Editors Note

Apologies for the delay in the report. We are working on an exciting research project which we will talk more about in the next issue. Until then, stay safe and have a happy new year.

- Editor

1. Factor Ranks

Large caps are under pressure. And that results in the Market factor dropping from 4th position to 6th position. Momentum is at No.1 , followed by Smallcap or Size Factor. Low Vol continues to languish at the bottom of the table here.

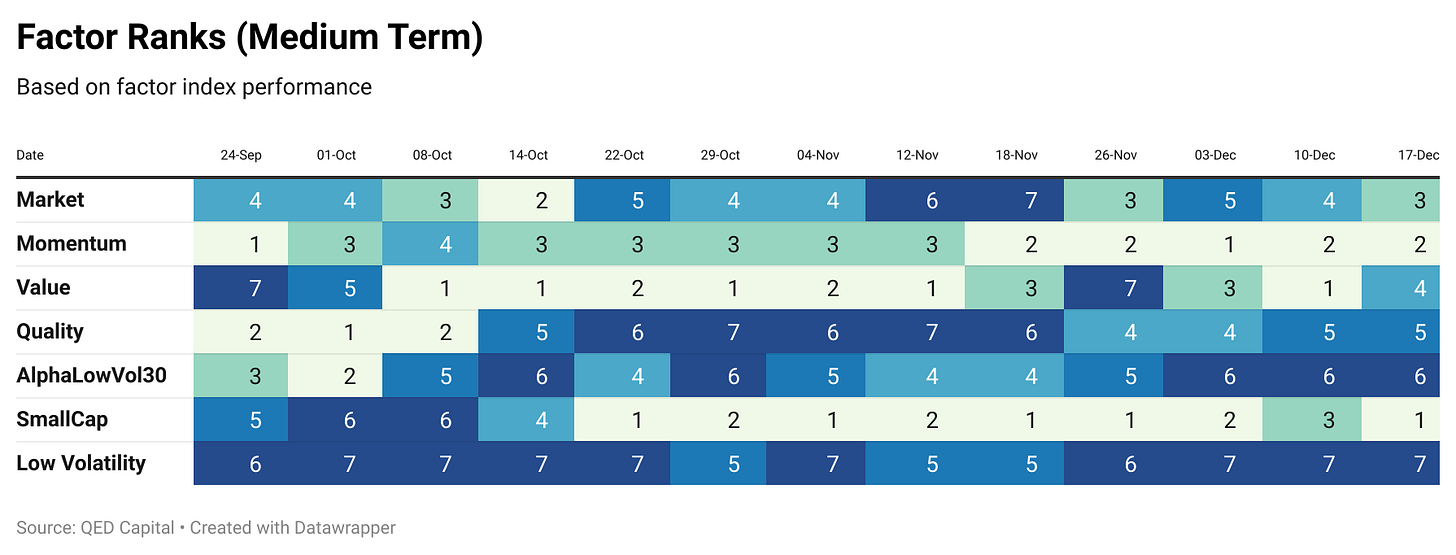

The medium term ranks also reflect the strength in Momentum and Smallcaps. Value’s trend is erratic. And so is Quality’s trend.

2. Sector Ranks

We keep track of sector ranks as well to understand sector rotation. This sector ranking is done on a long term “relative momentum” basis of the respective sector indices. We also look at sector ranks on a medium term look back time frame.

IT climbs to No. 1 spot pushing metals down to 3. Realty and FMCG continue to lose steam. While Pharma makes a good comeback from No. 10 to 6 now.

Pharma is climbing in the medium term ranks too. Divergence seen in Realty between long term and medium term trends. IT is the second position a big jump from 7 in November.

3. Stock Ranks

An important component of our process is ranking stocks on Momentum and Low Volatility over a look back period of 6 months. In the table below we show the top ranked 20 stocks in our Mid and Small Cap universe. The rank is a combined score of Momentum and Low Volatility. It also shows the ranking of the stock one and three months ago.

A mix of energy and IT names. Along with from other sectors. ATGL makes a huge jump and is the top 20 from 157 last month. Many other new names come in like ZEE, KEI, Delta Corp etc.

4. Reading/Listening Corner Corner

Top Traders Unplugged: Strategic Risk Management ft. Cam Harvey & Rob Carver

How should you protect your portfolio against large losses, but without giving up its upside potential? To answer this question, and many more, listen to professor of finance at Duke University, Campbell Harvey to the show. He is joined by Rob Carver, and Rob and Cam used to work together at Man AHL. The show discusses how to navigate a crisis in the markets, and what to expect in terms of the global outlook for investing. Listen here

Trillions: How a Band of Wall Street Renegades Invented the Index Fund and Changed Finance Forever

Fifty years ago, an unlikely group quietly assembled in the financial industry's backwaters, unified by the heretical idea that even the world's best investors couldn't beat the market in the long run. Including economist wunderkind Gene Fama, industry executive Jack Bogle, computer-obsessive John McQuown and former Second World War submariner Nate Most, the group succeeded beyond their wildest dreams.

Passive investing now likely accounts for over $26 trillion, equal to the entire gross domestic product of the US, and today is a force reshaping markets, finance and even capitalism itself. Yet even some fans of index funds and ETFs are growing perturbed that their swelling heft is destabilizing markets, wrecking the investment industry and leading to an unwelcome concentration of power in fewer and fewer hands.

In Trillions, Financial Times journalist Robin Wigglesworth unveils the vivid secret history of index funds, bringing to life the colourful characters behind their birth, growth and evolution into a world-conquering phenomenon. It is the untold story behind one of the most pressing financial uncertainties of our time. Read here.

Disclaimer: Nothing in this blog should be construed as investment advice. This is purely for educational purposes only. Please consult an investment advisor before investing.