Markets made a smart move in July and continued the upmove in Aug. US markets were spooked by Powell’s speech at Jackson Hole last week. And so were Indian markets, but made a recovery the next day. Momentum and Trend is building up. Lets see if this holds up in the coming weeks and months.

Wishing you all a very Happy Ganesh Chaturthi

- Editor

1. Factor Ranks

Value factor after dropping to number 5 last month is back to number one in the long term factor ranks. Low Vol maintains its position at the second place. Market factor drops two places to number 3. The size factor continues to bring up the rear

In medium term ranks the picture is changing. Momentum is at the top spot while Value is at number 6. Quality is at the second spot. So there is factor rotation going on and time will tell if this trend reverses or continues and becomes a longer term trend in this direction.

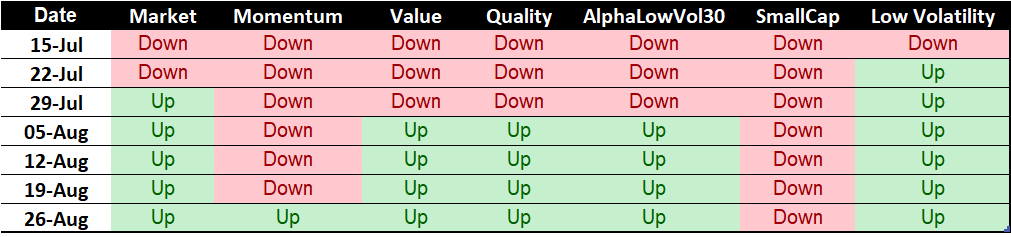

All factors except Size (smallcap) are in an uptrend. In July 22, only two factors, Market and Low Volatility were up. Now the trend is much more broad based.

2. Sector Ranks

Auto has steady moved up through the year and maintains it numero uno spot. Followed by energy, fmcg and metals. The rear is predictably bought up by IT.

The medium term ranks are more volatile. Auto is doing well here but has fallen in the last week to 5 from 1. Finance takes it place followed by FMCG and Bank.

Seven out of eleven sectors are in an uptrend. IT is the only major sector in an downtrend.

3. Stock Ranks

An important component of our process is ranking stocks on Momentum and Low Volatility over a look back period of 6 months. In the table below we show the top ranked 20 stocks in our Mid and Small Cap universe. The rank is a combined score of Momentum and Low Volatility. It also shows the ranking of the stock one and three months ago.

In keeping with the long term trend, we have stocks like TVS Motors, Mahindra CIE and Ashok Leyland from the auto sector in the top 20. Asahi, ABB and NOCIL are new entrants in the list.

4. Reading/Listening Corner

Antti Ilmanen, Ph.D., is a Principal and Global Co-head of the Portfolio Solutions Group at AQR Capital. Antti has published extensively in finance and investment journals and has received a Graham and Dodd award, the Harry M. Markowitz special distinction award, and multiple Bernstein Fabozzi/Jacobs Levy awards for his articles. Antti is the author of Expected Returns (Wiley, 2011), a broad synthesis of the central issues in investing, and Investing Amid Low Expected Returns (Wiley, 2022), which addresses the challenges facing investors amid the prospect of record-low future expected returns.

This podcast is hosted by Rick Ferri, CFA, a long-time Boglehead and investment adviser.

Disclaimer: Nothing in this blog should be construed as investment advice. This is purely for educational purposes only. Please consult an investment advisor before investing.