This week we have launched our YouTube channel - Link - where we will be looking at factor and sector performance and trends on a weekly basis. Along with that we will also cover factor and behavioral finance concepts.

Here is the link to the first video where we look at the often asked question - How often should I check my portfolio ?

So please like and comment on the videos and subscribe to the channel. And send in your suggestions on topics that you would want us to cover.

— Editor

1. Factor Ranks

Value and Momentum retain their top ranks from last month. Quality falls from 3rd place to 5th. Small Caps lose steam and fall from 2 to 6. Market and Low Volatility retain their ranks. Smallcap and Low Volatility bring up the rear.

An almost similar story here. Value and Momentum are at the top. Quality oscillates between 4 and 6. While Smallcap and Low Volatility are again at the bottom.

In the March report, Market and Momentum besides Value were in an uptrend. While the others were in a downtrend. Now only Value is an uptrend while Market and Momentum have joined the other factors to move into a down trend.

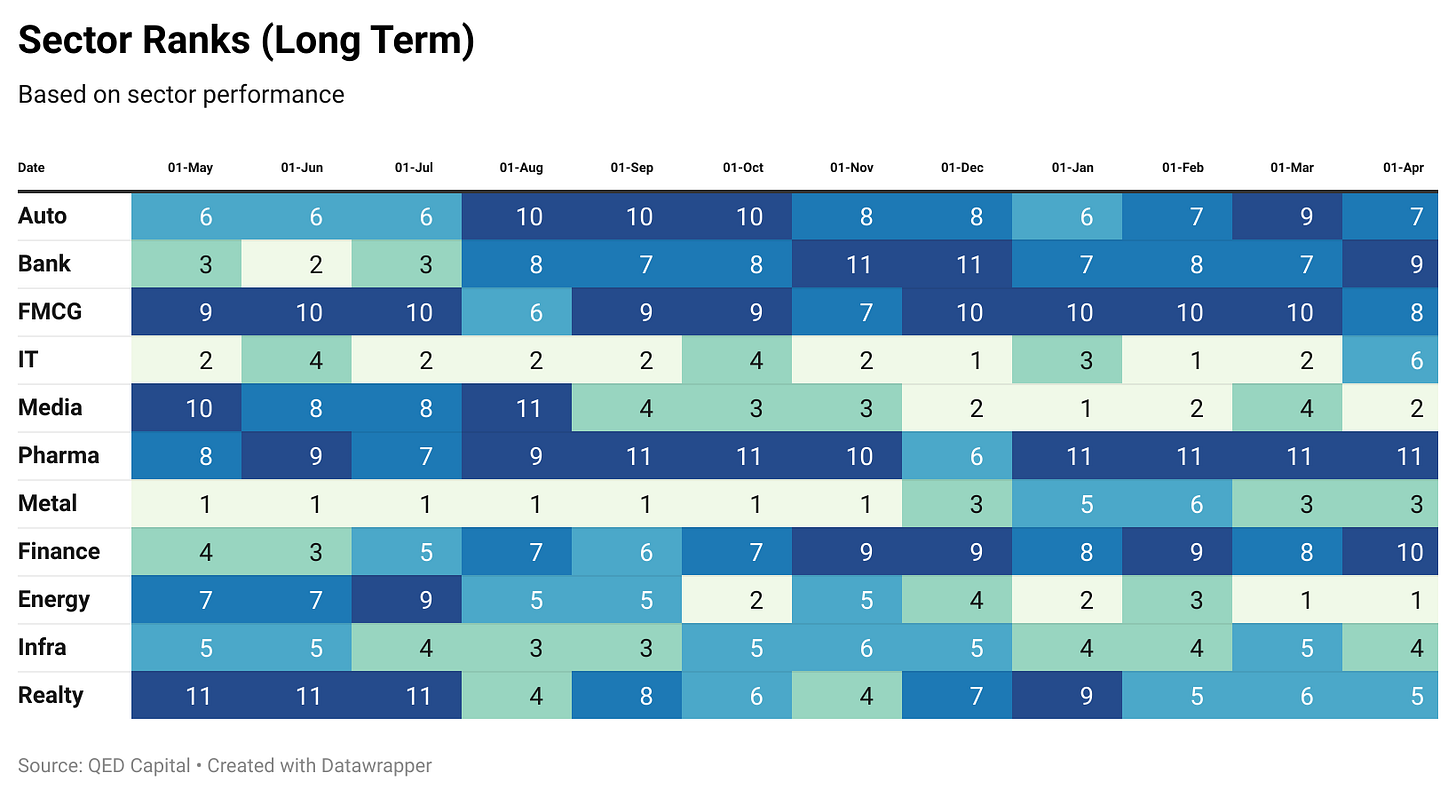

2. Sector Ranks

In keeping with the factor trend, stocks from the Energy and Metals sector are driving the Value factor. IT has moved down 4 ranks to 6th position now. It is reflected in the returns distribution too. Banking, Finance and FMCG are the other weak sectors while Pharma brings up the rear.

In the medium term ranks, IT is right at the bottom showing its reversal which had started this year after a stellar 2021. Energy and Metals (not surprisingly) show strength, while FMCG (surprisingly) is also showing strength.

Energy, Infra, Metals are in an uptrend besides Media. Auto is trying to make some headway into an uptrend. IT which in spite of weakness in relative strength was in an uptrend, has now moved into a downtrend. Other sectors like Pharma, Finance, Realty are in an downtrend.

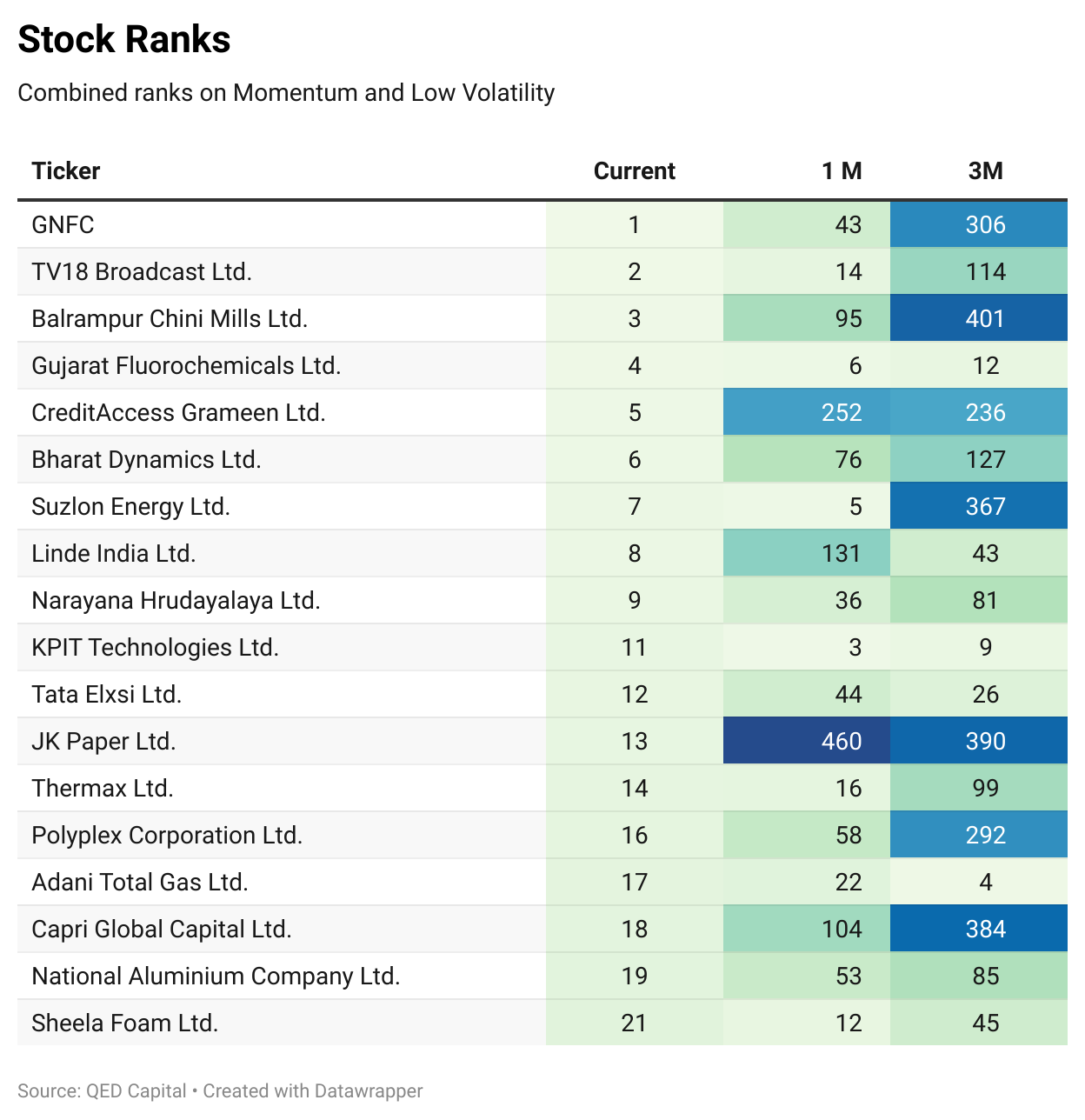

3. Stock Ranks

An important component of our process is ranking stocks on Momentum and Low Volatility over a look back period of 6 months. In the table below we show the top ranked 20 stocks in our Mid and Small Cap universe. The rank is a combined score of Momentum and Low Volatility. It also shows the ranking of the stock one and three months ago.

GNFC makes an entry in style, right at the top. CreditAccess, BDL, JK Paper and CapriGlobal also make big moves on the upside.

Disclaimer: Nothing in this blog should be construed as investment advice. This is purely for educational purposes only. Please consult an investment advisor before investing