April was a strong month for equity markets. A lot of macro noise persists but the tape is strong. All factors were positive for the month. Some sectors and stocks also made spectacular moves. We are also excited about a new feature we are working on - Dashboards. These dashboards will be powered by our Tactical Asset Allocation Models and Factor Models. We will be giving some snapshots of a Factor model and Market model in each edition. An interesting conversation coming up next week with the authors of “The Big Bull of Dalal Street: How Rakesh Jhunjhunwala Made His Fortune” which will be broadcast on Linkedin Live and YouTube.

- Editor

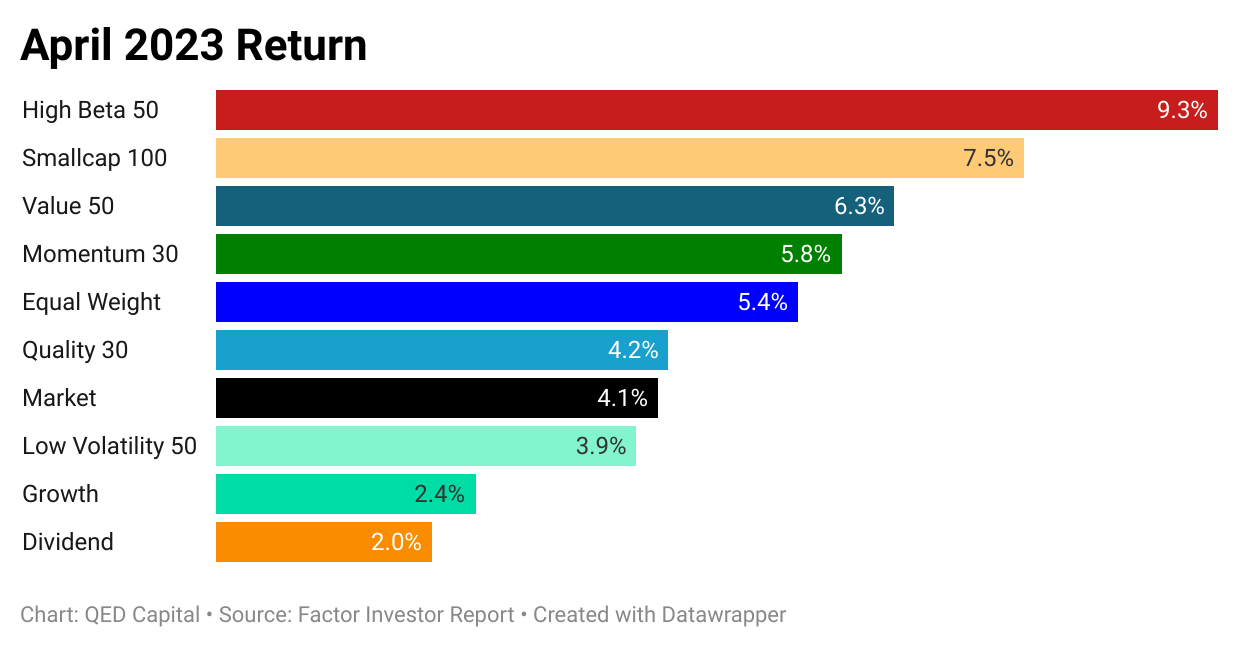

1. Factor Performance Summary

Markets bounced back and the most beaten down factor - High Beta was the largest gainer for the month. Followed by Smallcap, Value and Momentum. Defensives like Low Volatility and Dividend bring up the rear.

For the 4 months YTD however, dividend is still the highest gainer (perhaps led by ITC) followed by Value. Even after its spectacular gain in April, High Beta is negative and is the worst performing factor for the year.

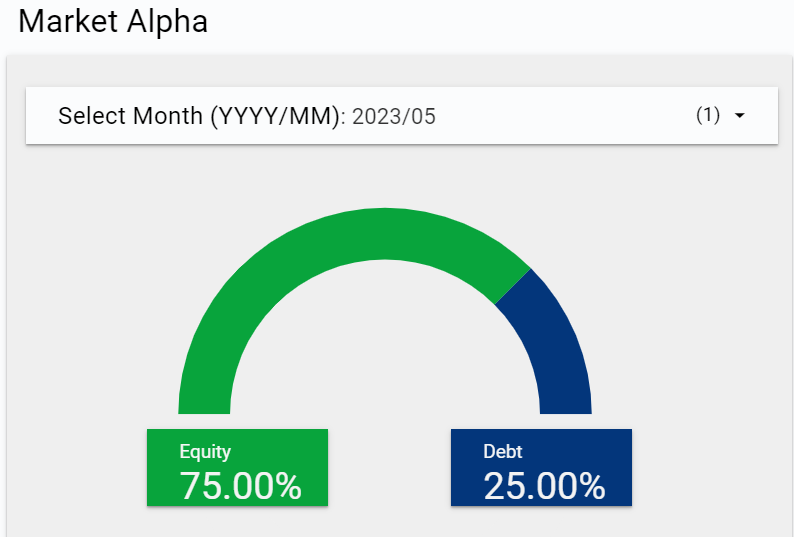

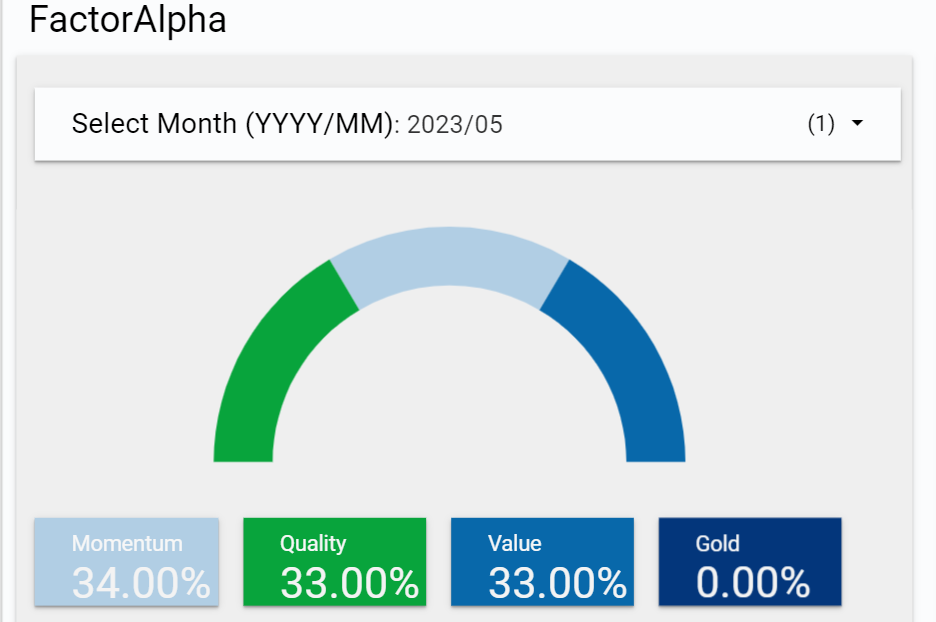

2. Tactical Asset Allocation

We will be writing a detailed post on this sometime during this this month. But for now, we share two Tactical Asset Allocation Models. Tactical is a fancy word for trying to approximatly time the market or be tactical about it. In this case process is driven by a combination of procyclical trend models with different speeds. This can be a good satellite to a pure buy and hold core portfolio. It it can be used also a contra indictor in a down trend to add more investments.

The first model uses the broad market index and for the month of May 23, it has 75% allocated to equities, compared to 0% last month. This model is driven by 4 sub models. The out of market asset in this case is short term debt.

The second model is a Long Only Factor based model, that switches between Long Only Factor Portfolios and the out of Market asset in this case is Gold. This model is equally divided between Value, Momentum and Quality and all three are in the “Buy” zone for the current month, compared to only Value being in last month, the balance being allocated to gold.

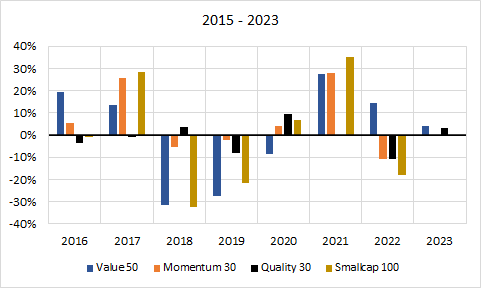

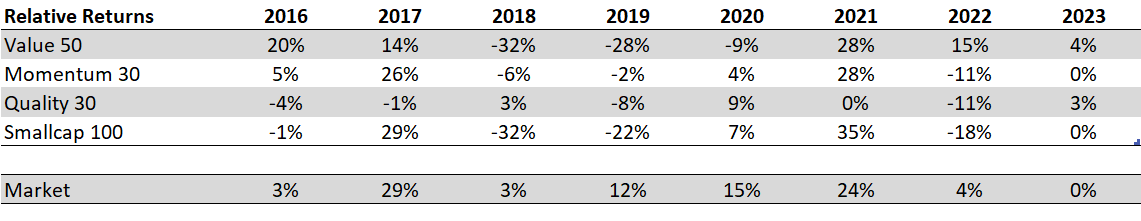

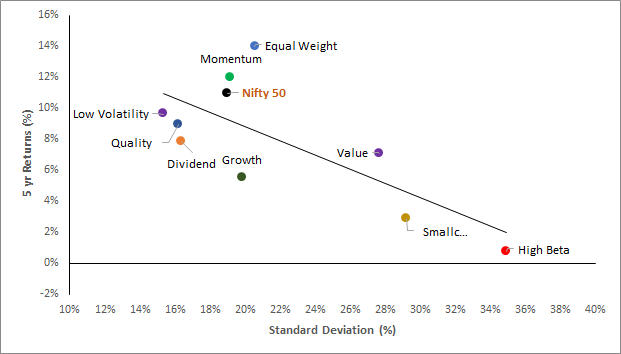

3. Relative Returns and Risk and Returns- Annual

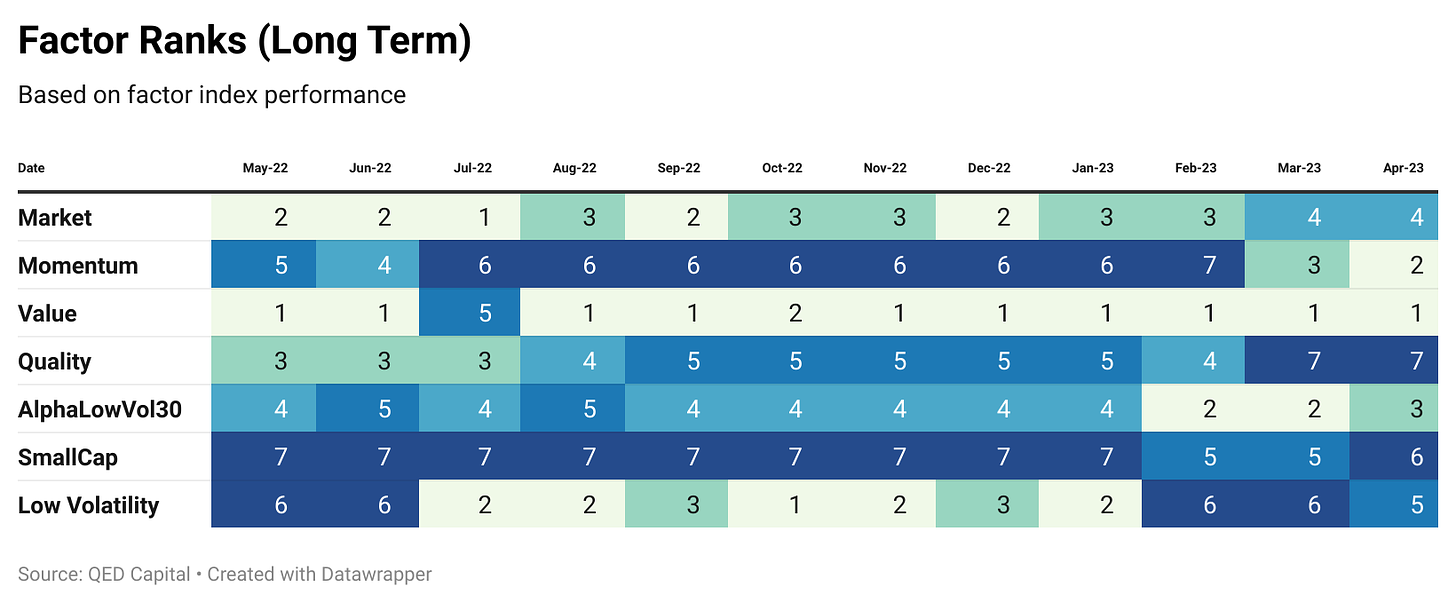

4. Factor Ranks

Value continues to lead, but the absolute numbers show its “growth” is slowing. Momentum has made its way up to the second position. Smallcaps bring up the rear.

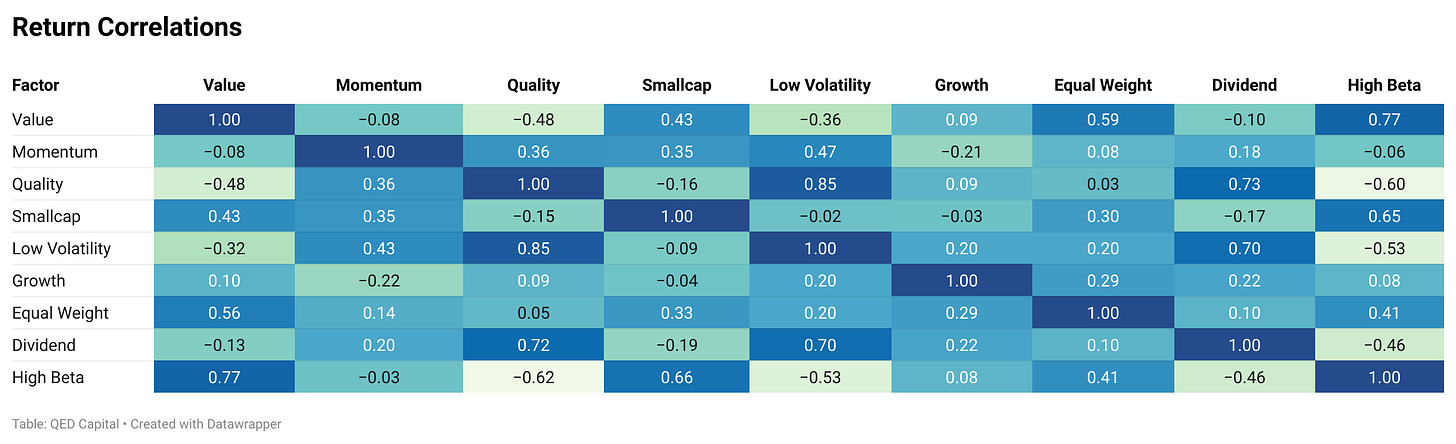

5. Factor Excess Return Correlations

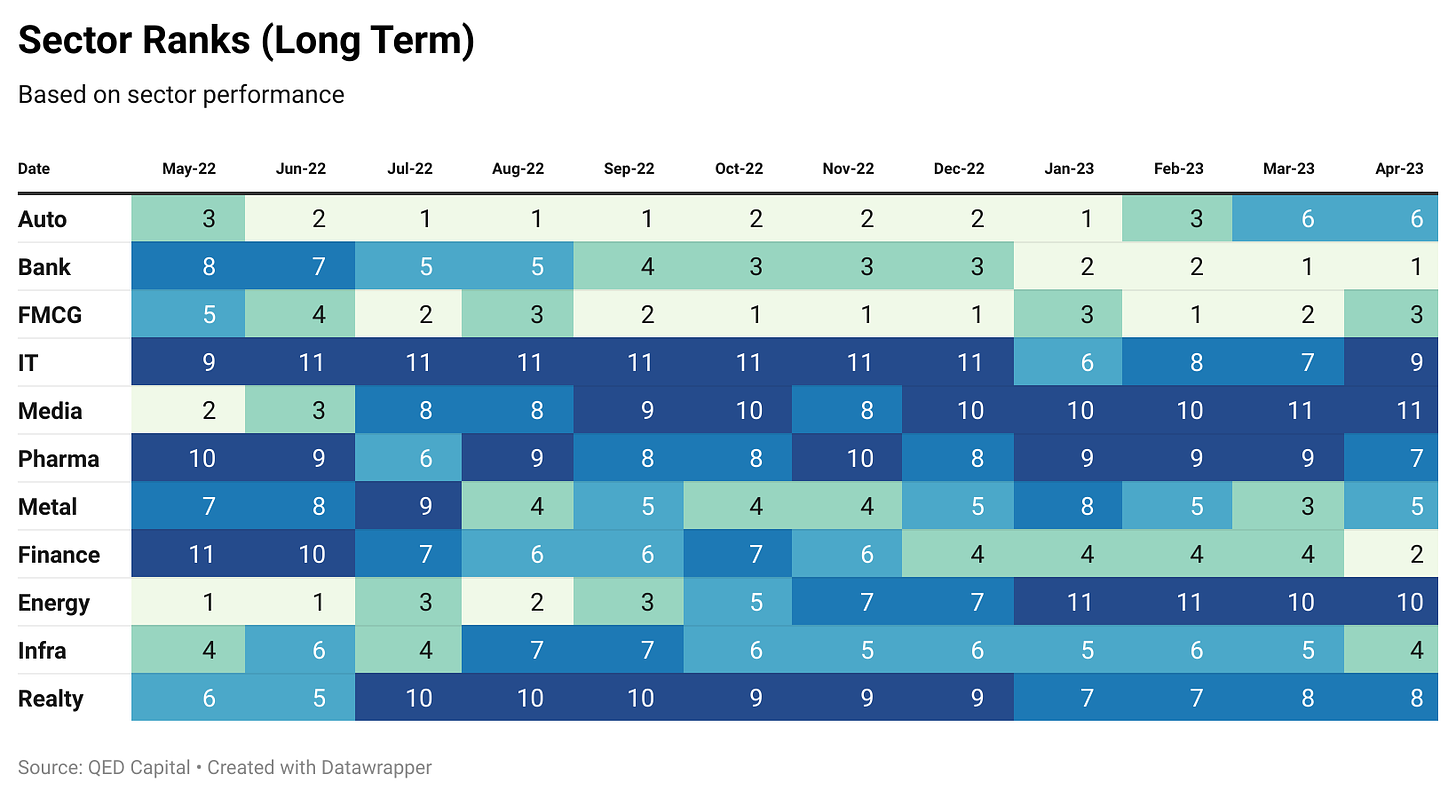

6. Sector Ranks

Banks and Finance continue to lead sector performance charts. Auto seems to be losing steam. IT is a mixed bag, with large cap IT being in the doldrums, but Mid Cap IT is showing some signs of life. Infra is also picking up steam.

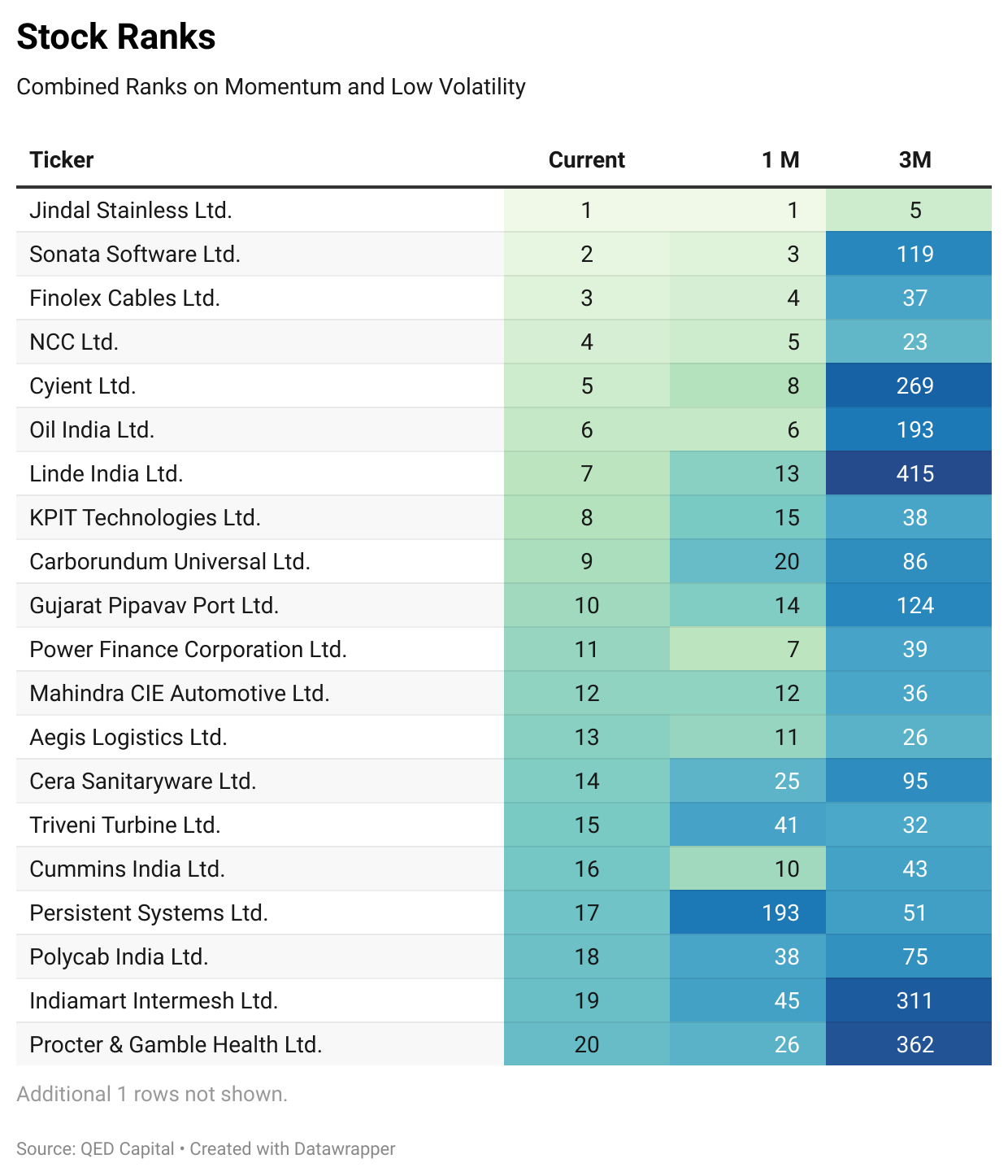

7. Stock Ranks

An important component of our process is ranking stocks on Momentum and Low Volatility over a look back period of 6 months. In the table below we show the top ranked 20 stocks in our Mid and Small Cap universe. The rank is a combined score of Momentum and Low Volatility. It also shows the ranking of the stock one and three months ago.

8. Readings

Next week, we will be in conversation, On LinkedLive on 17th May 2023, with the authors of “The Big Bull of Dalal Street: How Rakesh Jhunjhunwala Made His Fortune”

This book looks at the life of India's big bull, as Rakesh was famously known, both as a person and as a professional. Providing a fascinating account of his journey, it analyses the records of Jhunjhunwala's investments and interviews he has given over the years. More than just a biography, a large section of the book is devoted to understanding the stocks that made him rich and the mistakes he made. Looking at the journey of the legendary investor, the book offers retail investors some useful insights----benefits of long-term investing, mistakes one should avoid in the stock market, risk associated with leveraged trades, among others.

Disclaimer: Nothing in this blog should be construed as investment advice. This is purely for educational purposes only. Please consult an investment advisor before investing.