First of all apologies for the few days delay in putting this out. Also we dont have the stock ranks out yet. Once we get them out, we will update them here.

However, there is a fair amount of action in factor and sector ranks. So let us dive right into them.

1. Factor Ranks

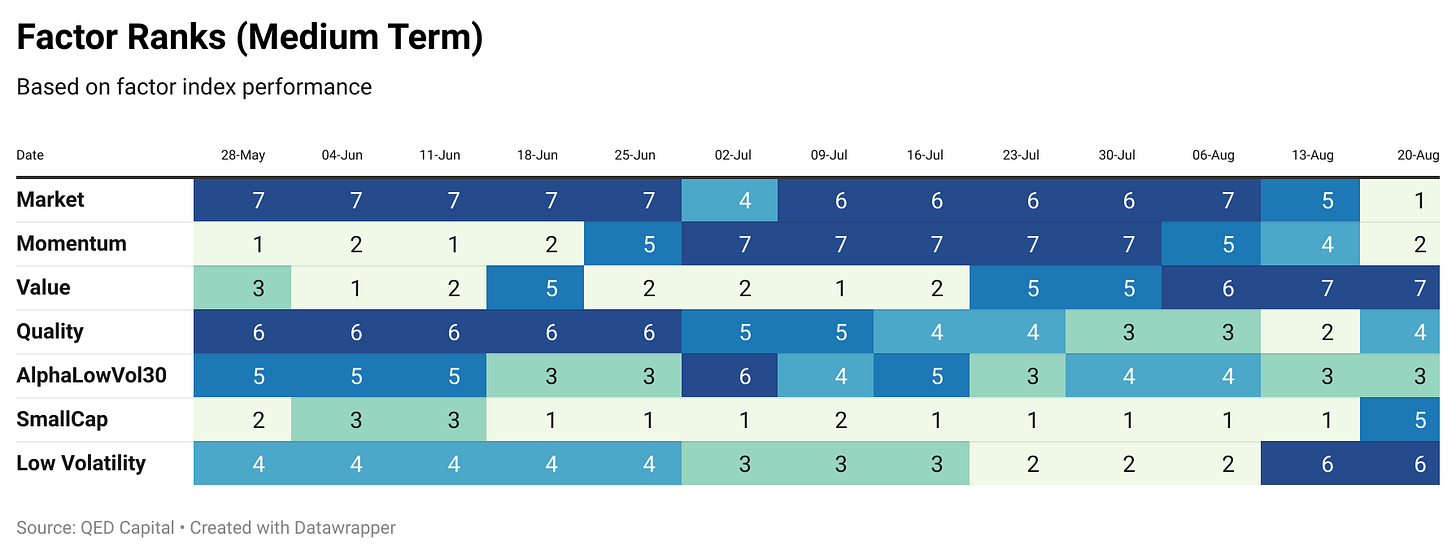

We rank the following factors based on long term (40 week) price performance. And on medium term (12+4 weeks) price performance.

Smallcap and value exchange places in the long term factor ranks. And market (large caps) drops from third place to sixth. This is on the back of a roaring month that Jul was for mid and smallcaps. Momentum (the chameleon factor) climbs a notch to third place.

It is in the medium term charts that divergence begins to show. Large caps have climbed to the top of the charts. Momentum comes in at two. However, smallcap and value bring up the rear. Smallcap drops from top spot to number five and value drops from second place in mid July 21 to seventh or bottom spot passing fifth and sixth place along the way.

2. Sector Ranks

We keep track of sector ranks as well to understand sector rotation. This sector ranking is done on a long term “relative momentum” basis of the respective sector indices. We also look at sector ranks on a medium term look back time frame.

Even after the current correction in Metals, they still rank first in the long term ranks. IT has climbed smartly from fifth place to second place. Pharma, Banks and Finance remain in the middle of the pack. Auto and Media bring up the rear.

Fair amount of action here. IT has climbed to the top. Metals fell to ninth place in the week ending 23rd July and is now at number seven. Finance (perhaps aided by insurance companies and AMCs) is at number two. Banks and Pharma continue to remain weak.

3. Reading/Listening Corner Corner

Podcast

This week, Richard Brennan from ATS Trading Solutions makes his debut on the show, and discusses the complexity behind successful Trend Following strategies, momentum trading versus Trend Following, the importance of average win rate, how a weak edge can still lead to strong returns, deflationary environments and their past effects on the Trend Following models, which markets, and how many, to include in a profitable trading system, and how to find the perfect exit strategy with minimum risk. Listen here.

Article

Investing in equities for better returns? Learn to play on the momentum factor

Momentum is a strategy based on the idea of delivering higher returns. UTI Nifty 200 Momentum 30 Fund offers a unique strategy to be with the winners, especially in the large-cap space. While returns are high, the strategy can turn choppy during the times of turbulence. However, there are ways to manage the volatility. Read on

Book Recommendation

“Talking to My Daughter: A Brief History of Capitalism” by by Yanis Varoufakis

Yanis Varoufakis writes to his daughter to teach her the hazards of capitalism.

‘Why is there so much inequality?’ asked Xenia to her father. Answering her questions in a series of accessible and tender letters, Greece’s former finance minister explains everything you need to know to understand why economics is the most important drama of our times. In answering his daughter’s deceptively simple questions, Varoufakis disentangles our troubling world with remarkable clarity and child-like honesty, as well as inspiring us to make it a better one.

Disclaimer: Nothing in this blog should be construed as investment advice. This is purely for educational purposes only. Please consult an investment advisor before investing.