month and are now almost in the region of $2 bn (Rs. 16,000 crs) every month and SIP accounts have grown at 23% YoY. Even when the market cooled off in CY 2022, flows didn’t moderate or stop. They were steady and kept growing. Even the number of demat and trading accounts have been growing at a fast pace. Two important elections this year are in India and the US. The second important event will be when the Fed starts cutting rates. Until then as Chuck Prince said - Dance as long as the music is playing.

- Editor

1. Factor Performance Summary

Value, Size and Momentum were the top performers for the quarter followed by Dividend Yield and High Beta. Quality has not had a great time as high valued quality stocks’ returns were muted compared to the Value, Size, Momentum and even Dividend, High Beta and Equal Weight Market Indices. Quality stocks have been fairly highly valued for a while now and nothing goes to the sky or goes to zero all the time. Most things mean revert. Quality’s valuations are mean reverting. At some point in time they will become attractive again.

But the stars of the year are Value, Size (Small caps) and High Beta. Stocks with higher volatility have done very well this year. In a year where the large cap indices has given a return of 20%, which is above its long term average, Small Caps have done almost 3x of that return. As we will see in the Risk/Reward charts below, exposure to higher volatility has given higher returns this year.

2. Tactical Asset Allocation

3. Relative Returns and Risk and Returns- Annual

Value and Small cap have been the clear winners. However, we must take these numbers with a pinch of salt as the proxy for Momentum here is the N200M30 index which comprises large and midcap stocks whereas the proxy for Value is the N500V50 stocks which includes small caps also.

This for me is the chart of the year. For the first time since we started this report, the Securities Market Line is trending up. Which means higher volatility has meant higher return. The 15 yr risk/reward line is still trending down though. The 5 year line too will perhaps straighten or trend down but as of now volatility is king.

15 year Risk/Reward

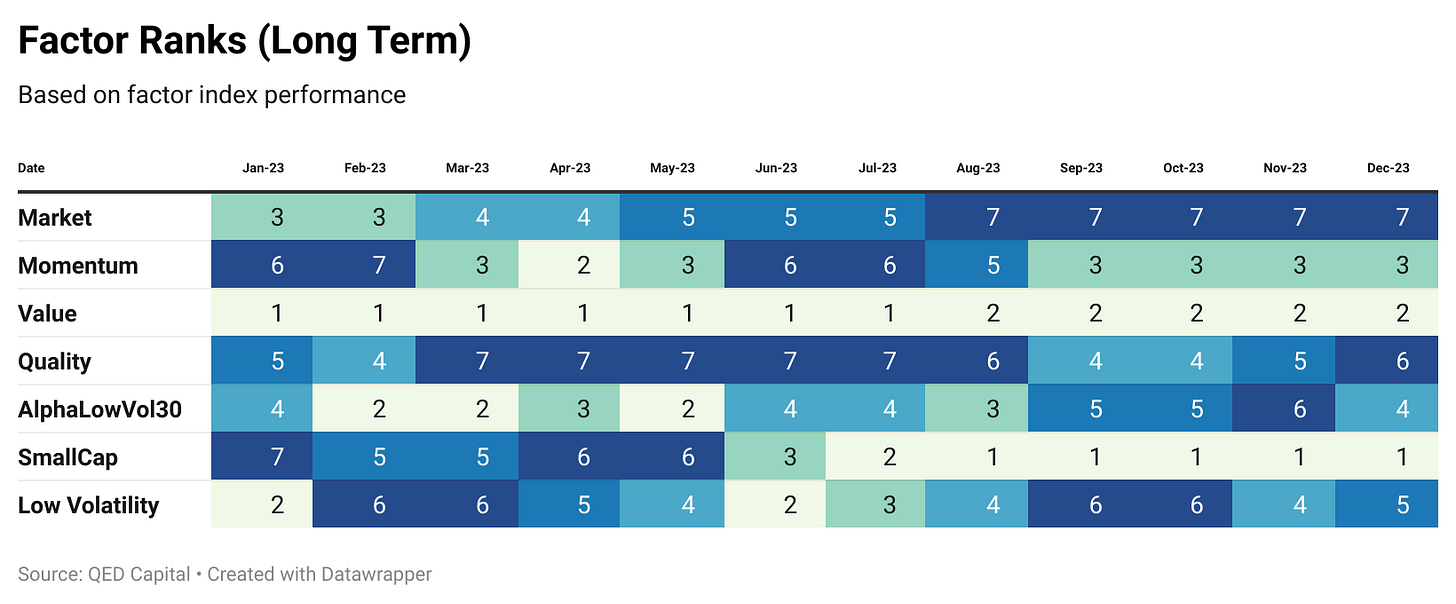

4. Factor Ranks

Value and Small Caps have been winners in the second half of the year followed by Momentum. Market and Quality bring up the rear.

5. Factor Excess Return Correlations

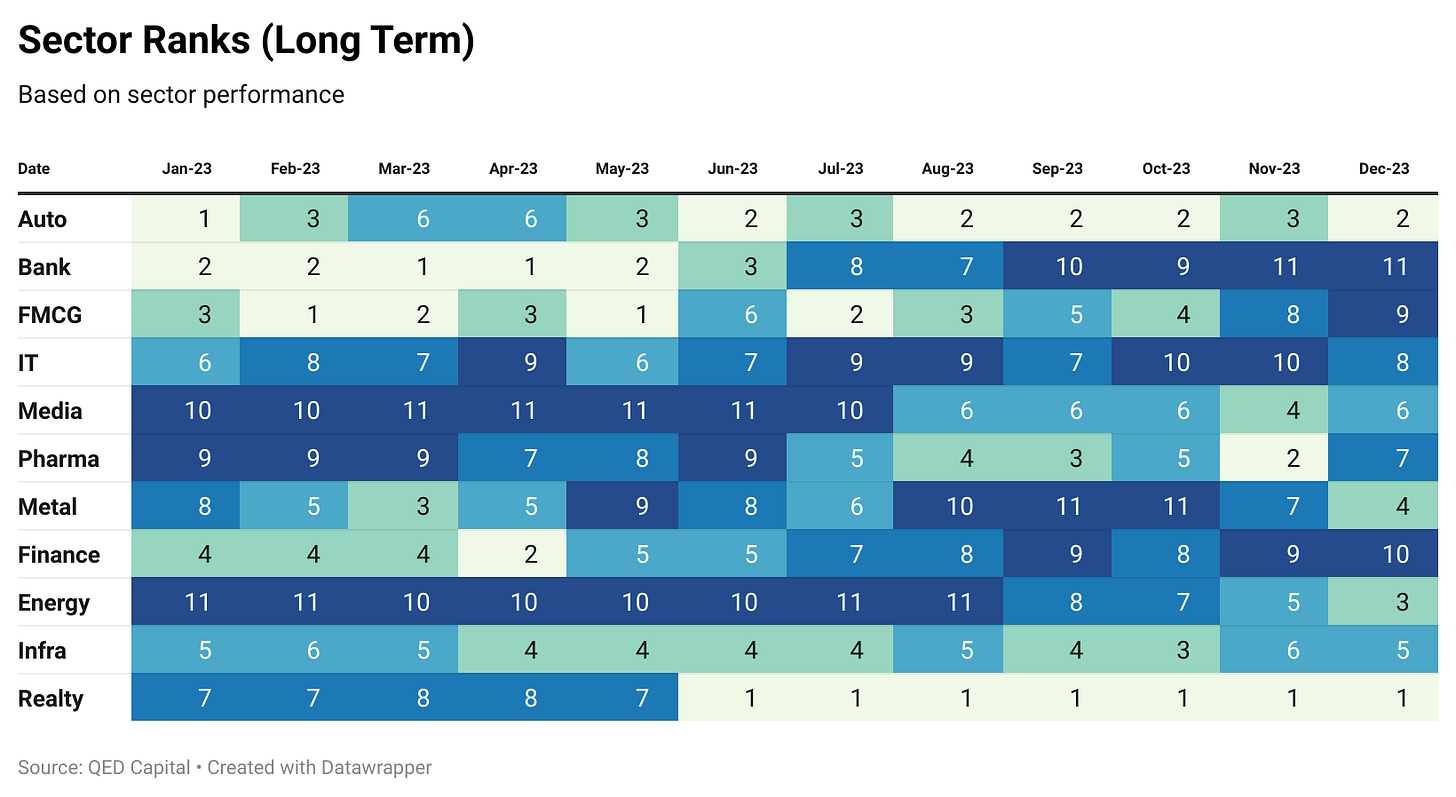

6. Sector Ranks

7. Stock Ranks

An important component of our process is ranking stocks on Momentum and Low Volatility over a look back period of 6 months. In the table below we show the top ranked 20 stocks in our Mid and Small Cap universe. The rank is a combined score of Momentum and Low Volatility. It also shows the ranking of the stock one and three months ago.

8. Readings

Timing the Tide: The Impact of Rebalancing Periods in Momentum Investing in Indian Equities by Rajan Raju

Date Written: January 8, 2024

Abstract

The frequency of rebalancing is a critical aspect of momentum portfolios with substantial implications for returns and risk. This paper, the final instalment of our trilogy of papers, examines portfolios derived from universe sizes of 200, 500, and 750 stocks, with holdings of 15, 30, and 50, across four weighting schemes over varying rebalancing intervals of 1, 2, 3, and 6 months on returns, risks, factor exposures, and other metrics. The critical finding of the study is that shorter rebalancing periods capture the effect of academic momentum more effectively. This insight is significant for its implications on strategy optimization, particularly in the vibrant and evolving context of Indian equity markets. The paper contributes to academic and practical aspects of momentum investing, addressing a literature gap, and offering guidance for investment managers and DIY investors navigating momentum strategies.

Disclaimer: Nothing in this blog should be construed as investment advice. This is purely for educational purposes only. Please consult an investment advisor before investing.